Okta’s shares have been very volatile, rising as high as US$294 and falling as low as US$199 year to date. The most recent selldown came after the company released its earnings results for 1Q2021 — despite its beating market expectations.

Okta reported smaller net losses and improved free cash-flow margin but lower-than-expected forward guidance from management, which historically tends to be conservative. The main reason for this is higher expenses for the integration of Auth0, which the company acquired in early May. The acquisition will expand Okta’s total addressable market (TAM) in the identity access business, which is positive for the longer term. But because Auth0 is at a very early phase of growth, its losses would be a drag on Okta’s financials.

We believe our investment thesis in Okta remains intact and that the stock will do well over the longer term. However, prevailing market sentiment does not yet favour highgrowth tech companies, especially those that are still in the rapid-growth and loss-making stages and hence, have longer gestation periods. Nonetheless, we remain convinced that digitalisation is a secular trend that can only accelerate going forward. As such, we decided to switch to a lower-risk alternative (at this point) in profitable tech giant, Amazon.com.

Amazon too reported robust earnings results for 1Q2021, with strong growth from digital retail and cloud services, both of which benefited from changes resulting from the pandemic. We expect its top-line growth to remain in the double digits for many years to come.

Digital sales still represent only less than a quarter of total US retail sales, on average, and far lower in categories such as apparel and accessories, food & beverage, furniture & home furnishings as well as health and beauty products. Amazon is currently estimated to have about one-third of market share of US e-commerce sales.

However, it is the company’s prospects in cloud computing that holds the most promise. We see the migration to cloud to be a secular trend, and more importantly, beyond that, the demand for cloud services will be a proxy for future economic growth. The size of global public cloud spending today is estimated at less than 16% of total enterprise spending for IT, which is estimated at some US$1.7 trillion ($2.25 trillion). Even more so, we have yet to begin quantifying the amount of data — and thus, the TAM for cloud — that will be generated as 5G increasingly becomes the solution for digitalisation of enterprises.

Amazon Web Services (AWS) currently accounts for just 12% of the company’s total sales but close to 60% of operating profits. AWS has the strongest grip in the infrastructure-as-a-service (IaaS) segment and is aggressively expanding into the more profitable platform-as-a-service (PaaS) segment, with overall global market share of about 34%.

Most recently, Amazon proposed to acquire MGM Studios. The addition of this film studio — one of the world’s oldest — would significantly expand the company’s back catalogue of movies and TV shows and, importantly, intellectual property library, which will enable future content creation. This would further strengthen the value proposition for its Prime membership, currently 200 million strong. For perspective, that is just a hair’s breadth behind total subscriber numbers for streaming leader Netflix. And like Disney, Amazon has multiple ways to monetise its investment in streaming content, by making Prime a more entrenched part of people’s everyday lives.

We also added to our holdings in Disney. The stock has been treading water for the past few months after rallying on what appears to be overly high expectations for its streaming services. Disney+ has done remarkably well since its launch in November 2019, racking up 103.6 million subscribers as at April 3.

Much of the narrative for Disney has, understandably, focused on the streaming business — and less on the fact that the company is one of the biggest beneficiaries of reopening. We think the imminent recovery in its parks and resorts, consumer products and studio entertainment — all of which were very profitable pre-pandemic — will be the key catalysts for its share price over the coming months.

Most of Disney’s parks and resorts were closed or were operating at significantly reduced capacity, while its cruise ship sailings were suspended for the better part of the past year or so. We especially see significant appeal — and pent-up demand — for its outdoor theme parks heading into the historically important summer season, as travel restrictions are gradually lifted. We bet people are raring to get back into movie theatres with their friends and families as well.

We sold China-based carmaker Geely in favour of General Motors. Geely remains a solid company with good fundamentals but we think that the US market will outperform in the short term — underpinned by reopening, huge stimulus monies and pent-up consumer spending. This is the key difference between portfolio investing (with fixed capital) and a direct investor. In reality, we do have to take into account relative performances within a shorter time frame.

US carmakers are reporting good earnings — despite production disruptions owing to chips shortage — on the back of strong demand, which also allows companies to focus on their best-selling and highest-margin models and pricing power.

Looking further ahead, we think legacy carmakers will be very competitive in the transition to the electric vehicle (EV) market. GM plans to launch 30 new EV models by 2025 and intends to go all-EV by 2035. It has budgeted a US$27 billion capex (2020-2025) for EVs and autonomous vehicles (AVs). Not to mention it already has a good head start over many start-ups — a well-recognised brand name, manufacturing at scale and distribution networks. GM has a stronghold in the popular pickup truck and SUV market segments in the US as well as the commercial fleet market.

The company’s first Ultium battery cell plant — a joint venture with South Korea-based LG Chem — is under construction and slated for completion in 1Q2022. A second plant is scheduled for operation by late-2023.

Meanwhile, its subsidiary, Cruise, is one of the companies closest to achieving volume production for AVs. A driverless shuttle called the Origin could be on the roads in early 2023. It has been testing a small fleet of some 200 self-driving Chevy Bolts in San Francisco and has applied for permits to start charging for rides and deliveries.

