Based on Cheong’s channel checks, UMS also looks set to benefit from its new customer’s (Customer L) expansion plans. The same customer is looking for more production capacity from several local semiconductor-related manufacturers to support its expansion and, or relocation of its Malaysian operation.

“UMS estimates that this new customer should contribute at least US$30 million ($40.9 million) in FY2024, which will make up a meaningful 11% contribution to our FY2024 forecasted revenue. For the longer term, UMS targets to grow Customer L’s contribution to be around the level of its existing largest customer,” writes Cheong in his Sept 18 report.

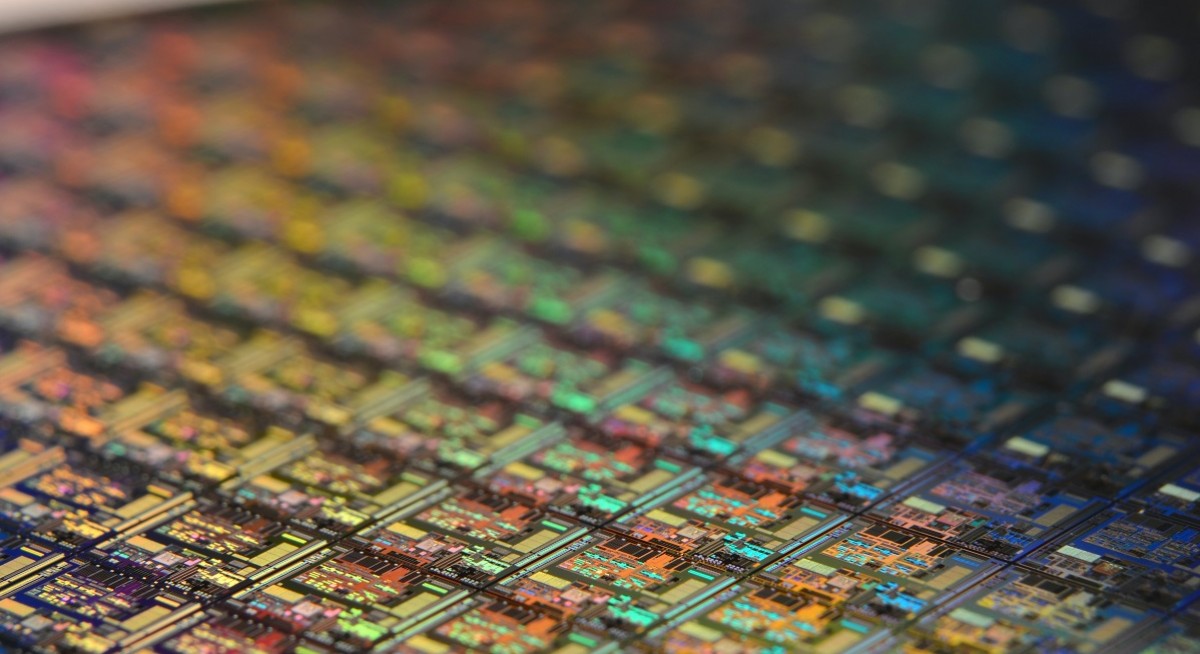

Another plus for UMS is the global recovery in fab equipment spending, which is set to happen in 2023.

During the quarterly World Fab forecast report by Semiconductor Equipment and Materials International (SEMI) published on Sept 12, global fab equipment spending for front-end facilities in 2023 is expected to decline 15% y-o-y before rebounding 15% y-o-y in 2024.

See also: Riverstone shares surge on UOB Kay Hian's higher target price of 98 cents led by AI-end demand

“Next year’s fab equipment spending recovery will be partly driven by the end of the semiconductor inventory correction in 2023 and strengthening demand for semiconductors in the high-performance computing (HPC) and memory segments,” says Cheong.

“The 2023 decline in equipment investment is proving shallower than expected, while the rebound in 2024 should be better than expected. The trend suggests the semiconductor industry is turning the corner on the downturn and on a path back to robust growth, fuelled by healthy chip demand,” he adds.

UMS is also set to benefit from the increased capacity within the global semicon industry. The industry is increasing its capacity by 5% in 2023 after an 8% increase in 2022. It is also expected to see capacity growth continue in 2024, the analyst points out.

Taiwan is expected to retain the global lead in fab equipment spending in 2024 with US$23 billion in investments, which is up by 4% y-o-y. Korea is projected to rank second in spending, with an estimated US$22 billion in investments in 2024, which is up by 41% y-o-y, reflecting a memory sector recovery.

“With export controls expected to limit China’s spending in leading-edge technologies and foreign investment, the region is forecast to place third in equipment spending worldwide in 2024 at US$20 billion, a decline from 2023. Despite the constraints, Chinese foundry suppliers are expected to continue investments in mature process nodes,” writes Cheong.

Finally, AI-related and automotive chips are expected to drive double-digit growth of spending in fab equipment spending in the next three years, which is another plus for UMS.

“Global 300mm fab equipment spending for front-end facilities next year is expected to begin a growth streak to hit a US$119 billion record high in 2026, following a decline in 2023, according to SEMI,” says Cheong.

“Strong demand for high-performance computing, automotive applications and improved demand for memory will fuel double-digit growth of spending in equipment investments over the three-year period. After the projected 18% drop to US$74 billion this year, global 300mm fab equipment spending is forecast to rise 12% to US$82 billion in 2024, 24% to US$101.9 billion in 2025 and 17% to US$118.8 billion in 2026,” he adds.

To this end, Cheong has raised his FY2024/FY2025 earnings estimates by 17% and 14% respectively. This comes after his raised revenue estimates by 4% and 3% respectively to factor in the potential recovery in the semiconductor industry from AMAT’s improved guidance.

“We also raise our gross margin assumption by 1.5% to 48.5% to account for better operating leverage from improved revenue,” says the analyst.

For more stories about where money flows, click here for Capital Section

On the back of his raised earnings estimates, Cheong’s target price is now at $1.56 from $1.24 previously.

His new target price is based on a P/E-based valuation of 13.5x FY2024’s earnings per share (EPS), up from 12.5x previously and pegged at 0.5 standard deviation (s.d.) UMS’s historical mean P/E.

“The reason for raising our PE-based valuation multiple from below mean is to reflect the improving semiconductor industry outlook and potential increase in UMS’s earnings quality from new contributions from its new customer,” he says.

Shares in UMS closed flat at $1.26 on Sept 19.