Market conditions were not favourable for the issuance of perpetual securities. “I believe if ART called the 4.68% $250 million perpetual securities and refinanced it with a new issuance, the spread could have been high- er, and in a reset, the trust saves on issuance costs as well,” says RHB Group Research analyst Vijay Natarajan.

“We explored various options, including the issuance of a new tranche of perpetual securities to refinance the current tranche. However, with liquidity receding from the market, the current market conditions are not favourable for the issuance of perpetual securities,” says an ART spokeswoman. “Nonetheless, ART continues to have the option to redeem the perpetual securities on any distribution payment date,” she adds. That means if market conditions permit, ART could call the perpetual securities on Dec 31 or June 30, 2021, and so on.

In its announcement, ART said that refinancing the perpetual securities with debt would raise gearing, and reduce the debt headroom available for acquisition opportunities during a market recovery. ART’s gearing is a moderate 35.4%, and its interest covers 5.1 times. Hence, if it had replaced the perpetual securities with debt, its gearing would have risen to around 39%-40%, but its interest savings would have been greater given that its average cost of debt was 1.8% in 1QFY2020.

ART’s property valuations could also come under pressure on the back of the softer operating performance, potentially increasing ART’s leverage further. In particular property valuations in Australia, Japan, Europe and US could be negatively impacted as their performance remains “soft”.

“The strategy to maintain gearing level coupled with interest savings is probably the best decision in view of the current difficult and uncertain time, amid a low interest rate environment. This decision will help to preserve cashflow (via interest savings) and reduce balance sheet stress and benefit all stakeholders, especially unitholders,” notes a DBS Research update.

Challenging year for hospitality

In a 1QFY2020 business update, ART acknowledged that the environment is challenging as 18 properties out of 88 were closed. The Cov- id-19 pandemic has caused travel and tourism to plummet. The trust’s 1QFY2020 portfolio

revenue per available unit (RevPAU) declined by 23% y-o-y to $103. Average portfolio occupancy was significantly lower y-o-y but above breakeven level, the trust says.

Eight key markets contributed approximately 84% to total FY 2019 gross profit. These are Australia (7%), China (8%), France (12%), Japan (12%), Singapore (11%), United Kingdom (9%), United States (16%) and Vietnam (9%). In 1QFY2020, the largest y-o-y declines in RevPAU were from Japan, (-37%), China (-31%), Singa- pore (-30%) and Australia (-28%). Among the mitigants are a recovery in China, government measures to support some businesses, Australia’s emergence from the lockdown, and France and the UK gradually lifting their lockdowns.

Since its merger with Ascendas Hospitality Trust (AHT), ART has a higher proportion of stable income of 45% versus 55% growth. Previously, the stable:growth ratio was 40:60. Properties with long stays were and will continue to be impacted to a lesser extent compared to those catering to transient travellers.

ART says it plans to pursue other sources of revenue. For example, its properties will continue to provide accomodation for those on self-isolation, frontline healthcare personnel and workers looking for alternate work-from-home locations as well as those affected by border shutdown. For instance in France, complimentary stays have been extended to medical staff working in Paris and the country’s regional areas. ART has also implemented cost containment measures.

The trust adds in its business update that it “may exercise prudence in review of distribution payout,” suggesting a cut in distributions. Its FY2019 distribution per unit was 7.61 cents. “While ART’s credit profile had been hampered in our view, the company is far from being in a credit distress situation, making it the first issuer in the Singapore dollar space not in distress to miss the call,” says OCBC Credit Research in an update. “Although technically not the first issuer in the Singapore dollar space to do so, ART has set a precedent in the Singapore dollar space for an issuer not in distress to miss the call. In our view, ART has signalled to the market that it has opted in favour of economics over continued market access to the perpetual market, thereby sending a ripple effect through the Singapore dollar-perpetual market.”

Based on OCBC Credit Research’s calculations, ART’s Ebitda should be able to cover its interest payments on its senior debt. This is based on 25% of reported gross profits being attributed to master leases. Taking figures from 4QFY2019, OCBC Credit Research also estimates

that Ebitda from master leases during the quarter were $15.1 million, which would have covered overall interest expense of $12.6 million.

For AHT, OCBC Credit Research also estimates that its master lease Ebitda would cover its interest expense by 3.1 times. Collectively, the master leases Ebitda could cover the enlarged ART’s interest expense by 1.6 times. Given that ART’s European, Australian and Chinese markets could recover in 2H2020, the trust should be in a comfortable position despite the stresses.

Perpetuals out of fashion

Even though ART is in a stronger position than its peers in the hospitality sector, its decision not to call this month is likely to impact the weaker REITs with perpetual securities in terms of yields and pricing. In particular Lippo Mall Indonesia Retail Trust (LMIRT) and First REIT have issues pertaining to all sorts of problems, and perpetual securities in their capital structure.

Already, weak REITs such as LMIRT could consider missing a distribution because it did not accrue distributions to perpetual holders under its statement of distribution, leaving the option open for a deferral. “Amongst the RE- ITs under our coverage, LMIRT faces high risk of deferral of perpetual distributions,” OCBC Credit Research indicates.

