DBS also highlights attractive yield opportunities throughout the fixed-income market spectrum — in developed markets, global investment grade bonds are at 5.5%, and high yield is at 9.1%. In emerging markets, the figure stands at 7.5%, and hybrid capital bonds are at 9% to 9.4%. “This is a very attractive market compared to what we’ve seen in the last 20 years,” adds Hou. Hou’s team has long advocated the “barbell strategy,” emphasising high-quality income-generating companies alongside growth-focused assets. This approach remains their preference. On the portion of income generation, the team once had substantial exposure to dividend-yielding stocks alongside bond interest income. However, due to the Fed’s recent policy shift, DBS has shifted focus entirely to bonds, significantly reducing their dividend-yielding equity holdings.

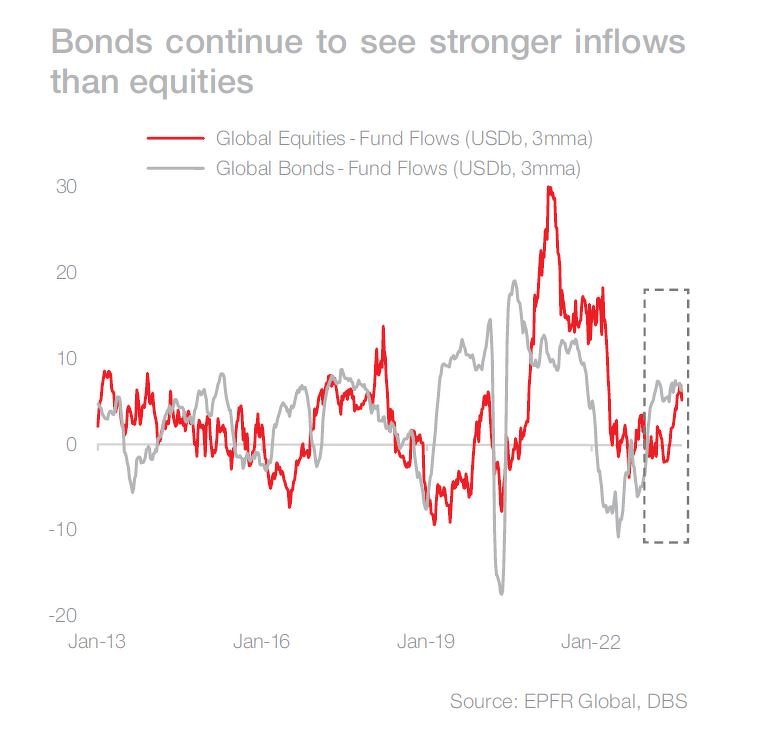

Bonds over equities

Since August 2022, the blended bond yield has surpassed the income equities dividend yield. DBS says that this suggests that the addition of income equities no longer boosts the overall yield of a portfolio. They now prefer bonds over income equities in this market cycle. Before, higher interest rates correlated with a higher percentage of interest payments in operating profits. However, analysts note that this correlation has broken in the current cycle. This is largely due to the high-quality large market capitalisation companies disproportionately represented in the index, contributing to a divergence between interest costs and higher rates. The team highlights that companies like Nvidia, Apple, Alphabet and others have benefitted from higher interest rates through positive net interest income. Such firms have high cash surpluses that can earn them attractive interest income, as they generate huge free cash flow annually from their underlying businesses, says DBS. For example, Apple generates more than US$100 billion ($136.6 billion) in annual free cash flows, while Google and Microsoft generate more than US$50 billion in annual free cash flows. “We think the current sell-off in equities is not a bad time for our clients to re-engage in these big cap, high-quality cash flow generating companies,” says Hou. The team also warns that not all companies in these sectors are worth investing in. They caution against companies that are highly indebted and loss-making.

See also: Thailand’s US$45 bil fund sees gold, equities boosting returns

Bonds over equities

Since August 2022, the blended bond yield has surpassed the income equities dividend yield. DBS says that this suggests that the addition of income equities no longer boosts the overall yield of a portfolio. They now prefer bonds over income equities in this market cycle.

