The theme this quarter is “A New Hope”, which builds on expectations of normalcy with wider availability of vaccines.

To be sure, there have been successive new waves of outbreak in major economies like the UK and Japan. While this may be the new norm, the possibility these outbreaks will have a dire impact on the markets is undeniable.

Still, DBS Chief Investment Officer Hou Wey Fook is sticking to a call he has been making — that is, investors should stay invested, and build “portfolios that last”. Apart from the vaccines, his optimism is fuelled by “very loose monetary policy” from central banks like the US Fed and also fiscal stimulus governments are compelled to introduce.

New bond proxy

DBS says the following themes will dominate investors’ attention: An attractive equity risk premium, corporate earnings recovery, and negative real bond yields.

The bank also believes that the current rally after the Covid-19 induced crash in March is the start of a new bull market, after the Covid-19 pandemic halted the previous 11 year bull market where the S&P 500 Index gained 401% from the 2009 Global Financial Crisis to March last year — the second highest gain in history. The only other bull market which registered stronger gains was the rally from October 1990 to March 2000 that saw US equities gaining 417%.

In the report, Hou acknowledges that sceptics will bemoan this “optimistic” view of a bull market, given how unemployment rate remains high and the service-related industries remain challenging.

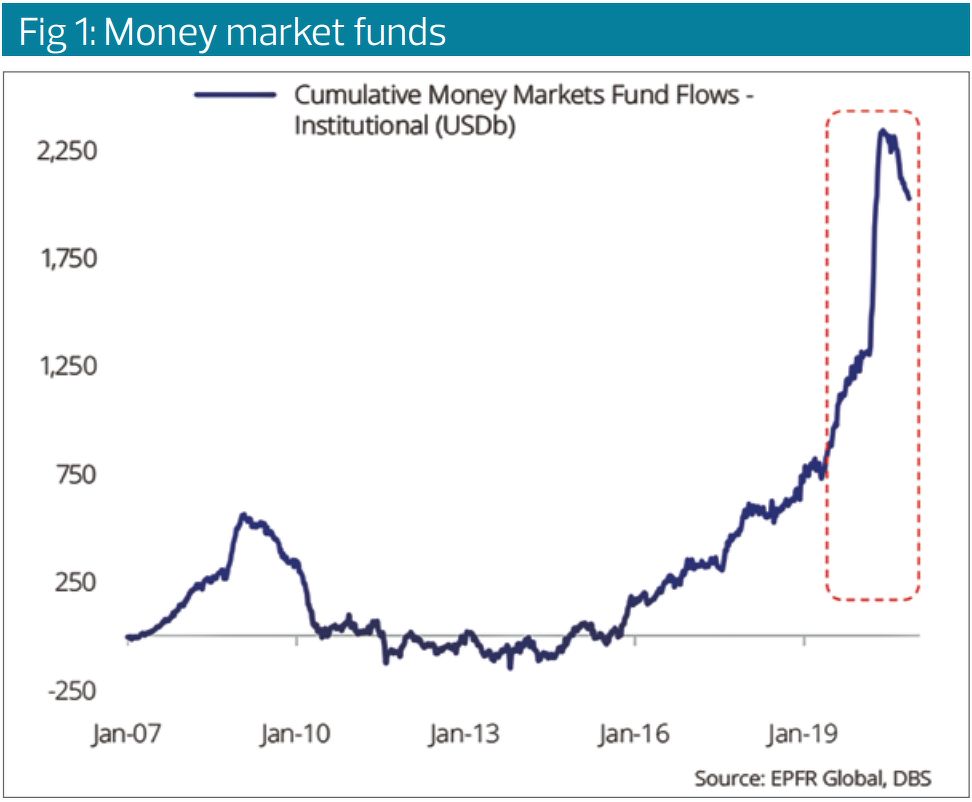

However, DBS also references that old adage, “bull markets are born on pessimism, grown on scepticism, mature on optimism, and die on euphoria”. As the report states: “Given the huge mountain of funds (see figure 1) parked in money markets, we are clearly in the pessimism stage, and this is where bull markets have historically been born.”