In addition, Cruise is working with Walmart — also a shareholder — on an AV delivery pilot programme in Arizona. In April, Cruise announced a major milestone, to expand its AV fleet operations to Dubai in 2023, with up to 4,000 vehicles by the end of the decade. GM plans to integrate the self-driving technology Super Cruise — similar to Tesla’s driver assistance system Autopilot — into 22 models by end-2023.

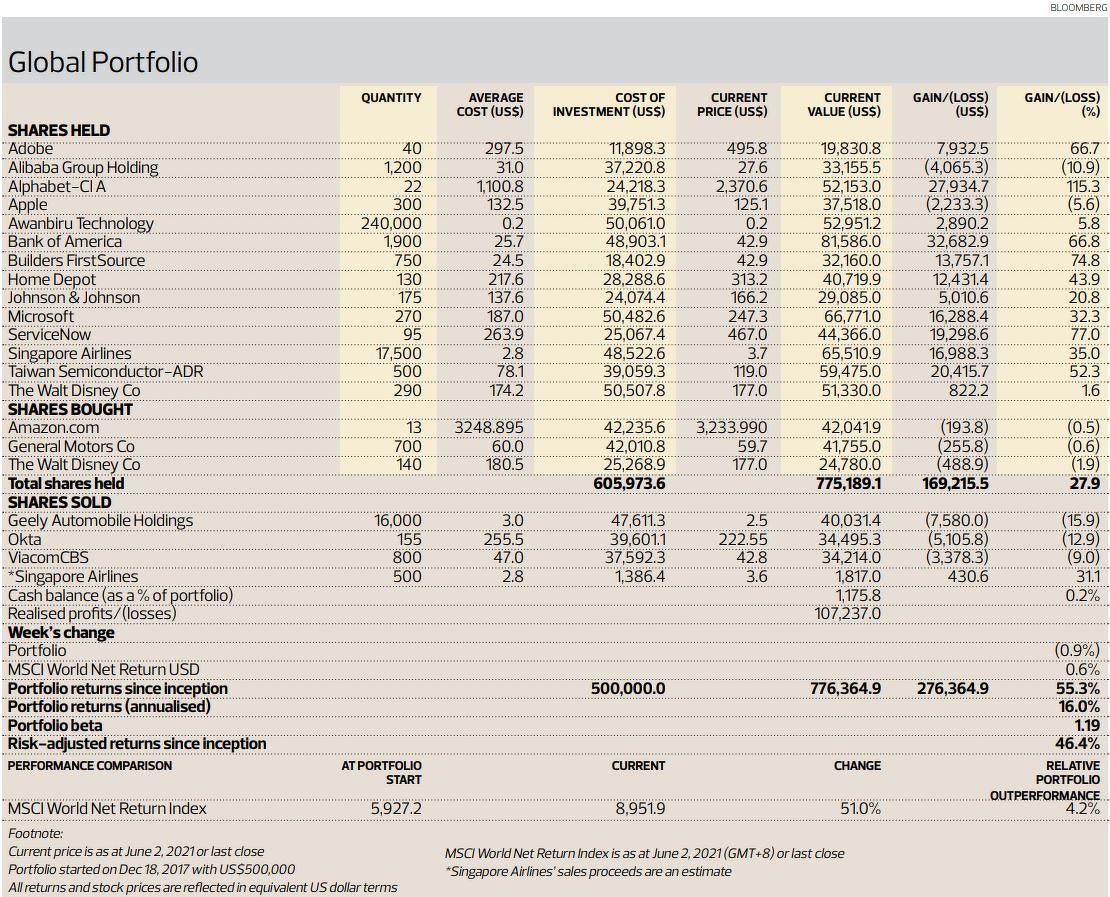

The Global Portfolio finished 0.9% lower for the week ended June 2. The top losers were Builders FirstSource (-5.1%), ServiceNow (-3.8%) and Adobe (-2.2%). On the other hand, Alibaba Group Holding (+3.6%), Taiwan Semiconductor Manufacturing Co (+2.5%), and Singapore Airlines (+2.1%) were among the notable gainers. Total portfolio returns stand at 55.3% since inception. We are still outperforming the MSCI World Net Return index, which is up 51% over the same period.

The Global Portfolio finished 0.9% lower for the week ended June 2. The top losers were Builders FirstSource (-5.1%), ServiceNow (-3.8%) and Adobe (-2.2%). On the other hand, Alibaba Group Holding (+3.6%), Taiwan Semiconductor Manufacturing Co (+2.5%), and Singapore Airlines (+2.1%) were among the notable gainers. Total portfolio returns stand at 55.3% since inception. We are still outperforming the MSCI World Net Return index, which is up 51% over the same period.

Disclaimer: This is a personal portfolio for information purposes only and does not constitute a recommendation or solicitation or expression of views to influence readers to buy/sell stocks, including the particular stocks mentioned herein. It does not take into account an individual investor’s particular financial situation, investment objectives, investment horizon, risk profile and/or risk preference. Our shareholders, directors and employees may have positions in or may be materially interested in any of the stocks. We may also have or have had dealings with or may provide or have provided content services to the companies mentioned in the reports.