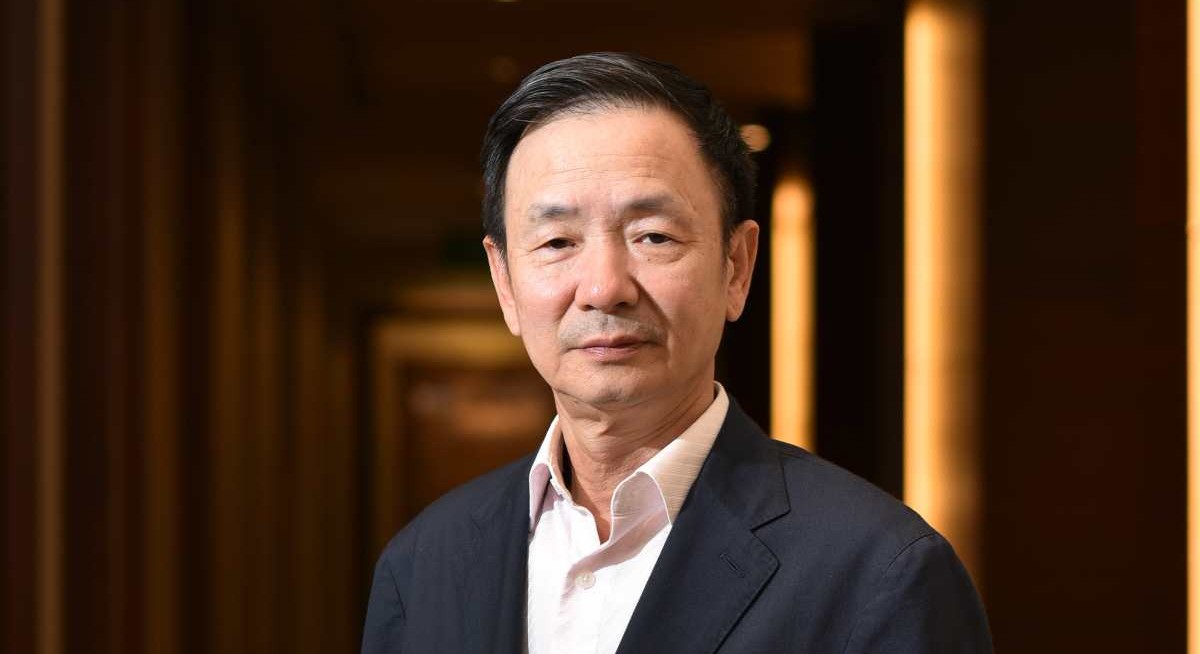

Yanlord Land Group, which won the best ROE in the real estate sector at last year’s Billion Dollar Club, has kept this award this year. For the three financial years taken into consideration for judging this year’s winner, Yanlord managed to generate a weighted ROE of 11.1 times. In addition, Yanlord — led by executive chairman Zhong Shengjian — has also been named the overall sector winner.

The company was founded in 1993 and listed on the Singapore Exchange in 2006. Over the years, it has kept its strong focus on the high-end market in the top tier cities of China. Right now, the company has an established presence in 18 key high-growth cities within the six major economic regions of China. One of which is the Yangtze River Delta region, which encompasses key cities such as Shanghai, Nanjing, Suzhou, Hangzhou, Nantong, Taicang and Yancheng. The company is active in other cities across China ranging from Tianjin to Shenzhen; from Haikou to Chengdu and Wuhan.

Besides developing residential properties, Yanlord has also been developing various commercial and integrated properties, which are kept for longer-term investments that help to generate a steady stream of recurring income.

See also: Chairman Zhong of Yanlord Land and Tangs of SingHaiyi see stakes rise in respective companies

They include the Yanlord Landmark, a premium commercial development comprising an upmarket retail mall, an office building, a 360-room serviced apartment building operating under the name of InterContinental Residences in Chengdu. This development has a gross floor area of some 165,800 sqm. There is also the Yanlord Riverside Plaza, whose GFA of 159,800 sqm covers a retail mall, an office building and a commercial street in Tianjin. As for the Yanlord Marina Centre, it consists of a retail mall, office suites and a 324-room five-star hotel operating under the name of InterContinental Zhuhai. It has a GFA of 103,400 sqm.

In recent years, Yanlord started making its presence felt more strongly in Singapore. It acquired United Engineers, gaining control over its portfolio of office properties. In addition, Yanlord now has two residential projects under development in Singapore, namely Leedon Green and Dairy Farm Residences.

First Sponsor Group, meanwhile, was named the winner for best returns to shareholders, as well as growth in profit after tax. The company was listed back in July 2014 and is described as a mixed property developer in the Netherlands and China, owning a portfolio of commercial properties (including hotels), and providing property financing services in the Netherlands, Germany and China.

What makes First Sponsor interesting is that its key controlling shareholder is the Hong Leong Group, which is also the controlling shareholder of property giant City Developments. Its other key shareholder is Tai Tak Estates, which is a private company incorporated in Singapore.

Photo: Albert Chua/The Edge Singapore