- What is the impact of US rate hikes on REITs and is it still safe to buy REITs? According to Tan, the tightening monetary policies and US rate hikes are less worrying if they are in response to better economic data and not a runaway supply-side inflation.

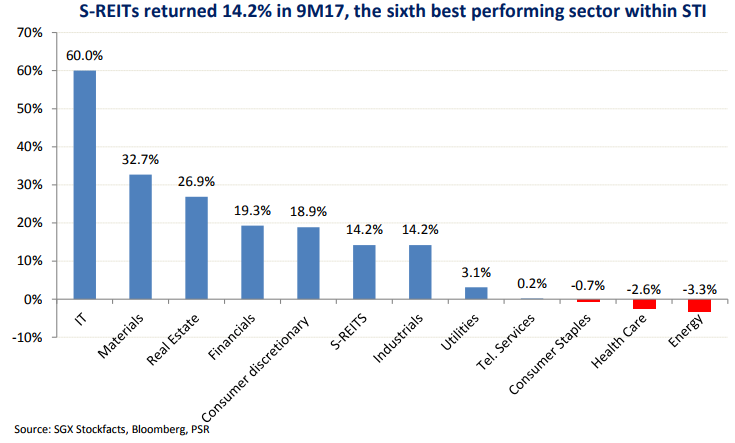

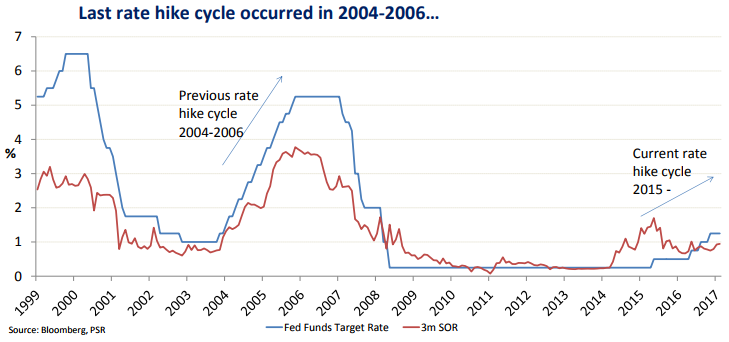

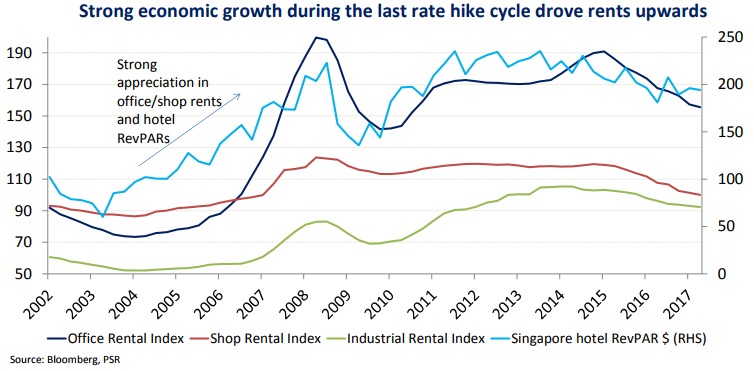

REITs can perform in rising interest rates environment, such was seen in the previous rate hike cycle in 2004-2006, as S-REITs had a CAGR of 26.5% compared to STI’s 15.9%. Tan says that more important thing to focus on is whether the accompanying economic growth is able to drive rental incomes higher, which could then offset the increased borrowing costs.

Scroll to continue

- What is the impact of US rate hikes on REITs and is it still safe to buy REITs?

According to Tan, the tightening monetary policies and US rate hikes are less worrying if they are in response to better economic data and not a runaway supply-side inflation. REITs can perform in rising interest rates environment, such was seen in the previous rate hike cycle in 2004-2006, as S-REITs had a CAGR of 26.5% compared to STI’s 15.9%. Tan says that more important thing to focus on is whether the accompanying economic growth is able to drive rental incomes higher, which could then offset the increased borrowing costs.

