Laxminarayan says: “One simple data point says it all: US annual inflation fell for an unprecedented eleven consecutive months up until May.” Although a consumer inflation percentage of above 4% is still “pretty steep”, Laxminarayan notes that consumer prices are typically the last to reflect change. Meanwhile, producers, who witnessed a disinflation in their prices last month, are the first to see this decline in prices. He takes the current high rental and housing prices against the declining prices of gasoline as an example; one year ago amid the backdrop of an energy crisis, there was no end in sight for the soaring prices, yet one year later, gas prices have trended downwards, which is proof that the market will always find an equilibrium. “The fact is that the inflationary trend is more or less done, [and it] will feed its way into the consumer prices at some point,” Laxminarayan adds. He cites the Cleveland Federal Reserve’s forecast of 3.2% for consumer price inflation for the month of June, noting that they have been accurate in predicting near-term inflation numbers in the past.

Geopolitical tensions, sky-high inflation rates and catastrophic banking failures have underscored a stormy market so far this year but experts at Julius Baer believe that the second-half will still be “sunny outside”.

Speaking at the mid-year market outlook media roundtable on July 3, Bhaskar Laxminarayan, CIO and head of investment management for Apac, and Mark Matthews, head of research Apac, are sticking to their view that this year is the “year of the cool-down” and anticipate that the global economy will become more balanced by next year.