However, DBS also references that old adage, “bull markets are born on pessimism, grown on scepticism, mature on optimism, and die on euphoria”. As the report states: “Given the huge mountain of funds (see figure 1) parked in money markets, we are clearly in the pessimism stage, and this is where bull markets have historically been born.”

At a briefing on Jan 4, Hou alludes to another reason for the possible gain in the market. “There is currently a huge mountain of cash sitting on the side lines, uninvested, a historical high despite deposit rates at zero. Clearly, this does not tell me we are in an euphoria stage, likely we are between pessimism and scepticism and therefore, we think that this uptrend is sustainable.”

Sooner or later, this savings pool would need to find a home somewhere. “And there are only three asset classes that can contain the pool of global savings, cash deposits, bonds, and equities,” he adds.

If cash deposits are giving zero (or negative) returns, bonds will be no better. He says 25% of the investment-grade bond universe is negative-yielding, and hardly any part of the investment-grade market is giving investors a yield of 4% and above. “So if bonds are no better than cash, then there is no alternative but equities, we think dividend-yielding equities will be the new bond proxy,” Hou continues.

Searching for IDEAs

In the wake of the pandemic-induced recession, one wonders if there will be lasting damage to economies. DBS firmly believes that the prevailing macro challenges are caused by exogenous factors that are transitory, and as such, have no bearing on the long-term structural outlook of the economy.

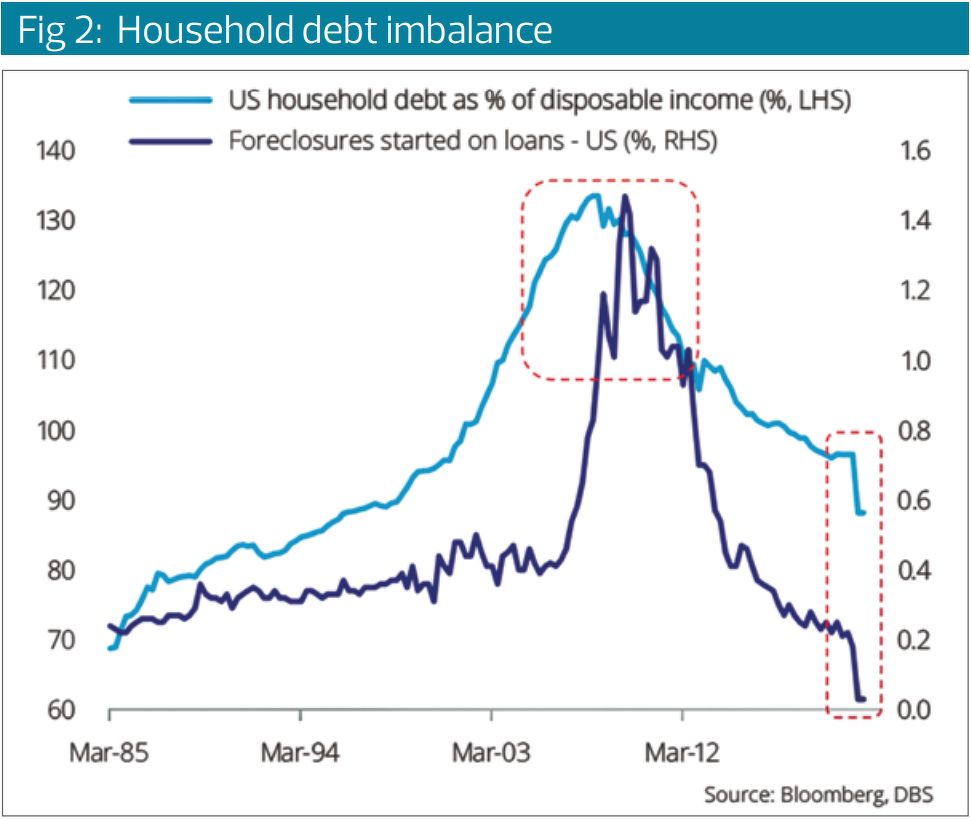

The report said back in 2008, US household debt to disposable income hit a high of 133.6% while foreclosures on all loans also peaked at 1.4% just prior to the onslaught of the 2008 subprime crisis. But none of these imbalances are prevalent today (see figure 2).

