Those who follow our Malaysian Portfolio column will recall that we acquired five small-cap stocks in April that we think offer value — because there is no story to drive interest and stock prices. We have since disposed of four of the five stocks, making gains on three of them. The reality is that, as a portfolio fund, we do not have the luxury of holding stocks for an extended period of time. And by that, we mean years, not months.

That said, we still believe in our investment thesis — that the underlying value of these stocks must eventually surface over time and attract interest from market investors or as acquisition-takeover targets.

To back-test our hypothesis, we filtered all Bursa Malaysia and Singapore Exchange listed stocks using several criteria, including valuations (price-to-earnings and priceto-book ratios), gearing, dividend yield and trading volumes relative to market average over the period 2009-2011. The results are shown in Table 1 (Bursa) and Table 2 (SGX).

See also: Great Chinese consumer tech stocks are systemically undervalued

The top list on both tables comprises essentially small-cap stocks that are relatively illiquid compared with the average market traded volumes, which most likely contributed to their comparatively low valuations. Additionally, all the selected companies have net cash or or very low gearing and have consistently paid dividends over the threeyear period. We then calculated the total returns for these stocks, assuming a buyand-hold strategy from December 2011 to December 2020.

See also: The coming of a perfect financial storm?

For the portfolio of stocks listed on Bursa, the actual combined cumulative returns totalled more than 271% over the nine years. That is equivalent to a compound annual growth rate (CAGR) of 15.7% — well above the total returns (including dividends) for the FBM KLCI and FBM Emas index over the same period. The returns are also far superior to bank deposit rates and dividend rates from the Employees Provident Fund (EPF) as well as returns from the majority of unit trusts.

Over on the SGX, we saw more corporate activity with these undervalued stocks. Of the nine stocks that met our preset criteria, four were taken over/privatised and delisted during the observation period, all of which at premium offer prices. Their combined cumulative returns totalled more than 142% from 2011 to 2020, equivalent to a CAGR of 10.3%. Again, this is significantly higher than that for many alternative investments (taking into account Singapore’s comparatively low country risks and currency gains).

The conclusion is that value investing works very well over the longer term, given sufficient time.

Using the same exact set of criteria, we generated two fresh lists of companies today, one each for Bursa and SGX. It is possible that not every single stock in this selection will do well individually. But we think that, in combination, these stocks as a group will outperform over the next 10 years. We definitely believe they will generate better returns than bank deposits and certainly outperform most of the unit trust funds, where you have to pay a fee.

For more stories about where money flows, click here for Capital Section

All have paid higher-than-market average dividend yields between 2017 and 2019. Dividends are important as steady income stream, and empirical evidence shows that reinvested dividends make up a huge part of total investment returns owing to the power of compounding. Sustained dividend payments are also evidence the company is doing well and generating real cash flow. Only two companies have a small 6% to 7% gearing. The rest are in net cash positions. In other words, they are quite safe investments. This is a 10-year buy-and-hold strategy. Given the long investment horizon, the two portfolios are suitable as retirement funds or your children’s education trust funds.

Sidebar: Higher inflation ... but we still think it’s transient

We have written extensively on the subject of inflation over the past few months. It remains a hot topic in the US, as the world’s largest economy gears up for full reopening on the back of a rapid immunisation programme. Clearly, inflation is a major factor to consider for investors. It will directly impact the US Federal Reserve’s monetary policy — whether it will be able to keep interest rates lower for longer or be forced to tighten financial conditions sooner than expected. And that will, in turn, be key to future corporate earnings and valuations.

The Consumer Price Index (CPI) for May 2021 increased 5% y-o-y, eclipsing the 4.2% growth in April, and the fastest pace of increase in nearly 13 years. Still, this was to be expected, mainly due to the low base effect last year. As we have noted previously (see flashback), the inflation rate hit a low of just 0.2% in May 2020 — when movement restrictions caused the prices of some goods and services to drop precipitously (see Chart 1). Indeed, compared with prices from two years ago (pre-pandemic), May’s prices are up by a more modest 2.5%, on average.

Prices are rising due to pent-up demand fuelled by excess savings and stimulus money as well as inventory restocking even as various bottleneck issues are disrupting supply. For example, one of the main contributors to the strong inflation figure is higher ticket prices, due to still-limited flight availability. Another big driver for the CPI gains was the rise in prices for new and used cars and trucks — chip shortage is hitting vehicle production particularly hard, just as consumers are raring to spend their money, causing temporary supply-demand imbalance.

Port congestion and container shortage, meanwhile, are adding to freight charges as well as disrupting the global supply chain. Prices of oil have recovered while those for other commodities too have rallied on the back of stronger demand and, quite likely, a healthy dose of liquidity-driven speculation. All these have led to higher costs — and consumer prices. Refer to our numerous articles over the past few months for more in-depth analysis.

That said, we do not yet see sufficient evidence to change our belief that the current inflationary pressures are transient and will fade, as supply issues are progressively resolved. A case in point: Shipping and transport rates and prices of many commodities appear to have peaked in recent days. Workers are getting back into the labour force — initial and continuing jobless claims are falling — and should continue to do so as unemployment benefits expire, Covid-19 fears recede and schools and daycare centres reopen (see Charts 2 to 4).

Markets are taking May’s robust inflation figure in stride. All three bellwether indices in the US ended higher on the day of the data release — the Standard & Poor’s 500 index hit a fresh all-time record high.

Yields on the 10-year Treasury fell to a threemonth low of around 1.4%, well off the recent peak. Coupled with prevailing weakness for the US dollar, it suggests that markets are quite complacent on the continuation of the current easy monetary policies and modest inflationary expectations, at least in the near-medium term. Indeed, the majority of economists forecast that inflation will moderate going forward (see Chart 1). It should be noted that strong demand from overseas investors is helping keep a lid on US Treasury yields, which remain attractive compared with returns on European and Japanese sovereign bonds.

