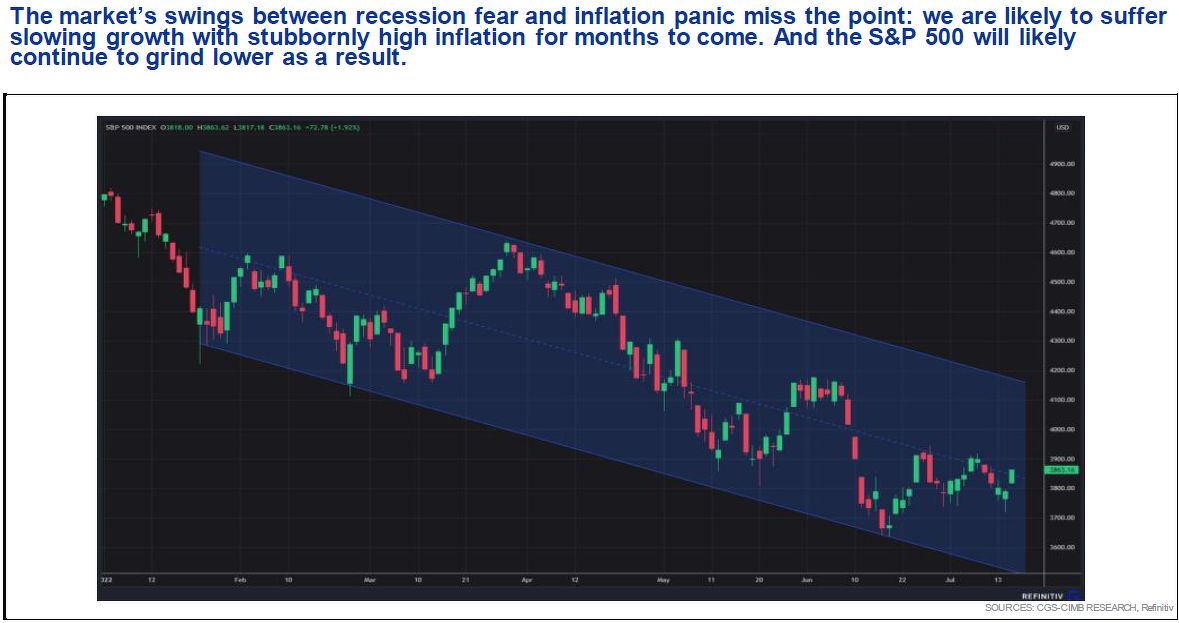

CGS-CIMB Research analyst Lim Say Boon is of the view that the global macroeconomic outlook will see slow growth and high inflation, saying in a July 18 presentation that this is the “likely outcome” from the usual time lag between demand destruction and sustained suppression of inflation.

“Slowing growth with stubbornly high inflation has historically been the result of the time lag between demand destruction and a sustained decline in inflation.” Lim says, adding that this phenomenon was observed in 1955-1957, 1973-1975, 1979-1980 and 2000-2001.

The all items consumer price index (CPI) for June rose 9.1% y-o-y for June from 8.6% in May; while producer price inflation (PPI) PPI rose to 11.3% y-o-y from 10.9%.

In contrast, real retail sales and industrial production went into contraction in June, falling 0.2% m-o-m and weakening further from zero growth in May.

See also: China says trade talks with US set for Friday in Malaysia

Elsewhere, real retail sales are still shrinking m-o-m, albeit at a slower rate than in May. Lim elaborates that nominal retail sales figures were “deceptively buoyant” because of inflation, particularly in energy prices, pointing out that spending at gasoline stations grew 4.7% m-o-m.

Meanwhile, the University of Michigan’s Consumer Sentiment Index remains in recessionary territory, with Lim saying that while this was a “tiny jump” from 50 to 51.1, “these are recessionary levels and will drag down consumer spending in the coming months if they persist.”

See also: Navigating geoeconomic risks: Asean businesses remain resilient but urge structural change

A bright spot on the inflation front, he notes, is that the decline in crude oil prices in early June flowed through to US gasoline prices by mid-June. A full month of lower gasoline prices might take the pressure off headline inflation next month.

However, Lim thinks keeping crude oil prices low is going to be “down to luck.” The supply and demand balance will be very tight until next year, and could be upset easily by sanctions on Russia or a revival in demand from China.

Chinese equities

Separately, Lim notes that for Chinese equities, China’s financing conditions have been improving since April and this is best captured by the all system financing aggregate, adding the market will want to see this rise continue.

Last month, he points out his prediction of the CSI Overseas China Internet Index having the challenge of breaking out of the 4,000-5,500 trading range. “It has yet to approach 5,500 and had fallen back. Beware of more volatility ahead.”

In addition, Lim notes the CSI 300 is returning to test its 100-day moving average technical support, saying “this is an important level on the rise and also on the decline”.