Analysts are generally positive on food court operator Koufu following its financial results for the FY2020 ended December 2020, which saw earnings fall by 64.3% y-o-y to $9.9 million as revenue dipped 19.2% y-o-y to $192.4 million.

The company plans to pay a final dividend of 0.7 cent. Together with the interim dividend of 0.5 cent already paid, the total FY2020 payout of 1.2 cents represents a payout ratio of around 70%.

UOB Kay Hian’s John Cheong is maintaining his “buy” call on Koufu with a higher target price of 77 cents, from 73 cents previously.

“We expect the earnings to continue to improve sequentially as seen in the 2HFY2020 earnings growth of 192% h-o-h, led by gradual sales recovery especially in heartland areas,” says Cheong, who also likes the stock as it has the highest ROE and is the most profitable among local peers.

Meanwhile, CGS-CIMB’s Cezzzane See has kept her “add” call on Koufu with an unchanged target price of 94 cents.

“We like Koufu as we deem it a resilient F&B play for its exposure to Singapore’s suburban heartlands. Moreover, a strong balance sheet (about $62 million net cash at end-December 2020) accords it dry powder to weather volatile times and/or to cash in on potential M&As,” says See.

See notes that while footfall in Koufu’s heartland outlets are recovering, its food courts located at offices, downtown areas, tertiary institutions and tourist hotspots were still seeing low traffic due to travel restrictions and workfrom-home initiatives.

Similarly in Macau, footfall remains low as tourist arrivals are still sluggish.

On the other hand, PhillipCapital’s Terence Chua has downgraded his call on Koufu to “accumulate” from “buy” previously with a lower target price of 68 cents from 77 cents previously.

Although there have been improvements in footfalls in 2HFY2020, the consumption recovery may be slower than expected. Due to work from home being the default arrangement, consumption recovery at food courts near offices, downtown and in tertiary institutions remains slow.

Meanwhile, the group’s expected TOP of its integrated facility (IF) is delayed again to 1QFY2021 ended March, due to Covid-19 slowing down the shipment of building materials from Malaysia to Singapore.

Management now expects to move into the IF and commence operation in 2Q2021.

“We continue to remain positive on the group’s outlook post “circuit breaker”. We believe the recovery in consumption post circuit breaker will continue to improve footfalls and revenue of the food courts and coffee shops in 2021. We expect the completion of the Group’s new IF in 1QFY2021 to yield cost savings and provide an additional revenue source from the rental of the balance 25% space,” says Chua.

As of end 2020, Koufu operates 48 food courts, 18 coffee shops and a commercial mall under the outlet and mall management segment. Its F&B retail segment is made up of 74 self-operated stalls, 36 kiosks, seven quick-service restaurants, four full-service restaurants and 57 Delisnacks branded stalls. — Samantha Chiew