To be clear, we certainly expect inflation rates to pick up — because the world is recovering from the pandemic-driven recession, even if the recovery is not as synchronised as we initially thought, owing to the hugely uneven distribution of vaccines.

It is possible that supply disruptions could persist for longer because of the slow vaccination rollout in many parts of the world. This could lead to price increases broadening across the economy as strong consumer demand gives businesses room to pass on higher costs — and may feed into inflationary expectations, which could be more permanent. The risk is real, albeit one that we think is low at this point.

There is no compelling evidence that inflation would be sustained at significantly higher levels that will cause central banks to react by rapidly tightening monetary policies. And, of course, we have always argued that the secular effect of digital technology will reduce costs and prices for consumers.

—Box Article Ends—

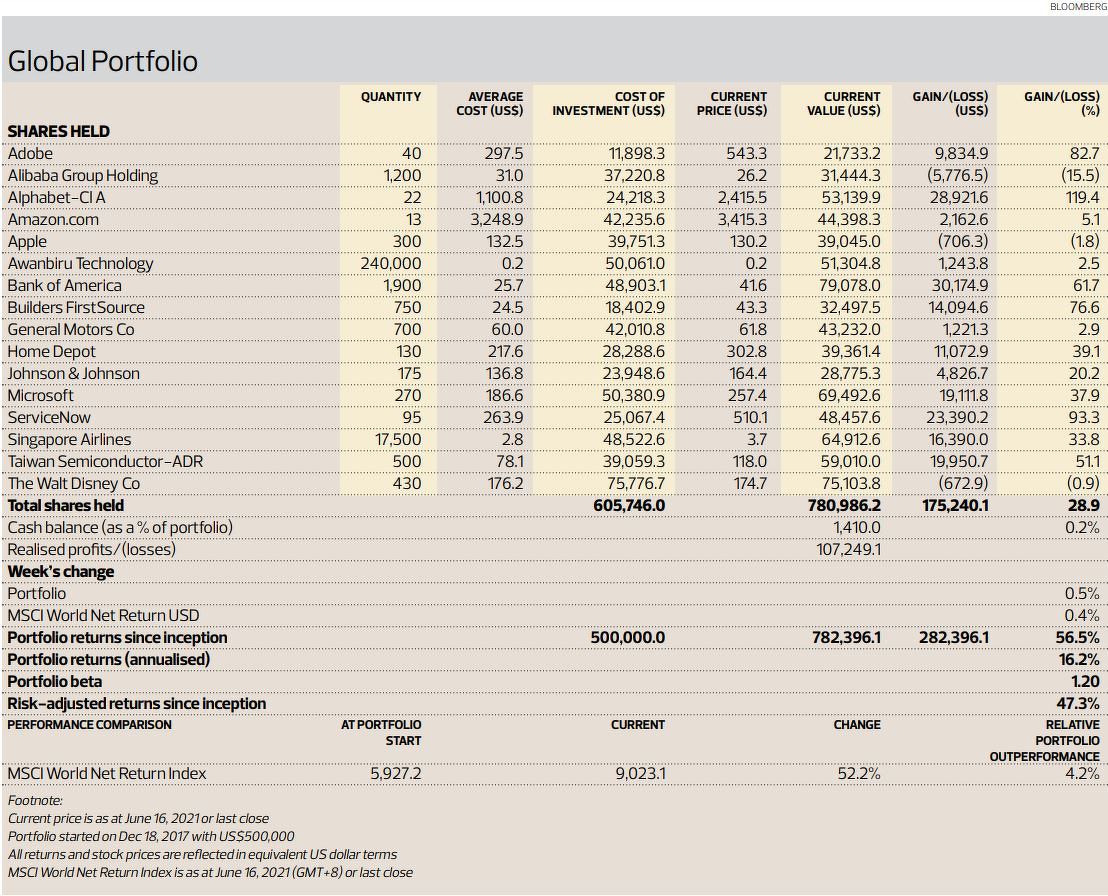

The Global Portfolio gained 0.5% for the week ended June 16. Tech stocks, as a whole, fared comparatively well, including ServiceNow (+9.8%), Adobe (+5.6%), and Amazon.com (+4.1%). Meanwhile, the notable losers were Alibaba Group Holding (-2.2%), Singapore Airlines (-2.1%), and Bank of America (-1.7%). Total portfolio returns since inception now stand at 56.5%. We are still outperforming the MSCI World Net Return index, which is up 52.2% over the same period.

The Global Portfolio gained 0.5% for the week ended June 16. Tech stocks, as a whole, fared comparatively well, including ServiceNow (+9.8%), Adobe (+5.6%), and Amazon.com (+4.1%). Meanwhile, the notable losers were Alibaba Group Holding (-2.2%), Singapore Airlines (-2.1%), and Bank of America (-1.7%). Total portfolio returns since inception now stand at 56.5%. We are still outperforming the MSCI World Net Return index, which is up 52.2% over the same period.

Disclaimer: This is a personal portfolio for information purposes only and does not constitute a recommendation or solicitation or expression of views to influence readers to buy/sell stocks, including the particular stocks mentioned herein. It does not take into account an individual investor’s particular financial situation, investment objectives, investment horizon, risk profile and/or risk preference. Our shareholders, directors and employees may have positions in or may be materially interested in any of the stocks. We may also have or have had dealings with or may provide or have provided content services to the companies mentioned in the reports.

Photo: Bloomberg