Yet, despite the latest bout of volatility, markets have stayed very resilient. The strength and durability of the current rally continue to confound many professional market observers. Indeed, various reports suggest that asset managers, as a group, are still sitting on a comparatively high percentage of cash in money market funds and bank deposits. According to a recent Bank of America survey, 78% of global asset managers think the US stock market is overvalued.

To many, the rising stock market appears disconnected from the battered underlying economic fundamentals, which, while recovering, remain well below pre-outbreak levels and will take some time to fully recoup all lost ground.

We have written about this before: The stock market is a market for stocks, not unlike markets for any other goods and services. In other words, stock prices are determined by supply and demand dynamics, which are not necessarily in sync with the intrinsic value of companies. The stock price goes up when demand exceeds supply and vice versa.

In the short term, demand and supply — buyers and sellers — are influenced by sentiment, which is, in turn, driven by narratives. That is also why markets tend to overshoot, both on the upside and downside, before correcting — creating booms and busts. Over time, in the long run, stock prices should reflect underlying fundamentals (earnings and economics).

In the past weeks, demand for US stocks is being driven by hordes of “Robinhood” traders, many of whom are first-time millennial investors using online-mobile platforms that offer zero commission and fractional share purchase.

They flood social media platforms, promoting stock ideas — and the idea that stock prices can only go up and making money is easy. The market rally reinforced this narrative, focusing on positive news on progress in the development of a vaccine and treatment, the reopening of the economy and stimulus measures

.

They flood social media platforms, promoting stock ideas — and the idea that stock prices can only go up and making money is easy. The market rally reinforced this narrative, focusing on positive news on progress in the development of a vaccine and treatment, the reopening of the economy and stimulus measures .

.

Their most popular trade by far? Perceived bargain stocks — companies that are hardest hit by the outbreak and, in particular, companies in financial distress. Like most retail investors, they are chasing stocks based on narratives, not fundamentals or valuations.

It is this market environment that allowed Hertz Global Holdings to file for and receive court approval (on June 12) to sell up to US$1 billion ($1.39 billion) worth of new shares. The catch? The car rental company filed for bankruptcy protection on May 22 and the more than US$20 billion owed to lenders far exceeds its net tangible assets value.