The report said back in 2008, US household debt to disposable income hit a high of 133.6% while foreclosures on all loans also peaked at 1.4% just prior to the onslaught of the 2008 subprime crisis. But none of these imbalances are prevalent today (see figure 2).

“This recession that we are in is unlike previous recessions, because in the past recessions are triggered by the unwinding of high leverage in the system,” says Hou.

He also notes that in the current recession, household debt as a percentage of disposable income has remained at a very low level as compared to the GFC. Similarly, corporate debt is also a lot more manageable than previous recessions.

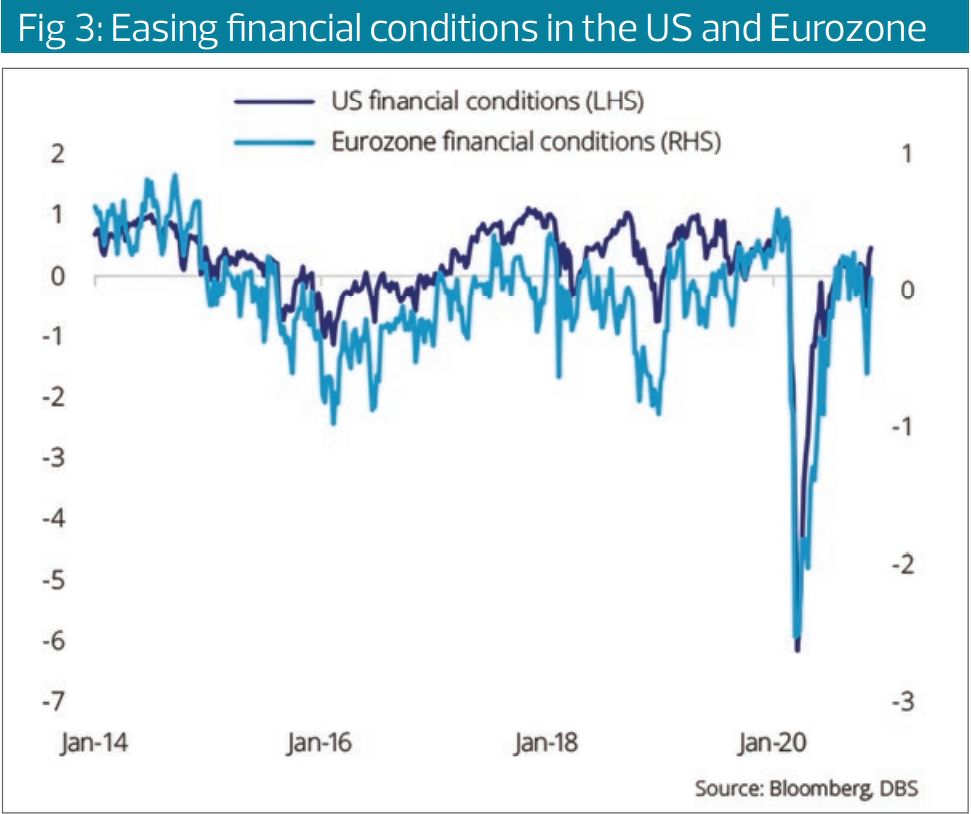

With the exception of some industries that will face sustained challenges (like airlines), DBS believes that the broader economy will undergo a broadbased recovery as business normalcy resumes while financial conditions ease (see figure 3).

