Credit Bureau Asia was listed late last year at 93 cents. Koo bought the shares just a week after Credit Bureau Asia reported that earnings for 1HFY2021 ended June 30 was up 5.5% y-o-y from $3.72 million to $3.92 million.

However, the bottom line included one-off items such as IPO expenses. If those items were excluded, Credit Bureau Asia would have increased its earnings by 15.5% y-o-y.

The company plans to pay an interim dividend of 1.7 cents per share, equivalent to about its entire earnings. “We are off to a great start with this set of results, and we expect to end the year with a strong finish,” says Koo, in his Aug 5 earnings commentary.

“Going forward, we are working on a series of exciting projects such as the Moneylenders Credit Bureau and potential digital bank customers which will continue to drive our business forward. We are also in dialogue with several parties in the region to forge alliances to bring our business to greater heights.”

CEO and group adviser raise stakes

Similar to Credit Bureau Asia, two insiders at GHY Culture & Media bought shares of the company from the open market following the release of its 1HFY2021 earnings.

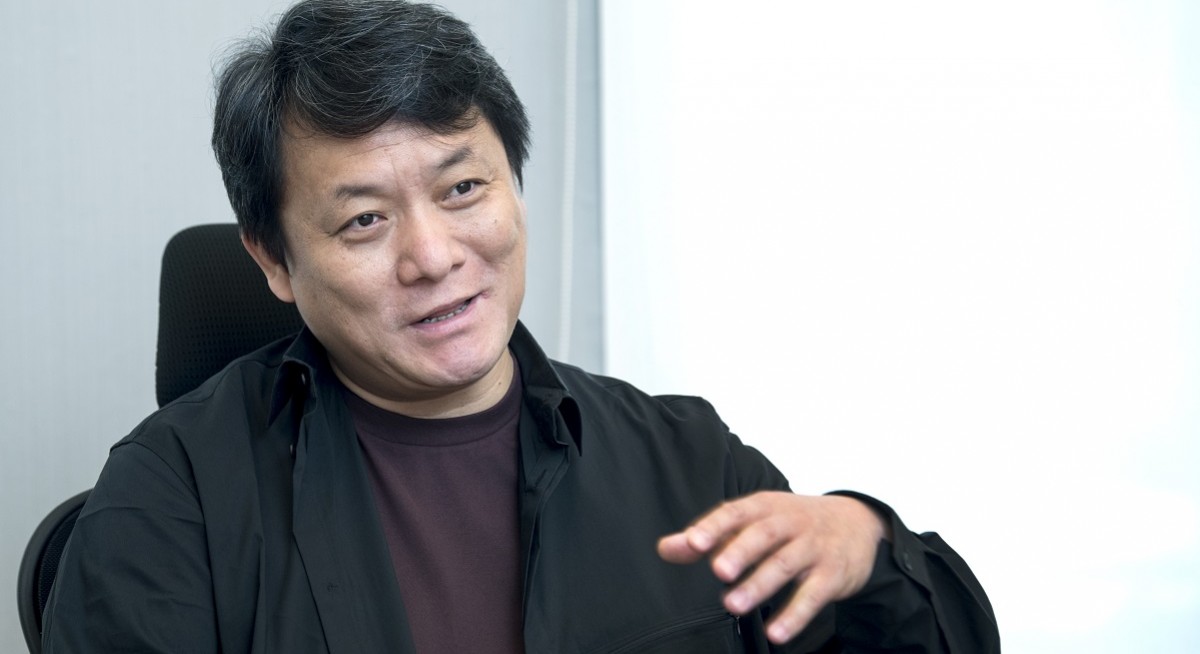

Guo Jingyu, GHY’s executive chairman and CEO, on Aug 12 acquired nearly 1.83 million shares for $1.15 million, which works out to an average price of nearly 63.3 cents each. On Aug 13 and 16, he acquired another 223,800 shares for $140,727.89, which works out to an average of around 63 cents each.

With the purchase, Guo’s direct stake increased to just over 3.93 million shares or 0.37%. In addition, Guo holds a deemed stake of another 640 million shares. In total, he has an interest of 643.93 million shares or 59.97%, up from 59.96% previously.

In addition, John Ho Ah Huat, who is “group adviser” to GHY, bought shares on the open market as well. Ho is no stranger to the media and entertainment business. He was CEO of Scorpio East Holdings and is now a substantial shareholder of GHY. Ho’s wife, Lian Lee Lee, was appointed the company’s deputy CEO in May. On Aug 12, Ho acquired 312,700 shares for $193,007.82 or 61.7 cents per share. With that, Ho now holds a total of 113.6 million shares or 10.58%, up from 10.55% before the purchase.

Guo and Ho bought their shares the day after the company reported a 73% y-oy drop in earnings to $3.5 million in 1HFY2021 ended June from $13 million in 1HFY2020. The company explains that because of the lockdown in Malaysia, it had to shift production of its shows to China, incurring higher costs and causing margins to halve.

However, GHY is guiding for a stronger 2HFY2021. This indicated by a 64% jump in “other receivables” to $17 million as at end June from end December 2020 mainly due to prepayments made for upcoming drama productions. “Contract assets, which represent GHY’s right to consideration for drama and film productions in progress but unbilled, also grew by 36.5% to approximately $72.6 million in 1HFY2021,” according to DBS Group Research, which has a “buy” call and $1 target price on GHY.

Besides drama productions, GHY also has in the pipeline plans to ramp up the number of concerts it can produce when such activities can be resumed. The company has moved into the production of programming via other formats such as bite-sized online videos.