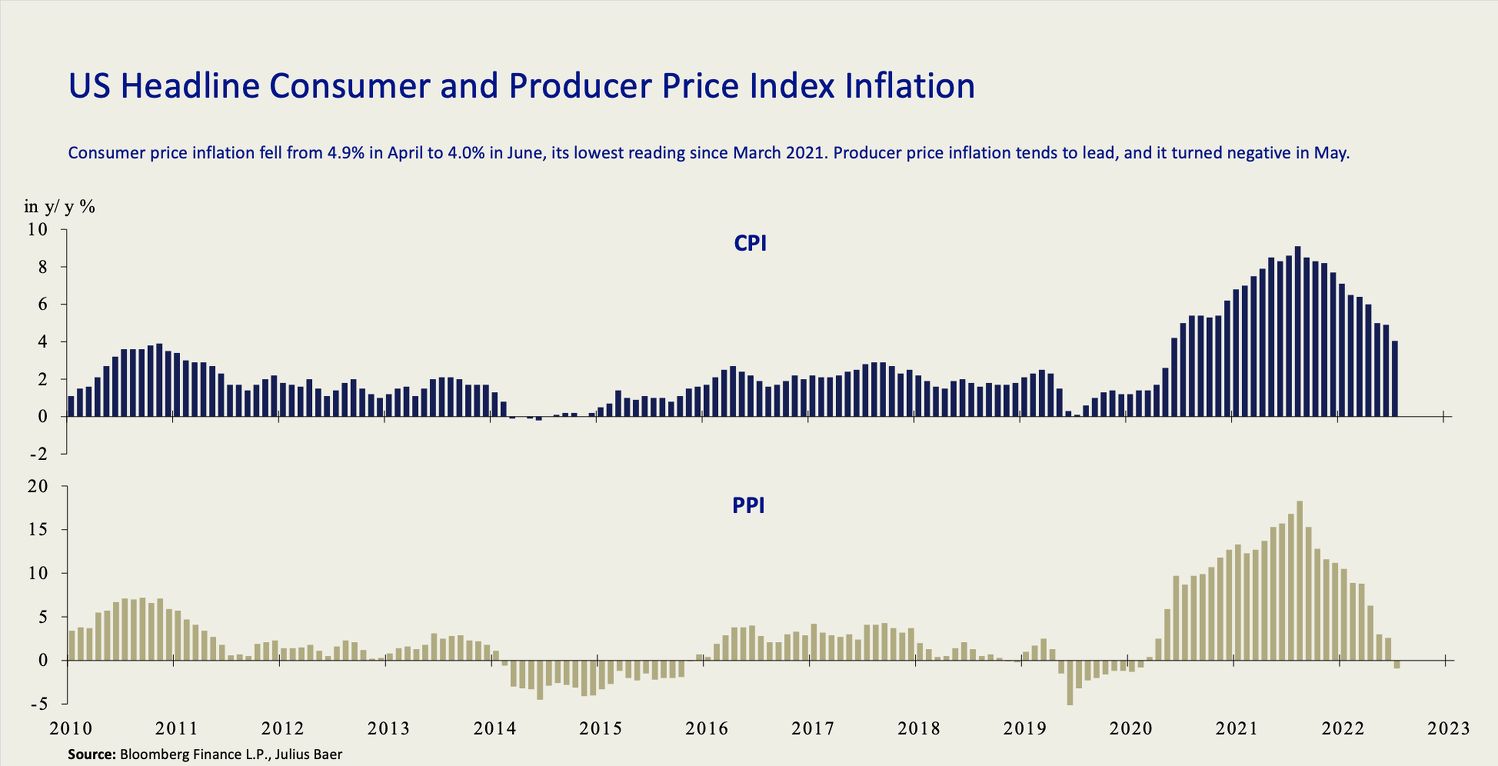

Inflation — something that has been talked about ad nauseam — will still be the key data swaying how economies will fare in the coming quarters. For now, the latest data is lending weight to expectations that inflation is trending lower, having dipped below 5%.

Laxminarayan says: “One simple data point says it all: US annual inflation fell for an unprecedented eleven consecutive months up until May.”

Although a consumer inflation percentage of above 4% is still “pretty steep”, Laxminarayan notes that consumer prices are typically the last to reflect change. Meanwhile, producers, who witnessed a disinflation in their prices last month, are the first to see this decline in prices.

He takes the current high rental and housing prices against the declining prices of gasoline as an example; one year ago amid the backdrop of an energy crisis, there was no end in sight for the soaring prices, yet one year later, gas prices have trended downwards, which is proof that the market will always find an equilibrium.

“The fact is that the inflationary trend is more or less done, [and it] will feed its way into the consumer prices at some point,” Laxminarayan adds.

He cites the Cleveland Federal Reserve’s forecast of 3.2% for consumer price inflation for the month of June, noting that they have been accurate in predicting near-term inflation numbers in the past.

Will there be a recession? But is this enough to warrant the stopping of interest rate hikes? Going into July, Matthews notes that the US Fed fund futures market estimates about a 70% probability that there will be a rate hike but the team at Julius Baer is siding with the minority forecast that rate hikes have peaked. Besides commodity prices, the labour market is another key indicator used by the Fed, which has expressed concerns about a wage inflation spiral. After the ratio between job switchers and job stayers was at an all-time high last year, the ratio has since returned to normal, while temporary job growths have slowed.