With the exception of some industries that will face sustained challenges (like airlines), DBS believes that the broader economy will undergo a broadbased recovery as business normalcy resumes while financial conditions ease (see figure 3).

As the world navigates the new year, DBS believes investors should maintain exposure to the technology sector, while having “tactical exposure” to “vaccine winners” such as those in the restaurants, hotels, leisure, and casino space, and added industries that require faceto-face interactions are poised to rebound strongly in the event of a vaccine discovery.

Hou reiterates his so-called barbell strategy, where there are two outsized areas of focus in an investor’s portfolio. On one end, he advises investors to invest in “income generators”, things like “credit, triple-B bonds, dividend-yielding stocks like Singapore REITs, Singapore banks” to add resilience to their portfolio. BBB/BB-rated bonds in Asia and Europe are deemed by DBS to be the “sweet spot” given in terms of yield/ default rate ratio, and investors are advised to hold these in their portfolio for about five years for a meaningful return.

On the other hand, Hou said investors should look at companies that are riding the secular wave of long term, irreversible growth trends. He classifies these as innovators, disruptors, enablers, and adaptors — or IDEA companies, for short.

Innovators are companies that create new products that change the way people live. Examples include companies like Apple’s launch of the now ubiquitous iPhone back in 2007, with its share price jumping 30 times in the last 13 years.

Disruptors like Amazon and Alibaba are upending the traditional retail industry while AirBnB is disrupting the hospitality industry. Hou highlights the fact that Airbnb’s market value has overtaken hospitality brands like Marriott International, Hilton Hotels Corporation and Hyatt Hotels Corporation combined.

As for enablers, these are companies that empower ongoing innovation and disruption trends. Companies that provide Infrastructure as a Service (IaaS) such as Amazon — via its Amazon Web Services unit — and Microsoft. These companies are in turn powered by semiconductor chips provided by the likes of AMD, Nvidia and Qualcomm. These companies are coming together to enable new trends such as the Internet of Things, 5G and autonomous vehicles, says Hou.

Finally, there are the so-called adapters or traditional companies that are able to successfully transform their old business models to the digital economy. Hou gives the example of Visa and MasterCard who hold legacy infrastructure, but adapted very quickly to the digital economy.

“What they did was they opened up their infrastructure, for FinTech, for online payment platforms. They open it up to their their competitiors like Google Pay, Apple Pay, Paypal, so much so that when the plastic card becomes obsolete, Visa and MasterCard will be relevant and highly profitable still,” Hou says, adding that these two companies will be ubiquitous in the back end of the global payment system, making transactions and handling the sending and receiving of money.

Gold still glittering

For investors who may prefer alternative investments, gold still remains the safe haven of choice for investors. DBS believes the gold rally could continue into 2021 as in the near term, risks are still lurking. The uncertainties over US policies as the country transitions into a Joe Biden administration, a Democrat controlled US Senate and escalating Covid-19 cases should lend good support for gold. In addition, the Fed’s QE policy has the effect of providing liquidity into the system, bringing bond yields down, weakening the US dollar, and driving inflation higher.

DBS reckons these factors are tailwinds for the price of gold. Moreover, its dual characteristics as a diversifier while still appreciating in value when equity prices rise should make it a desirable asset class that will enable the overall portfolio to be resilient in a volatile environment.

Gold is also seen as a store of wealth and a hedge against systemic risk, currency devaluation, and inflation can become more relevant in broad-based portfolios such as pension funds and personal private wealth. Therefore, DBS thinks allocation towards gold should increase, driving the strategic demand for gold.

Unlike oil and property prices, gold is not inflationary and does not hinder economic recovery. Hence, higher gold prices are unlikely to trigger monetary response, says DBS. At this juncture, Hou sees light at the end of the tunnel with the coming of 2021. “With the deployment of vaccines, there will be less infection rates, less death rates, [and] the rotation to value and laggards is a start. We therefore think it’s a healthy market, it signals a sustainable rally.”