In FY2016, it reported earnings of $384.5 million. The number increased subsequently to $685.6 million for FY2017, $755.4 million for FY2018 and $688.6 million for the most recent FY2019. Over the evaluation period, it saw a CAGR of 18.9%, which is the third highest among the top 10 overall winners across all nine Billion Dollar Club sectors. The highest CAGR for profit after tax was by CapitaLand at 23.7% and Venture Corporation at 23.1%.

Its ESG (environmental, social and corporate governance) score of 15.2 puts it relatively high among the 10 overall winners, where the range was 13.1 to 18.6. For FY2019, Genting Singapore was in its in the fourth year of its Sustainability21 Strategy and made further progress on its sustainability efforts. For example, it recorded a 9% drop in waste sent for incineration, and recycled 24% of the waste produced. Through its corporate social responsibility initiative, RWS Cares, Genting Singapore donated some $6.7 million in cash and in kind to various charities and organisations.

Genting Singapore’s weighted ROE, meanwhile, was 7.5 times, amid an overall top 10 range of six to 25 times. It did not rate for shareholders’ return though, as did many other companies classified in this sector.

See also: A market worth your time and participation

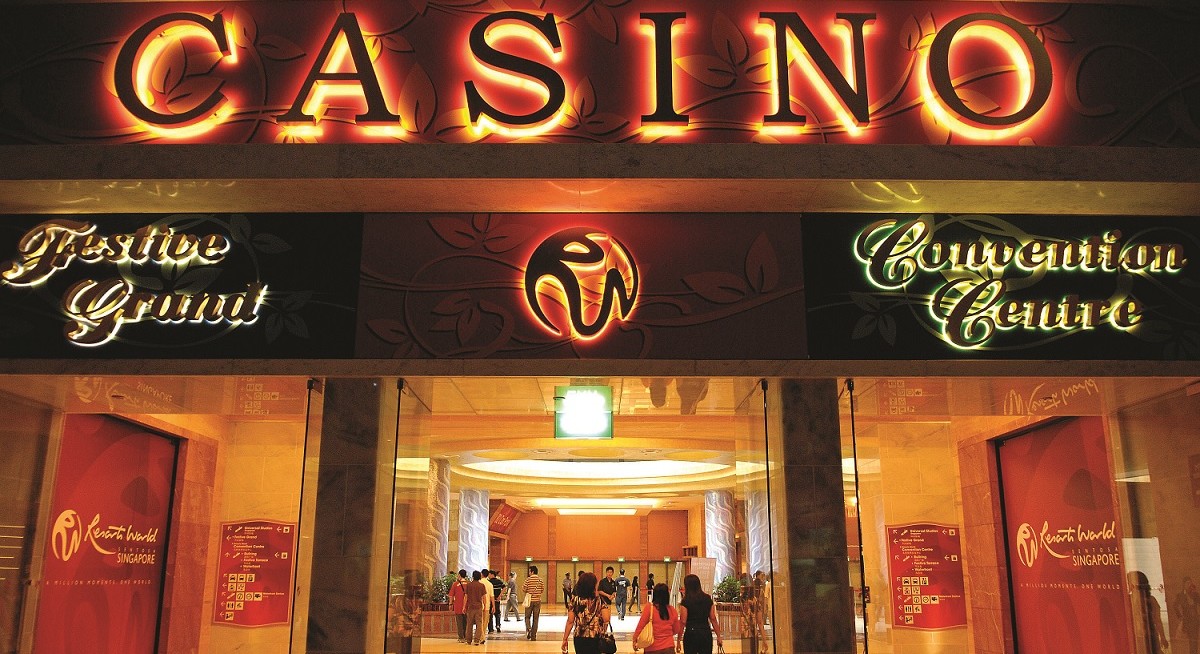

For the early part of 2020, Genting Singapore was hit by the Covid-19 pandemic. Inbound tourists virtually disappeared and local lockdown measures severely restricted the operations of both its casino floors and convention space business, as companies cancelled the big conferences and exhibitions. Subsequently, F&B, attractions and various other ancillary businesses were hurt too.

In 2Q2020, Genting Singapore announced a net loss of $163.3 million, on revenue of just $41.3 million. For the half year ended June 30, losses came in at $116.7 million, versus $373.9 million.

Yet, as lockdown measures eased, Genting Singapore was able to quickly reclaim some of the business, and went back into the black in 3Q2020 ended Sept 30, with earnings of nearly $54.5 million reported, on revenue of $300.1 million.

See also: Well-placed to play central role in building sustainable financial future for Asia

The revenue growth in 3Q2020 was led largely by gaming revenue of $212.9 million. Presumably, the bulk of the casino visitors during this period were locals, as inbound tourism was still very much capped. While the gaming revenue for 3Q2020 was down 41% y-o-y, it was a big jump from just $6.5 million in 2Q2020.

In its 3Q2020 business update, Genting Singapore called Covid-19 an “unprecedented crisis” for the travel and tourism industry. It is adapting by offering staycation packages to locals and also theme-based dining experiences.

In a sign that Genting Singapore is looking beyond the pandemic, it is reiterating its commitment to develop the $4.5 billion mega expansion for RWS, which was announced last September. In addition, Genting Singapore is “keenly exploring” the Yokohama integrated resort opportunity in Japan.

“We will evaluate the conditions of the Request-for-Proposal and the investment environment when the formal bidding process begins and will respond with a proposal if these conditions meet the group’s investment criteria,” states the company.