See also: Thailand’s US$45 bil fund sees gold, equities boosting returns

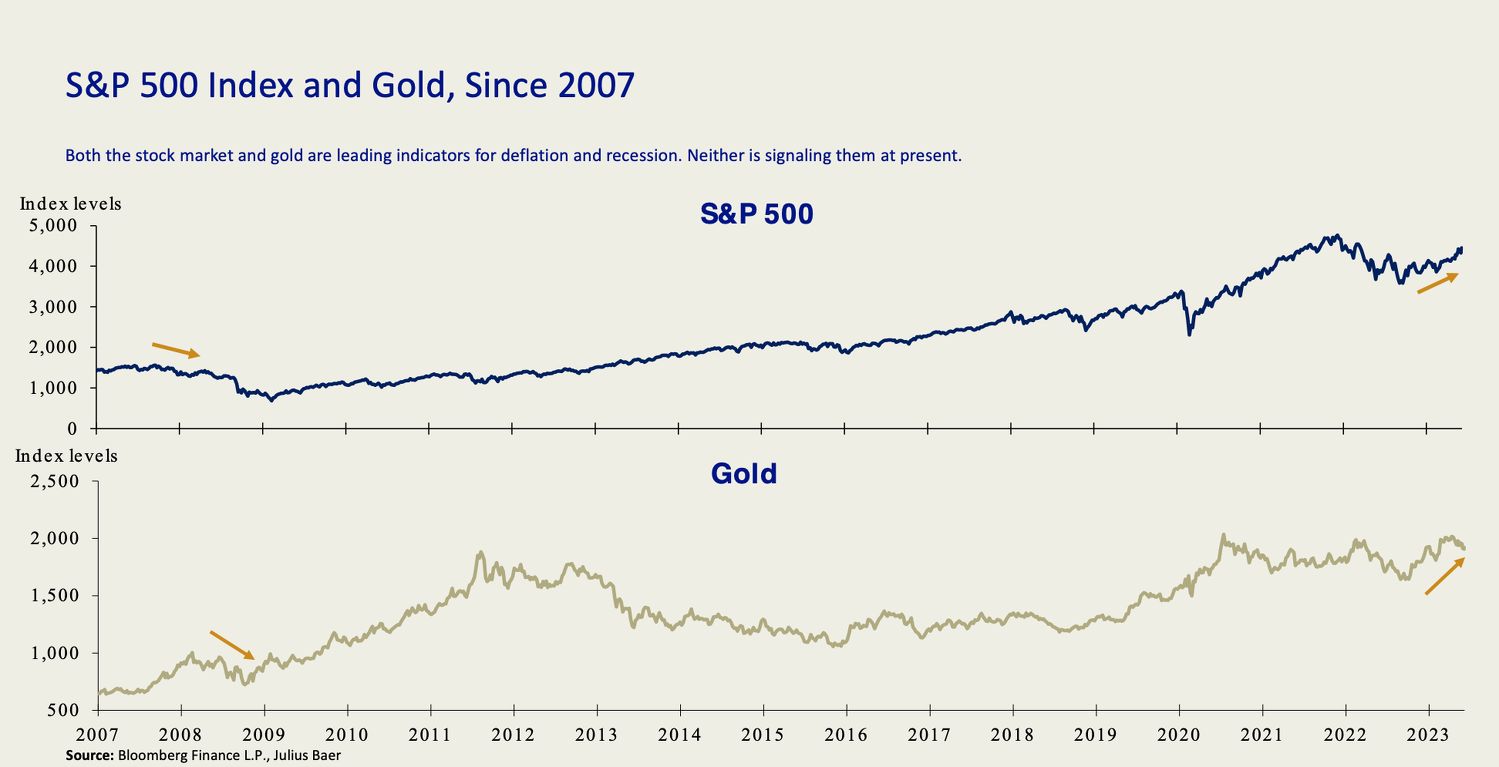

Typically, these indicators are followed by a recession, says Matthews, but there are “two canaries in the coal mine that suggest a mild recession”, instead of a deep one. Both the stock market and the price of gold are increasing — two opposite leading indicators of a potential deflation and recession. Meanwhile, Laxminarayan says that despite supposedly being an independent, non-partisan body, it is in the US Fed’s best interest not to make a policy move that might trigger a recession in the coming 2024 election year, as no incumbent president has been re-elected in such market conditions. He caveats that this is a consideration that is not openly said, and cautions against expressing this “political” view, but also notes that raising of rates also directly impacts the government’s borrowing. The analyst believes that a peak in rate hikes has been reached, after which a rate cut will follow which may take place within two quarters from the last rate hike. “According to our own analysis of this, we think [it might happen] in December, and it could be at five [percent],” says Laxminarayan, “But if that doesn’t happen in December, the question we should all ask ourselves is where are the rates going to be next June? And we think it could be 4%–4.5%.”

Will there be a recession?

But is this enough to warrant the stopping of interest rate hikes? Going into July, Matthews notes that the US Fed fund futures market estimates about a 70% probability that there will be a rate hike but the team at Julius Baer is siding with the minority forecast that rate hikes have peaked.

Besides commodity prices, the labour market is another key indicator used by the Fed, which has expressed concerns about a wage inflation spiral. After the ratio between job switchers and job stayers was at an all-time high last year, the ratio has since returned to normal, while temporary job growths have slowed.

Typically, these indicators are followed by a recession, says Matthews, but there are “two canaries in the coal mine that suggest a mild recession”, instead of a deep one. Both the stock market and the price of gold are increasing — two opposite leading indicators of a potential deflation and recession.