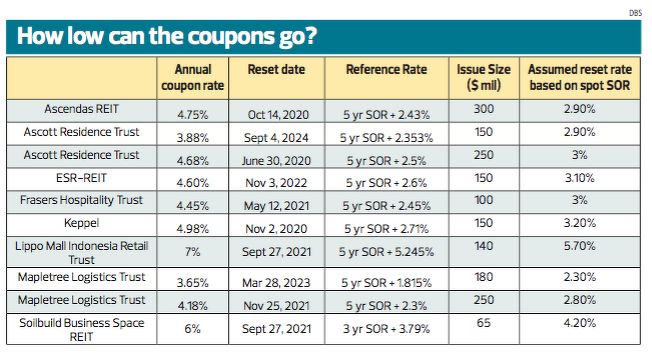

For the perpetual securities with call dates this year, the temptation is to reset coupons given the very low level of five-year SOR. “We expect more REITs may now view this as a possible option depending on market conditions. There are currently $1.55 billion of perpetual securities in issue, and we note that the next reset date is Ascendas REIT’s $300 million perpetual securities at 4.75% on Oct 14, 2020 and Keppel REIT’s $150 million 4.98% perpetual securities which may result in more than 150bps in savings if reset,” DBS Research says.

Ascendas REIT and Keppel REIT have more resilient portfolios, with many of the former’s tenants both in Singapore, Australia, UK and the US deemed as essential services. But the temptation to reset with interest savings is probably too great. As a result, market observers anticipate that investors could be dissuaded from investing in perpetual securities issued by REITs.

Is this the end for perpetuals? “We think in a low rate environment, Singapore dollar bond investors would still be interested in investing in perpetuals (for example, corporate perpetual, bank capital) which tend to be higher yielding to compensate investors for taking subordinated structure risk,” says Ezien Hoo, an analyst at OCBC Credit Research. “The new perpetual security issuances will need to be structured in such a way that protects investors from low rates (for example, with higher step-up, significantly higher spreads) as investors will now be more cognisant that the underlying perpetual structure matters. That being said, the reception for new REIT perpetuals may be lacklustre as REITs are not allowed to have step ups to meet the Monetary Authority of Singapore (MAS) aggregate leverage cap,” she elaborates.

MAS allows REITs to use perpetual securities as equity provided they do not have a step-up characteristic that corporate perpetual securities have. Instead, REITs have a reset which in the current environment enables them to reset at lower coupons.

Is this the end for perpetuals? “We think in a low rate environment, Singapore dollar bond investors would still be interested in investing in perpetuals (for example, corporate perpetual, bank capital) which tend to be higher yielding to compensate investors for taking subordinated structure risk,” says Ezien Hoo, an analyst at OCBC Credit Research. “The new perpetual security issuances will need to be structured in such a way that protects investors from low rates (for example, with higher step-up, significantly higher spreads) as investors will now be more cognisant that the underlying perpetual structure matters. That being said, the reception for new REIT perpetuals may be lacklustre as REITs are not allowed to have step ups to meet the Monetary Authority of Singapore (MAS) aggregate leverage cap,” she elaborates. MAS allows REITs to use perpetual securities as equity provided they do not have a step-up characteristic that corporate perpetual securities have. Instead, REITs have a reset which in the current environment enables them to reset at lower coupons.

MAS allows REITs to use perpetual securities as equity provided they do not have a step-up characteristic that corporate perpetual securities have. Instead, REITs have a reset which in the current environment enables them to reset at lower coupons.

“Refinancing with another perpetual is likely more expensive than allowing the existing perpetual to reset. Going forward, we think that the markets may consider each perpetual on a case by case basis instead of pricing regardless to call. After all, call is an option held by the issuer, and not the investor,” Hoo says.

Furthermore, not all perpetuals have first call dates that coincide with their reset date. “If there is no reset but merely a non-call, we think rather than all investors being dissuaded, we may see a shift in investor profile. The current typical investor of a perpetual may be dissuaded from investing as they are unsure when their principal may be returned. However, the perpetual asset class may attract an alternative pool of investors/different profiles who are accustomed to a lack of a ‘maturity date’, for example investors who invest in preference shares that have no maturity date,” she adds.

ART is the largest hospitality trust among the S-REITs and in the Asia-Pacific. It is also a trend-setter of sorts, being the first hospitality trust to merge with another. Now, it is the first property trust to reset its perpetual securities.

Reset versus step-up

To be treated as equity and be excluded from the computation of the REIT’s aggregate leverage, the property funds guideline stipulates that perpetual securities must: i) have a perpetual term; ii) redemption is at the sole discretion of the property fund or REIT; iii) distributions are non-cumulative iv) there are no features that will have the effect of incentivising the property fund or REIT to redeem its units (for example, step-up in interest rates); and v) the securities are deeply subordinated in the event of liquidation.

The step-up is typical in non-REIT perpetuals as a mechanism to incentivise the issue to redeem the instrument at first call, or suffer higher interest rates. The REITs can reset the rate at a five-year Swap Offer Rate plus a spread.