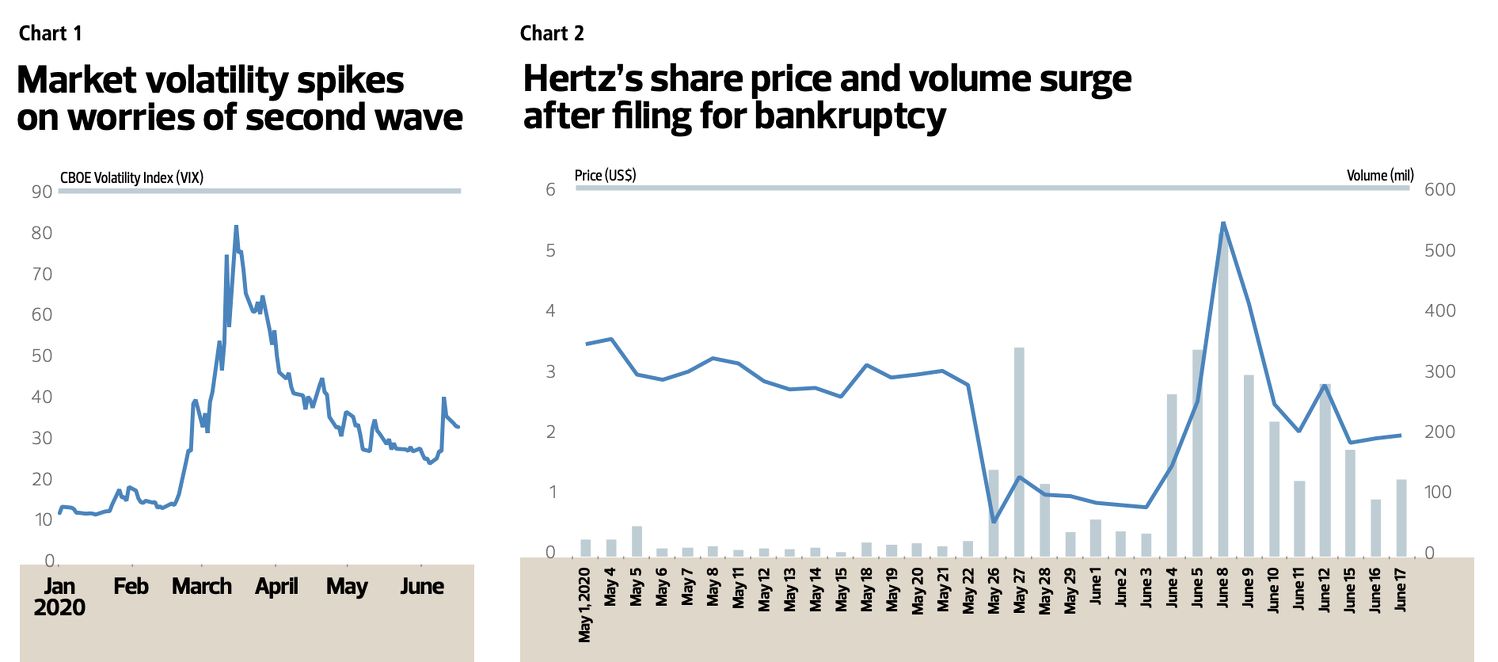

Its billionaire shareholder, Carl Icahn, sold his 39% stake at 72 US cents per share, taking a massive loss. However, in subsequent days, Hertz’s share price rebounded to as high as US$6.25, after having fallen to a low of 40 US cents, on big volumes (see Chart 2).

The seemingly irrational surge was driven by speculators and Robinhood traders — and prompted the company’s latest shares sale plan, even as it appeals against the New York Stock Exchange’s delisting order. In the latest turn of events, Hertz suspended the planned sale (on June 17) after the Securities and Exchange Commission launched a review.

That the company believes there is sufficient demand for what are most likely worthless shares is heretofore almost unheard of. Any money raised will go towards paying off first-in-line creditors. According to a Wall Street Journal report, nearly US$3 billion of Hertz’s unsecured bonds are trading at 40 US cents on the dollar. That means the bond market expects less than full repayment. What more of shareholders? In fact, Hertz admitted in its prospectus (filed on June 15) that its shares may be worthless and that it expects shareholders to be wiped out in the event of liquidation.

The global pandemic has unveiled many “unprecedenteds” — unprecedented lockdown and a sudden halt in nearly all economic activities on a global scale, unprecedented rescue measures, stimulus and liquidity, unprecedented speed in vaccine-treatment development and so on.

The current market frenzy, however, is certainly not without precedent. We have seen this play many times before, most recently during the dotcom bubble in the late 1990s when shares traded on irrational blue-sky valuations.

It is looking increasingly like the Robinhood traders called the market bottom in late-March, outperforming many socalled smart money investors. Time will tell if they too will end in tears.

That said, central bank liquidity and government stimulus measures are backstopping the economy and supportive of the broader market rally. We wrote about this last week.

In just the past one week, the Trump administration is said to be preparing a US$1 trillion infrastructure package while the US Federal Reserve begins buying individual corporate bonds in the secondary market, on top of its purchases of corporate debt exchange-traded funds (ETFs).

The biggest central banks in the developed world — including the US Fed, the European Central Bank, the Bank of England and the Bank of Japan — are going full steam ahead on quantitative easing (QE) and near-zero or negative interest rate policies.

This current breed of central bankers has evolved far beyond their traditional role as regulators. They are actively participating in capital markets and directly influencing financial asset prices in order to support and promote employment and economic growth. We are keeping the Global Portfolio unchanged and near fully invested. The portfolio fell 0.6% for the week ended June 18, mirroring the broader market decline. Last week’s losses pared total portfolio returns to 18.1% since inception. Nevertheless, this portfolio is outperforming the benchmark MSCI World Net Return Index, which is up 10.6% over the same period.

Newly acquired Vertex Pharmaceuticals was the top gainer for the week, up 2.1%. Adobe and Alibaba Group Holding were the two other stocks that closed higher, gaining 1.6% and 0.3% respectively. On the other hand, The Boeing Co was the top loser in our basket of stocks. Its shares fell 5.3%. Other notable losers include Starbucks, Johnson & Johnson, BMC Stock Holdings and Builders FirstSource.