Meanwhile, Laxminarayan says that despite supposedly being an independent, non-partisan body, it is in the US Fed’s best interest not to make a policy move that might trigger a recession in the coming 2024 election year, as no incumbent president has been re-elected in such market conditions. He caveats that this is a consideration that is not openly said, and cautions against expressing this “political” view, but also notes that raising of rates also directly impacts the government’s borrowing.

The analyst believes that a peak in rate hikes has been reached, after which a rate cut will follow which may take place within two quarters from the last rate hike.

“According to our own analysis of this, we think [it might happen] in December, and it could be at five [percent],” says Laxminarayan, “But if that doesn’t happen in December, the question we should all ask ourselves is where are the rates going to be next June? And we think it could be 4%–4.5%.”

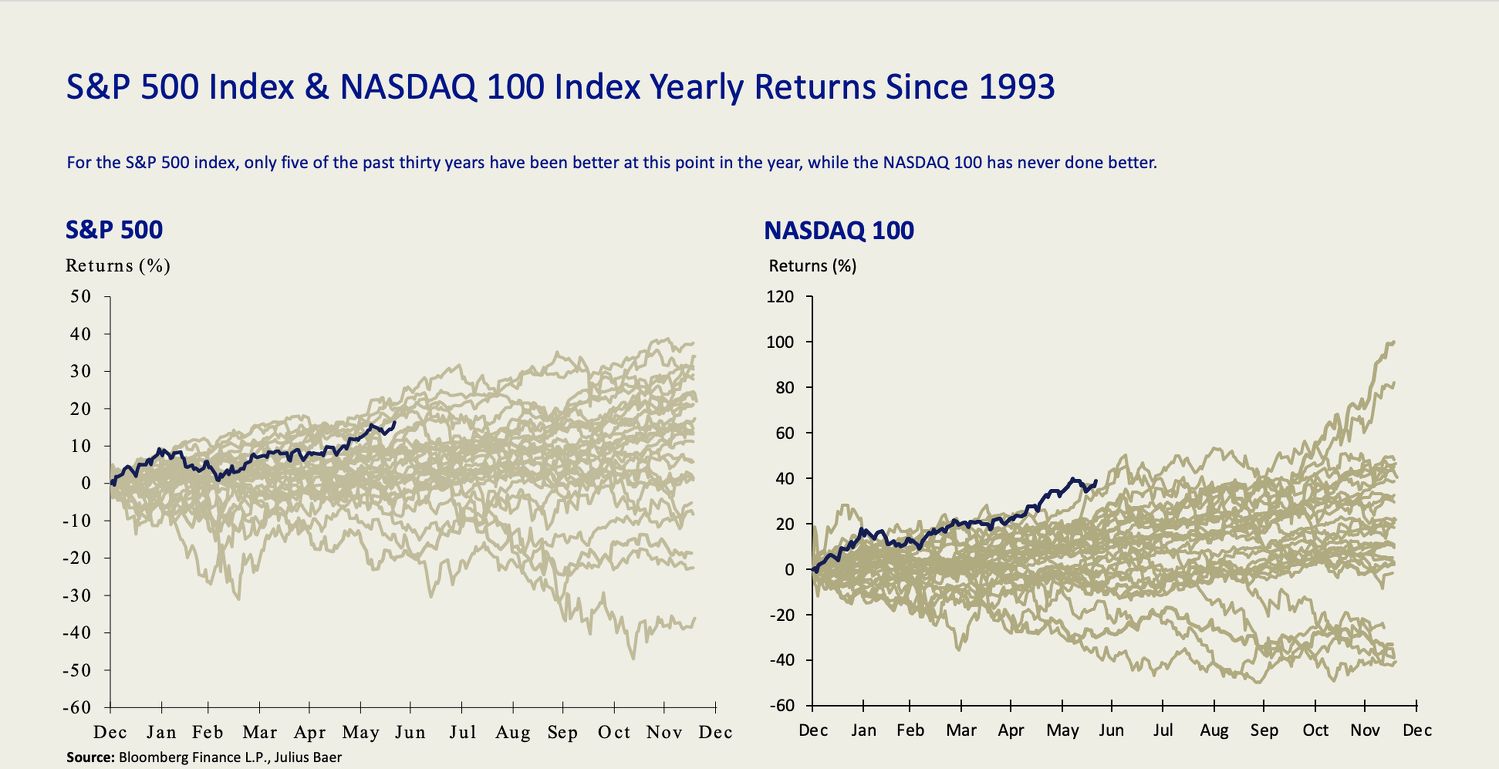

What should investors look out for? For the first time in a very long time, investment-grade corporate bonds in the US and Europe are at their highest inflation-adjusted yield since the global financial crisis, an opportunity Matthews says investors can focus on in the coming two to three quarters. The Julius Baer experts also say that the future is looking bright for equities, despite less than a quarter of companies outperforming the S&P 500 in the first five months of the year while usually over half do. They note that the index yearly returns of the S&P 500 and Nasdaq 100 have both been on an upward trajectory, a trend that has rarely occurred since 1993.

See also: US-China trade truce: Reprieve or realignment?

This can be attributed to the fact that the S&P 500 and Nasdaq 100 have a third and two-thirds of their respective portfolio in technology stocks, which have soared this year, and have thus advised investors to “stay invested”. Additionally, Laxminarayan says that this strong rally from the technology sector in the first five months of the year could be clouding out three other sectors that are typically cyclical — transportation, financial, and oil and gas, all of which are beginning to break out in terms of trade. “So when you start digging a little deeper, the rally is widening out, which is one of the primary reasons for it to stay invested.” he adds. The goal is to allow some stocks to run, while others remain where they are.