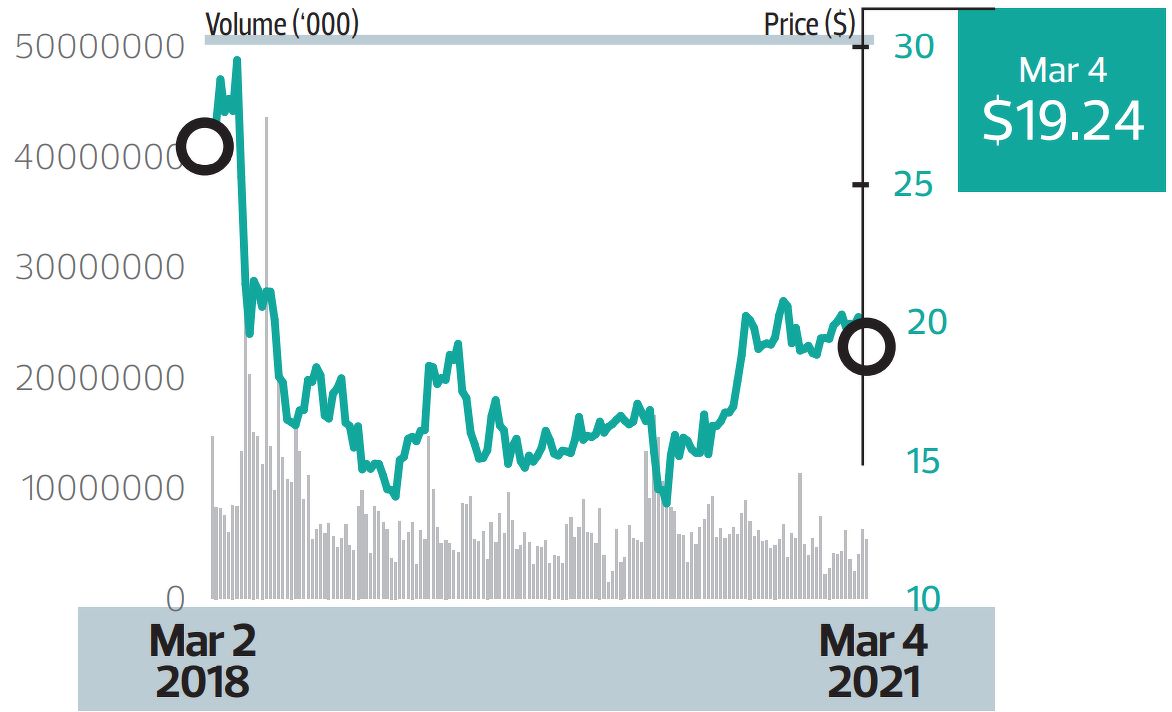

Venture Corp

Price target:

RHB Group Research “neutral” $19.60

PhillipCapital “neutral” $19.20

Maybank Kim Eng “buy” $22

DBS Group Research “buy” $24.30

Well-positioned for recovery despite lower-than-expected FY2020 results

Venture Corp’s financial results for FY2020 ended December 2020 showed continuing recovery though figures are slightly below expectations.

As such, analysts are split in their recommendations on the company, with RHB’s analyst Jarick Seet, seeing weaker-than-expected earnings growth ahead, downgrading the stock to “neutral” from “buy”, with a lower target price of $19.60 from $22.60.

“Valuation seems high at this point,” says Seet in a March 1 note.

On Feb 26, Venture Corp reported 2HFY2020 of $166.8 million, down 8.1% y-o-y. FY2020 earnings was $297.3 million, down 18.1% y-o-y.

Seet notes consistent recovery across the four quarters in terms of profitability in FY2020, a pattern likely to carry into FY2021 with improvement in revenue and profitability.

Meanwhile, PhillipCapital’s Paul Chew is maintaining his “neutral” call, as he sees Venture Corp’s pivot to new growth drivers, including EV batteries and wafer-fab equipment.

In a March 1 note, Chew raised his target price to $19.20 from $18.60, noting that the company was able to contain costs and is selling a mix of higher value products.

Meanwhile, Maybank Kim Eng Research analyst Lai Gene Lih says Venture Corp is still a “buy” even with 2HFY2020 earnings at the lower end of consensus estimates.

That said, the analyst has lowered Venture Corp’s target price to $22 from $23.27 on an unchanged 18.5 times FY2021 P/E at 1.5 standard deviation above four-year mean.

He also notes that Venture Corp was able to command the same net margin y-o-y despite lower volumes, thanks to exposure to the higher-value life-science domain.

Lai sees the company moving into other “interesting domains’’ such as robotics, automation and AI, as well as the advanced semiconductor equipment.

Meanwhile, DBS Group Research analyst Ling Lee Keng notes that new products and services initiatives (NPI) in 2021 are expected to drive FY2021 earnings higher.

That said, a number of these NPIs have been pushed back to FY2021 due to the demand and supply disruption in FY2020 as a result of the Covid-19 pandemic.

However, due to the chip shortages, some of the NPIs could see a slight delay, likely lasting till 2HFY2021.

In a March 1 note, Ling is maintaining her “buy” call on this ‘tech blue chip’ with a target price of $24.30.

“We continue to like Venture for its differentiating capabilities to attract key leaders in the respective domains that it has a presence in, and to offer end-to-end solutions from R&D right through product commercialisation.” — Jovi Ho

“We continue to like Venture for its differentiating capabilities to attract key leaders in the respective domains that it has a presence in, and to offer end-to-end solutions from R&D right through product commercialisation.” — Jovi Ho

Riverstone Holdings

Price target: CGS-CIMB “add” $2.30

RHB Group Research “buy” $1.85

DBS Group Research "buy" $1.85

Leaving no stone unturned as it beats expectations for 4Q2020

Analysts from CGS-CIMB Research, RHB Group Research and DBS Group Research have maintained their “buy” and “add” calls on Riverstone Holdings.

CGS-CIMB and RHB have reduced their target prices to $2.30 and $1.85 respectively, while DBS has left its target price unchanged at $1.85.