REITs can perform in rising interest rates environment, such was seen in the previous rate hike cycle in 2004-2006, as S-REITs had a CAGR of 26.5% compared to STI’s 15.9%. Tan says that more important thing to focus on is whether the accompanying economic growth is able to drive rental incomes higher, which could then offset the increased borrowing costs.

- Apart from higher financing costs, what other ways do higher interest rates affect REITs?

An increase in long-term interest rates will cause a decrease in the yield appeal of REITs as an asset class. In terms of financing costs, despite slightly rising SORs over the past two years, banks have been tightening loan spreads for REITs due to the competitive banking landscape. Hence, borrowing costs for REITs has been kept in check. Also, the strong SGD meant the uptick in SOR rates remained relatively muted over the last two years.

- What is the outlook for each S-REIT sector – retail/commercial/industrial/hospitality?

Most of the sectors – office, industrial and hotels, apart from retail, are generally facing a tapering of supply after a peak/surge in supply this year.

- How does S-REITs compare with regional REITs?

S-REITs trade at the highest yield of 5.9% on an absolute yield basis compared to other major REIT markets. The yield spread of 3.8% is third, trailing behind HK and Japan REITs. Apart from Hong Kong which has been using data available from 2012 to present, the yield spreads for all other major REIT indices have been trading above post-GRC average.

- Is valuation attractive from a yield angle? How does S-REITs’ valuation stand now compared with historical valuations?

S-REITs are currently trading at a yield spread of 3.8, which is the difference of 5.9% average yield and 2.1% risk free rate, which is around post-GFC (2010-present) average.

- Is book value a good way to judge if a REIT is under or overvalued?

Tan says that book value (P/NAV) is useful to compare against the industry as well as peers. It also compares a REIT’s own historical P/NAV against the economic outlook. Big cap REITs usually trade at higher valuations as these REITs are able to obtain lower costs of funding, making it easier for accretive acquisitions. They also enjoy economies of scale in the management of a larger portfolio. Similar sized companies can also have portfolios with different geographic exposures.

Hence, investors should take that into account when comparing. In addition, when comparing its own historical P/NAV investors should note if the macro environment is similar to the historical period and whether changes in the environment can justify it trading at a premium/discount to the average over the historical period. A REIT trading at a big discount to book and high yield may imply that the market is pricing in potential deterioration in the future for rental power of the portfolio properties and may not mean that it is a value buy.

- Growth in global economies is accelerating. Wouldn’t investors be better off looking at growth stocks instead of stable stocks like REITs/telcos/utilities?

Telcos and utilities have highly regulated fees and tariffs, unlike REITs that are exposed to commercial rents and market driven prices. Thus, REITs can capture the upside in rents in an improving economy, while still paying out at least 90% of rental income, appealing to investors who desire stable passive income and at the same time participate in growth from improving economies.

- Is a REIT with a larger portfolio of freehold properties better than another REIT with a portfolio of shorter leasehold properties?

Land tenure should be one of the considerations in deciding if a portfolio is better or worse off, but it alone is insufficient to make a conclusion.

Freehold buildings usually trade at a lower cap rate than shorter leasehold properties, such that the NAV would have already priced in the freehold factor. Also, due to properties in Singapore having shorter 30-year leases compared to retail of office properties, the higher yield compensates investors for the shorter tenure and the lower potential for capital gains in the long run.

- How would you calculate and compare REITs’ metrics and duration vs fixed income in falling, flat, rising interest rate environments?

REITs do not have fixed “maturities” like that of fixed incomes, making calculations on a duration that measures the sensitivity of the REIT’s price to fluctuations in interest rates not as straightforward.

Investors can instead watch out for an easier metric in the annual report under “sensitivity analysis”, which posts the sensitivity of the REIT’s earnings (not price) to fluctuations in interest rates or forex movements.

- What are key risks of investing in REITs now?

The strong performance in S-REITs has been supported by tepid inflation despite improving economic data, which then presents a Goldilocks situation of moderate economic growth with low inflation, accommodating market-friendly policies. An accelerating inflation could however lead to faster than expected rate hikes/tightening by the Fed. Any sharp upturn in inflation could reverse these trends.