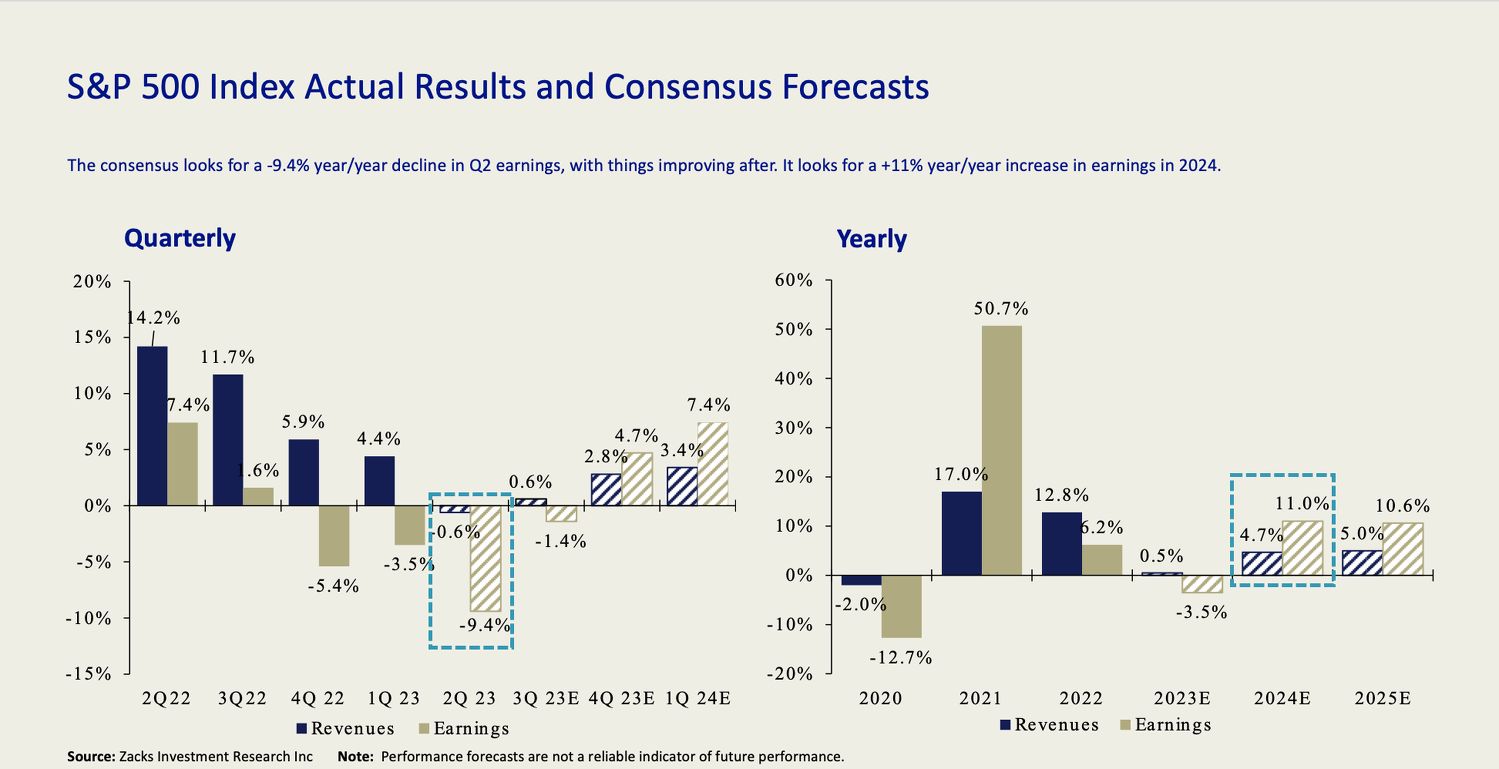

Finally, the experts say that the biggest reason to stay invested is the anticipation of a positive 2024 consensus earnings forecast for the S&P 500, right after this coming quarter which will see the biggest negative decline of 9.4%. “Markets like I said are a future and forward-looking mechanism,” Laxminarayan explains. “When you start looking at the future quarters, the numbers are much, much better looking.”

What should investors look out for?

For the first time in a very long time, investment-grade corporate bonds in the US and Europe are at their highest inflation-adjusted yield since the global financial crisis, an opportunity Matthews says investors can focus on in the coming two to three quarters.

The Julius Baer experts also say that the future is looking bright for equities, despite less than a quarter of companies outperforming the S&P 500 in the first five months of the year while usually over half do. They note that the index yearly returns of the S&P 500 and Nasdaq 100 have both been on an upward trajectory, a trend that has rarely occurred since 1993.

This can be attributed to the fact that the S&P 500 and Nasdaq 100 have a third and two-thirds of their respective portfolio in technology stocks, which have soared this year, and have thus advised investors to “stay invested”.

Additionally, Laxminarayan says that this strong rally from the technology sector in the first five months of the year could be clouding out three other sectors that are typically cyclical — transportation, financial, and oil and gas, all of which are beginning to break out in terms of trade.

“So when you start digging a little deeper, the rally is widening out, which is one of the primary reasons for it to stay invested.” he adds. The goal is to allow some stocks to run, while others remain where they are.

Finally, the experts say that the biggest reason to stay invested is the anticipation of a positive 2024 consensus earnings forecast for the S&P 500, right after this coming quarter which will see the biggest negative decline of 9.4%.

