CENTURION CLUB: SOFTWARE & IT SERVICES + TECHNOLOGY EQUIPMENT

AEM Holdings, a regular winner at these awards, is back again, with its overall sector win. The company, which provides testing services for the semiconductor industry, came out tops for weighted return on equity (ROE) and shares the growth in profit after tax (PAT) win with another semiconductor play, UMS Holdings (SGX:558

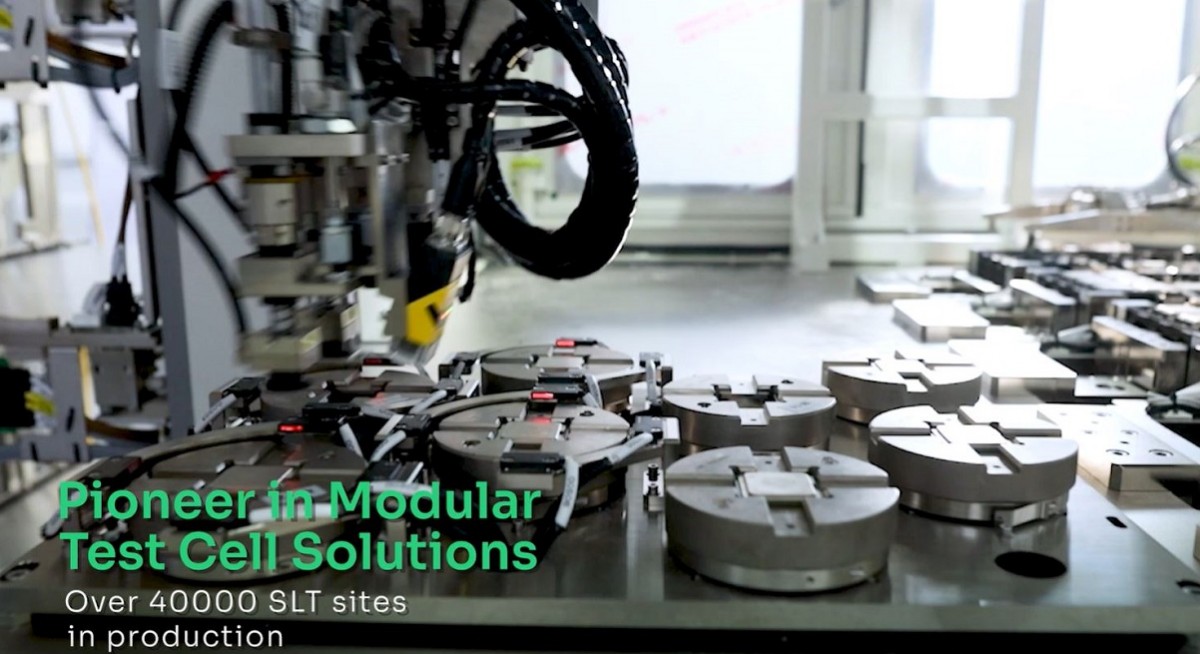

AEM is a global provider of semiconductor test solutions. Its comprehensive semiconductor and electronics test solutions cover multiple stages of the testing process over various testing types, for full-stack test capabilities for advanced engineering to high-volume manufacturing.

Over the years, AEM has built up a global presence across Asia, Europe and the US. Besides R&D centres in Singapore, Malaysia, Finland, France and the US. AEM operates manufacturing plants in Singapore, Penang, Batam, Ho Chi Minh City, Suzhou, and Lieto in Finland. In addition, it has a global network of engineering support, sales offices, associates, and distributors.

In the past few years, AEM, like many other companies in the semiconductor industry, was riding on the upswing of the industry cycle and reported record numbers for 1HFY2022 ended June 2022.

See also: The Edge Singapore unveils winners of 2023 Billion Dollar Club

Since 2HFY2022, the industry has gone the other way though. AEM chairman Loke Wai San sums up the market dynamics in its annual report, saying 2022 “was a tale of two halves that were separated by meaningful shifts in the global macro environment”.

“In the second half of 2022, the world started to exit its collective Covid mitigation with people returning to a more normal life of physical interaction and IT consumption. Governments pulled back previous monetary easing policies and inflation kicked in,” says Loke, adding that the higher interest rates imposed by central banks to curb inflation resulted in a slowdown in discretionary spending, capital expenditure and a rush to reduce levels of inventory. “This swing of the pendulum to contractionary policies will likely normalise over the next nine to 18 months but not in time to make 2023 a year of growth for many,” he adds.

However, for players who have been around for quite some time like AEM, industry cycles are the norm in the semiconductor industry. “Though ebbs and flows are common in the semiconductor industry, we believe the ongoing structural shift with the need for more semiconductors across multiple end markets will continue,” says Loke.

See also: Celebrating the top listed companies in Singapore

In a rare development, UMS Holdings, another semiconductor company, jointly won the growth in the PAT category with AEM Holdings (SGX:AWX

In his FY2022 annual report, chairman and CEO Andy Luong acknowledges that the outlook has turned softer but is still upbeat about long-term growth prospects. “Our long-term outlook stays strong as we are well-poised to scale higher with our twin growth engines in semiconductors and aerospace. Both industries have bright futures and will be our key growth drivers in the years ahead,” he says.

Azeus Systems, based in Hong Kong but listed in Singapore, has more than 30 years of experience in successfully delivering IT solutions. Over the years, it has built up a client base across Europe, Asia Pacific, America, Africa and the Middle East. Throughout the years, Azeus has maintained an extensive track record of developing large and complex IT systems for the public and private sectors. Azeus delivered 250 IT projects to over 60 government departments and public authorities in Asia and Europe, including one announced in September to provide combined system development services for the business information solution kit for the Hong Kong Police Force.