For the FY2020 ended March 31, Neo Group reported earnings of $6.3 million, up 21.2% y-o-y from $5.2 million in FY2019. Revenue increased by 2.7% y-o-y to $185.9 million, with substantial growth from its core food catering business. The company also sells food via retail outlets and manufactures foodstuff.

“Our strategy of nurturing diversity through the build-up of our highly synergistic business segments over the last few years, and by having a multi-brand platform, has continued to deliver resilient performance,” says Neo. The company plans to pay a dividend of 0.5 cent for FY2020, the same amount paid out in FY2019.

Neo Group plans to further broaden its market share in the food catering business by strengthening its recurring income stream and widening its catering and takeaway meal options. It will also try and extract economies of scale with its strategically-located central kitchens across Singapore.

Raising stakes in real estate agency

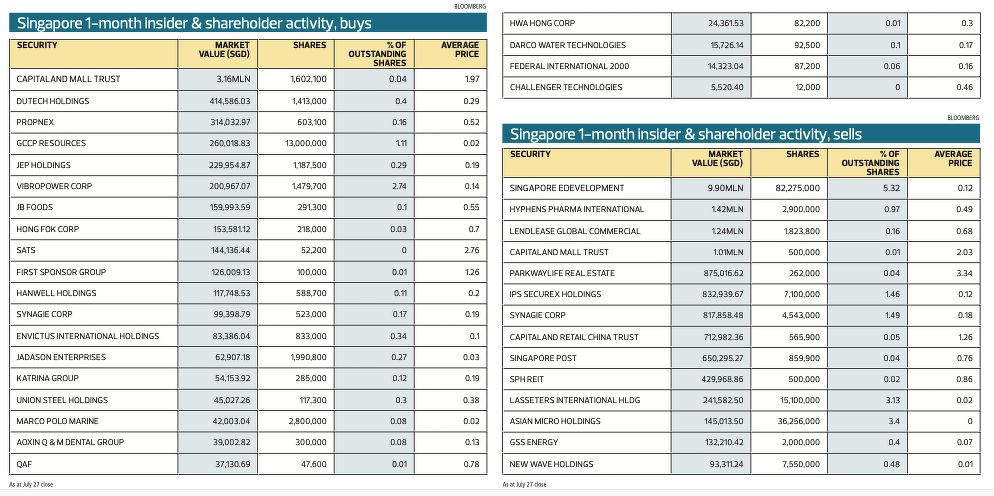

Kelvin Fong Keng Seong, executive director of PropNex, has been buying shares steadily on the open market in recent weeks. The most recent purchases were made on July 24, when he bought a total of 140,000 shares at an average price of 53 cents each. Fong now owns about 30.1 million shares, or 8.15%. Most of his shares are held through a nominee account with Citibank as well as 100,000 shares held by his wife Janet Lim Bee Hua. Earlier on July 21, 22 and 23, Fong had acquired 69,000 shares at between 52 and 52.5 cents each, 11,100 shares at 52.5 cents each, and 186,800 shares at around 53 cents each respectively. The last time Fong bought shares was in the middle of March, at around 50 cents each.

Besides Fong, Mohamed Ismail s/o Abdul Gafoore, executive chairman and CEO of PropNex, recently bought shares too. On July 22, he bought 400,000 shares on the open market at 52.5 cents each, raising his total stake to 239,320,779 shares, or 64.68%.

Inside trades from steel trader

Ang Yew Chye, an executive director at Union Steel Holdings, is steadily buying shares of the company from the open market. The most recent purchase was made on July 23 where he acquired 31,500 shares for $12,600. With the purchase, his stake increased to some 3.5 million shares, or 9%, from 8.92% previously. Earlier on July 8, 9 and 21, he had also acquired 7,300 shares for $2,409, 10,000 shares for $3,300 and 68,500 shares for $27,238.34 respectively.

In 1HFY2020 ended Dec 31, 2019, Union Steel reported earnings of $573,000, 84% higher compared to earnings of $311,000 a year ago. This was due to 4% higher revenue of $33.6 million as well as higher gross margins of 18.6%, up from 16.3% a year ago.

However, the company issued a profit warning on July 24. It expects to end FY2020 with a net loss because of an impairment from an investment property, no thanks to the uncertain economic outlook brought about by the Covid-19 pandemic.\

However, the company issued a profit warning on July 24. It expects to end FY2020 with a net loss because of an impairment from an investment property, no thanks to the uncertain economic outlook brought about by the Covid-19 pandemic.\