CGS-CIMB’s Ong Kang Chuen notes that despite some shipment delays, Riverstone’s net profit of RM$331 million ($108.6 million) in 4QFY2020 ended Dec 31, 2020, was 85% higher q-o-q and a 932% surge y-o-y due to stronger-than-expected margin expansion, led by stronger average selling prices (ASPs).

FY2020 net profit also came in at RM$647 million, 396% above FY2019’s figure.

He does not believe elevated ASPs to be unsustainable in the long run despite seeing “strong earnings prospects” for FY2021.

Riverstone targets healthcare and cleanroom glove ASPs to grow respectively by 40% and 30% q-o-q to US$95 ($126.50) and US$100 per carton in 1QFY2021.

“We expect gross profit margin (GPM) to further expand in 1QFY2021, as the selling price uptrend continues to outpace raw material cost increases,” says Ong.

Riverstone continues to maintain existing capacity (currently at 10.5 billion pieces a year) to its long-standing customers, while its FY2021 capacity of an additional 1.5 billion pieces per annum has been fully taken up.

In FY2021, Ong expects Riverstone to raise its volume mix of its cleanroom segment — which generally commands higher average selling prices — to 20%, from 15% in FY2020. Ong says this demand comes from the growth in tech manufacturing and pharmaceutical industries.

DBS Group Research’s Ling Lee Keng, who shares similar views as CGS-CIMB’s Ong, has a “buy” call and $1.85 target price.

However, given that earnings will gradually decline in FY2022 and beyond, Ling says her target price is “lower than consensus” given her more conservative assumptions.

In the near term, the company has two further expansion phases which will add 1.5 billion pieces per year in production capacity, bringing total annual production capacity to 15 billion by end FY2023.

Separately, RHB’s Singapore Research Team gave a $1.85 target price, down from $2.73, given the perceived risk premium in its discounted cash flow (DCF) methodology.

“We expect share price volatility, as we are approaching peak ASPs in FY2021. Additionally, we have rolled over our DCF to start from FY2022.” the team notes.

However, they said that despite the reduction in target price, Riverstone is still “undervalued”, given how at current prices of around $1.37 is 45% of its peak last July. The stock is now trading at 6.4 times FY2021 P/E, which is “unprecedentedly low”. — Lim Hui Jie

United Hampshire US Reit

Price target:

UOB Kay Hian “buy” 95 US cents

Yield remains enticing

UOB Kay Hian analyst Jonathan Koh maintains his “buy” rating on United Hampshire US REIT with a higher target price of 95 US cents ($1.33) — from 92 US cents previously — citing the resiliency of its grocery and necessity retail properties, high rental collections (at 98.9%), and higher demand for self-storage facilities.

The REIT’s 2HFY2020 results were in line with Koh’s expectations, with a distribution per unit (DPU) of 3.03 US cents, 1.3% above its IPO forecast.

The better DPU comes despite lower than forecasted revenue for the period caused by a slowdown in leasing activities because of Covid-19 and a delay in the opening of the Perth Amboy self-storage facility.

Koh notes that the lower revenue, along with additional legal expenses incurred for relief negotiations, was offset by a 25.4% drop in finance costs thanks to interest rate swaps that hedged its floating rate term loans to more favourable fixed rates.

United Hampshire US REIT maintained stable occupancy for its properties catering to essential needs.

Koh believes the built-in rental escalation for over 80% of its leases on such properties and a long weighted average lease to expiry (8.2 years) will provide the REIT with a defensive, stable income moving forward.

This is further reinforced by its roster of bluechip tenants such as Walmart, Lowe’s and The Home Depot.

Koh also points out that the REIT had a significant increase in demand for self-storage facilities as lockdowns increased work from home arrangements, forcing homeowners to shift belongings to storage facilities to accommodate home offices.

“Occupancy for self-storage facilities has improved considerably and trended upward since the gradual lifting of the lockdown in May 2020. Occupancies for the Carteret and Millburn self-storage facilities have hit above 90% in 4QFY2020. Occupancy for Elizabeth self-storage has improved from 27.4% in 3Q 2020 to 36.6% in 4QFY2020. Rents have increased by 4.2%,” he says.

Koh has kept his FY2021 DPU forecast relatively unchanged at 6.2 US cents and reiterates the REIT’s attractive yield spread.

“United Hampshire US REIT trades at a 2021 distribution yield of 9.2%, which represents an attractive yield spread of 7.8% above the 10-year US government bond yield of 1.4%. It trades at P/NAV of 0.9 times,” he adds. — Atiqah Mokhtar