“Markets like I said are a future and forward-looking mechanism,” Laxminarayan explains. “When you start looking at the future quarters, the numbers are much, much better looking.”

What does the rest of the world look like?

The Julius Baer experts note that China’s recovery has been much weaker than they had hoped, a view that is congruent with that of many other financial institutions. Instead, Japan as a country has emerged as a market of relevance and an opportunity for diversification.

Looking at Asia Pacific by market capitalisation and free float, almost half of the free float of the region’s 100 largest companies belongs to Japan, despite the country being less than a fifth of the region’s market capitalisation — this presents as a huge positive to Matthews and Laxminarayan.

As Japan has also been struggling with disinflation for years, the current consumer price inflation and wage inflation they’re experiencing will reap positive outcomes. “If prices can go up, effectively, companies can make higher returns on equities,” says Laxminarayan. “And if companies can make higher returns on the equities, it leads to a higher stock market valuation.”

Julius Baer notes that Japan has the highest level of cash as a proportion of total assets as compared to other countries in the West. As the new head of the Japanese stock exchange has shown to be a big believer of stringent balance sheet management across Japanese companies, Matthews and Laxminarayan believe that the country will start to move its cash in more productive ways through buybacks and dividends.

Lastly, Matthews is positive on India, which is the only market that has come close to reasonable total returns in US dollars over the past 30 years. “We remain overweight on India as it should benefit from favourable economic policies, and the composition of its private sector supports the country’s long-term structural growth.”