Less than a fortnight later, the company announced that revenue for 3QFY2022 ended Sept 30 improved by 22% y-o-y to $2.2 billion. For 9MFY2022, revenue increased by 19% y-o-y to $6.51 billion, with growth seen across all its business segments.

In the quarter ended Sept 30, ST Engineering added new orders worth $4.8 billion, bringing its order book to a record $25 billion, of which $2.5 billion is expected to be delivered by 4QFY2022. This figure excludes $1.9 billion worth of orders from the recently divested loss-making US marine business.

In line with a revised dividend policy of quarterly instead of half-yearly payouts, ST Engineering plans to pay an interim dividend per share of four cents a share, on track to bring the full-year total to 16 cents as guided, implying a yield of between 4.5% and 5%. The ex-dividend date is Dec 6 and dividends will be paid out on Dec 20.

Of the 11 brokerages with updated calls on the stock after Nov 28, nine have “buy” or equivalent recommendations, with target prices ranging from $3.85 to $4.74. Macquarie’s call is “neutral” and Citi’s is “sell”, with target prices of $3.73 and $3.26 respectively.

See also: Philippines halts AirAsia MOVE sales for ‘criminal’ airfares

Maybank Securities’ Kelvin Tan estimates that the TransCore contract wins will let the company book annual revenue of at least $120 million for the coming three to four years. Coupled with continuous improvement in commercial aerospace, ST Engineering enjoys clear revenue visibility, says Tan, who has raised his target price from $4.20 to $4.30.

This view is shared by CGS-CIMB’s Kenneth Tan and Lim Siew Khee, who have maintained their “add” calls on the stock, along with a slightly raised target price of $4.03 from $3.99. Besides the New Jersey contracts won by TransCore, another recent big contract win was a $1.4 billion turnkey rail contract in Taiwan’s Kaoshiung city, they note.

To pay for TransCore’s acquisition, ST Engineering took on debt — a point of concern flagged by analysts given how rates are rising. Maybank’s Tan calls the current ratio of fixed-to-floating debt at 54:46 “well balanced”. However “as the cost of debt rises, we are mindful that acquisition funding will face pressure from rising interest rates as the short duration exposes it to rollover risk upon maturity”, he adds.

See also: Airline industry scales back profit outlook amid trade tensions

As such, ST Engineering plans to term out a portion of its floating-rate commercial paper via new fixed-coupon loans or bonds, estimated by CGS-CIMB at around $500 million to $700 million, while DBS Group Research’s Suvro Sarkar expects the figure to be between $700 million and $1 billion of floating-rate commercial paper. He says the company still has US$32 million in T-lock gains which will partly offset the interest rate for the next bond issuance or loans.

Citi’s contrarian call

Citi’s Jame Osman, meanwhile, has kept his contrarian view on the stock. Along with his “sell” call, he has also lowered his target price to $3.26 from $3.49. Osman believes that the positives — strong order book, air travel recovery, and the defensive nature of ST Engineering’s business — have all been priced in already.

Instead, he sees potential downside risks arising from supply and labour bottlenecks as well as cost inflation. In addition, Osman warns of potential operational headwinds as ST Engineering goes about integrating its various acquisitions.

As such, Osman has lowered his FY2022 and FY2023 earnings per share estimate by 4–7%, after factoring in TransCore acquisition contribution and its integration costs as well as higher financing costs. As of 1HFY2022, the company’s net-debt-to-equity stands at 2.4x.

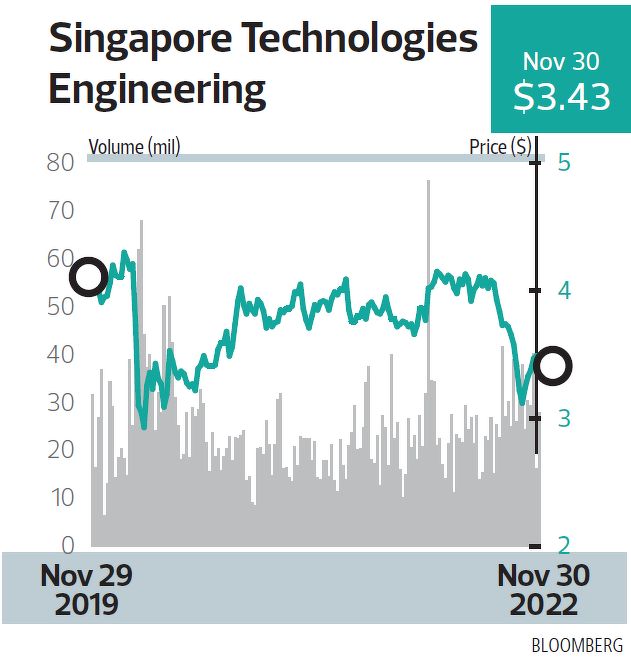

When the business update was released on Nov 28 before the market opened, ST Engineering shares stood at $3.50. However, since then, its share price has fallen slightly to close at $3.43 on Nov 30, valuing the company at $10.68 billion. Year to date, the stock is down 8.78%. It traded at a recent low of $3.12 on Oct 21.

On Nov 28, the company paid between $3.48 and $3.50 per share to buy back 500,000 shares, bringing the total buyback under the current mandate to 5.5 million shares, equivalent to 0.1764% of the company’s total issued shares.

On Nov 28, the company paid between $3.48 and $3.50 per share to buy back 500,000 shares, bringing the total buyback under the current mandate to 5.5 million shares, equivalent to 0.1764% of the company’s total issued shares.