Before, higher interest rates correlated with a higher percentage of interest payments in operating profits. However, analysts note that this correlation has broken in the current cycle. This is largely due to the high-quality large market capitalisation companies disproportionately represented in the index, contributing to a divergence between interest costs and higher rates.

The team highlights that companies like Nvidia, Apple, Alphabet and others have benefitted from higher interest rates through positive net interest income. Such firms have high cash surpluses that can earn them attractive interest income, as they generate huge free cash flow annually from their underlying businesses, says DBS. For example, Apple generates more than US$100 billion ($136.6 billion) in annual free cash flows, while Google and Microsoft generate more than US$50 billion in annual free cash flows.

“We think the current sell-off in equities is not a bad time for our clients to re-engage in these big cap, high-quality cash flow generating companies,” says Hou. The team also warns that not all companies in these sectors are worth investing in. They caution against companies that are highly indebted and loss-making.

Alternatively, selective companies in non-technology sectors have also demonstrated quality moat characteristics, which can defend profit margins and grow market share. These include companies with big economies of scale, such as Walmart in the US or European names selling luxury goods. DBS notes that LVMH and Hermes reported 13% and 22% y-o-y revenue growth on the back of robust sales in Europe and China in 2Q2023. “Luxury companies are investing in marketing initiatives, rebranding efforts, and acquisitions to capture a larger portion of the market, which largely comprises millennials’ spending habits and an expanding middle class,” says DBS, maintaining its positive stance on this sector. “The removal of restrictions on Chinese overseas group travel could potentially lead to an upswing in Chinese tourists on a global scale, providing a favourable backdrop for further growth,” adds DBS.

See also: US-China trade truce: Reprieve or realignment?

More ideological than economical

The analysts at DBS continue to remain overweight on their stance on Asia equities. Despite China starting the year with a confident outlook, initial hopes of strong pent-up demand spurring domestic consumption failed to transpire even after the end of its zero-Covid policy.

Concerns about China’s real estate sector, which comprises around one-quarter of its economy, and issues in the shadow banking space have raised discussions about structural imbalances. As a result, China is currently trading at a discount compared to global peers.

The analysts say that while the People’s Bank of China (PBOC) has cut lending rates, existing policy measures are not significant enough to give the economy the massive boost it needs. Given the overall weakness in China equities, their call on Asia ex-Japan continues to underwhelm. DBS believes that China, as one of the world’s largest economies and most populous nations, still has the capacity for substantial spending, making it an attractive option from a valuation standpoint. The bank’s senior investment strategist, Yeang Cheng Ling, notes that the present policies implemented by the Chinese government have been more targeted as an antidote to more regional-centric issues before moving on to broader base policy recommendations. “We believe that the government is trying to reserve some bullets to cater for more important stimulus going forward next year,” says Yeang. “A strong dose of policy stimulus will rekindle animal spirits for the market.” When asked about Chinese property credit, senior investment strategist Daryl Ho says that the team has been cautious about China’s property credit since early 2022. Back then, they recognised that ideological factors influenced the property credit sector’s performance more than economic ones. Consequently, their cautious stance on China’s property credit remains the same.

A bright spot

Given tight bank lending standards and slow, high-yield bond issuance, DBS analysts see an opportunity for private credit investors. “In our portfolio allocation for clients, besides having equities and bonds, we need another sleeve called alternative assets, which include private assets with private equity, private debt,” says Hou.

He adds that direct lending transactions today look attractive, as they would normally have provisions for more favourable covenants with borrowers. They are also typically in floating rate loans to enjoy a higher short-term interest rate environment.

Hou observes that this private credit investment opportunity is mirrored in traditional banks like JP Morgan and Barclays, which are also looking to enter the private debt market. “Over time, these return sources from private debt and private equity are very much alpha returns, not beta or market directional returns,” he adds. “So they add a lot of resilience to our client’s entire portfolio.”