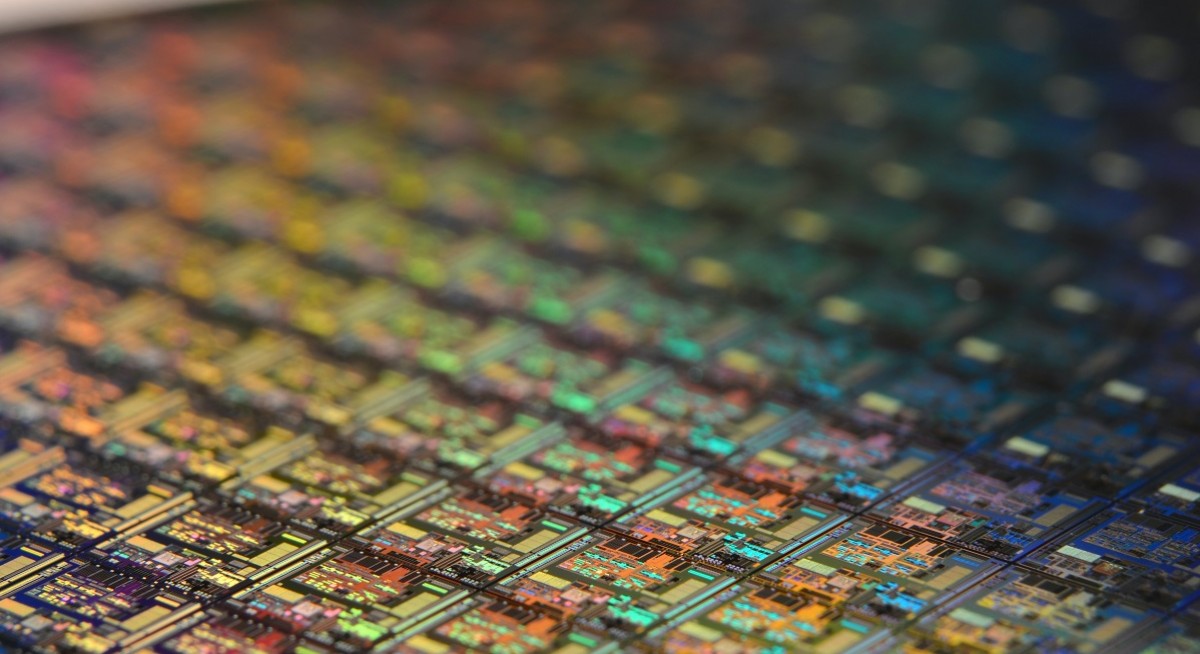

Revenue in the semiconductor segment fell 30% as global semiconductor demand remained soft while revenue in its others segment plunged 55% mainly due to the weaker material and tooling distribution business affected by the general business slowdown.

However, revenue in UMS’ gerospace segment grew 35%, buoyed by the sustained recovery of the global aerospace industry.

Compared to 2QFY2023, the group's 3QFY2023 bottom-line improved, indicating an upturn in performance. Net profit rose 25.9% to $15.4 million from $12.3 million in 2QFY2023 and net attributable profit climbed 32.0% to $15.3 million from $11.6 million in the same period.

For the quarter, the group registered $3.5 million operating cash flow, compared to $17.8 million in 3QFY2022, and a free cash flow loss of $6.1 million, compared to its loss of $2.1million in 3QFY2022. The lower net cash from operating activities was caused by some delay in receivables collection, payment of staff bonus and the inventory build-up in preparation for new projects.

See also: Hongkong Land's underlying profit for FY2025 down 8%; earnings reach US$1.26 bil

As at Sept 30, UMS’ cash and cash equivalents stood at $36.6 million.

The board is recommending an interim dividend of 1.2 cents for 3QFY2023.

"While global chip demand remains soft and macro-economic challenges persist, there are now signs of an industry rebound,” says Andy Luong, UMS' chairman and CEO.

See also: DFI Retail reports underlying profit of US$270 mil for FY2025, up 35% y-o-y

Compared to 2QFY2023, group sales continued to stabilize in 3QFY2023 while earnings recorded double digit growth, he notes. “Our robust Semiconductor business performance is mainly attributed to our integrated system business, which forms a higher share in the global foundry sector.”

“We are extremely proud of being conferred another prestigious corporate award recently — The Centurion Club Award by The Edge, a leading financial publication in the region. This is the fourth corporate accolade the Group has received since last year,” adds Luong.

Shares in UMS Holdings closed 1 cent or 0.77% down at $1.29 on Nov 10.