The Covid-19 pandemic was unprecedented, however, in that it resulted in a vast majority of the world’s population “grounded” within the confines of their own homes — be it mandatory or voluntary — with the closure of international, and at times even state, borders.

In this crisis, services — especially those that require physical and personal interactions — particularly in the tourism, hospitality, bricks-and-mortar retail and F&B sectors, were the hardest hit.

Technology has helped mitigate the impact somewhat, through e-commerce, video and gaming streaming, and food delivery platforms. Case in point: According to Adobe Analytics, online spending (for 80 of the top 100 US online retailers) rose 22% y-o-y on Black Friday, traditionally the day of frenzied shopping in malls, and Cyber Monday recorded the highest one-day digital sales in US history. Adobe forecasts online sales to expand 30% y-o-y for the entire holiday season. Meanwhile, foot traffic at malls was more than halved, according to retail tracking firm Sensormatic Solutions.

But even the increase in consumer spending on goods — including money diverted from not spending on services — cannot fully offset the sharp declines in the services sector. This is why unemployment remains heightened even though factories restarted months ago. According to data from the International Labour Organization, the sector accounts for nearly 80% of total employment in the US, about 84% in Singapore and 63% in Malaysia, and just over half for the world, on average.

The charts (see “Services PMI weaker than manufacturing PMI”) underscore the much sharper contraction in services, compared with manufacturing, at the outset of the pandemic — as well as the slower recoveries since. Indeed, the manufacturing PMI, in general, has continued to recover even as the services PMI fell anew, with the current resurgence in Covid-19 cases, most notably in Europe.

Positively, as we can see in the case of China, the services sector has steadily recouped lost ground after the outbreak was effectively contained and people felt confident in resuming their normal daily activities.

We should start to see a similar sustained recovery trend in the rest of the world next year, once vaccines are approved, manufactured and distributed to the masses. The timeline will become increasingly clear with each positive development on the vaccine front.

The US Food and Drug Administration is set to discuss approval for Pfizer’s and Moderna’s vaccines at its meetings on Dec 10 and Dec 17 respectively. Goldman Sachs estimates that 70% of the population in developed countries will be vaccinated by Fall 2021. And this is what is driving the broader stock market and, in particular, cyclical stocks.

US stocks performed strongly in November, with the Dow Jones Industrial Average and Standard & Poor’s 500 index gaining 11.8% and 10.8% respectively. Notably, some Asian markets fared even better — the Singapore Straits Times Index was up 15.8%, Japan’s Nikkei 225 index gained 15% and the Korea Composite Stock Price Index rose 14.3%. The best-performing market in the region was Thailand, its benchmark index gaining 20.3% for the month, though still down 9% year to date.

The tech sector has been somewhat of a laggard of late, amid investor rotation into cyclicals. Some have highlighted that tech stocks are trading at very high valuations, having led the rally for the better part of this year. But this should not be surprising. Stocks that are expected to grow faster should trade at higher price-to-earnings (PE) valuations. It is just maths.

The price of a stock is equal to its future cash flow discounted by the minimum required rate of returns, r (which reflects the prevailing cost of capital and risks) less sustained long-term growth, g. Hence: Price = Cash flow/(r-g)

Let us assume, for simplicity’s sake, two stocks have the same risk profile, say, r = 9%, with one growing at 4% and the other at 8% in perpetuity. Applying the formula, each $1 earning/cash flow/dividend would be fairly valued at $20 (20 times PE) for the 4% growth stock and $100 (100 times PE) for the 8% growth stock.

That is how great the PE disparity will be for a 4% difference in growth, for perspective. High-growth stocks have more of their earnings in the future, which would be worth more today when the discount rate is low. And this is one reason that growth stocks have far outperformed in the last decade, when interest rates have been in a steady decline to historical lows. We should keep in mind, though, that the higher the growth (all else being equal), the steeper the valuation compression will be when cost (interest rate) starts to rise.

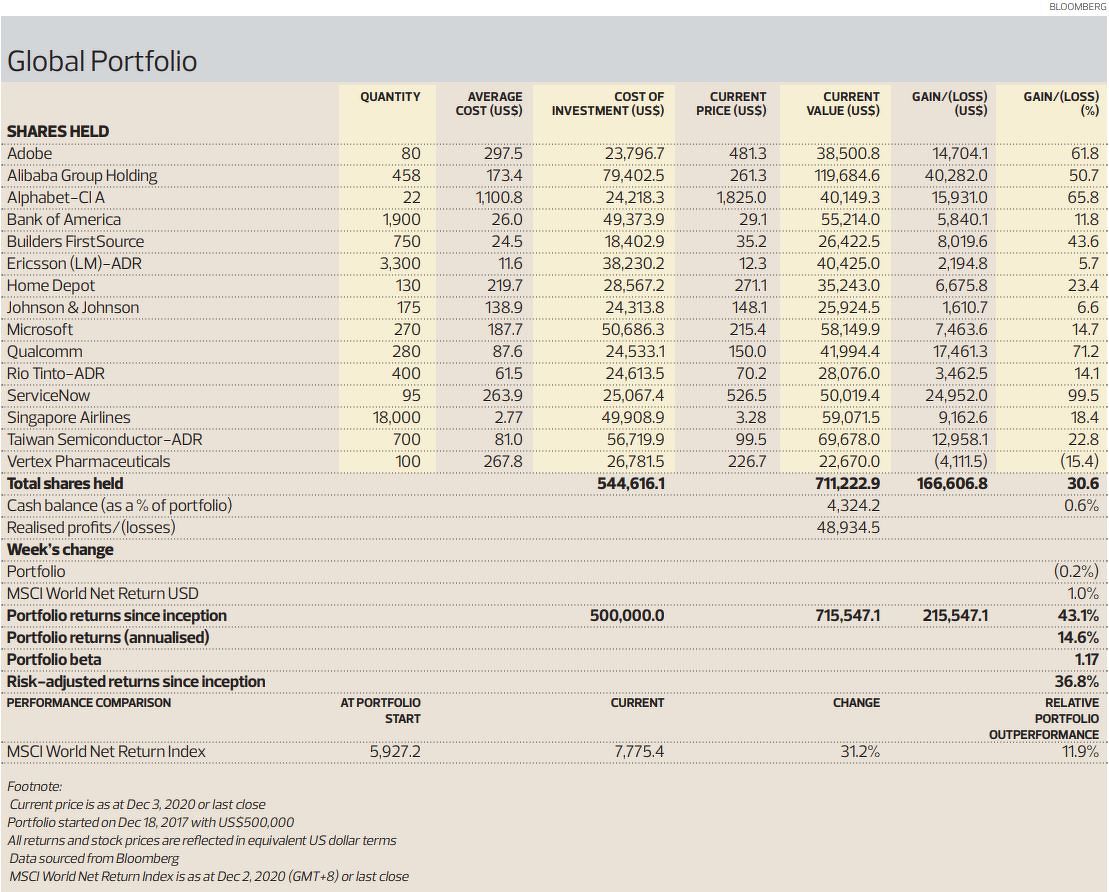

Stocks in the Global Portfolio traded on a mixed note during the week ended Dec 3, closing 0.2% lower and paring total returns to 43.1% since inception. Nevertheless, the portfolio is outperforming the MSCI World Net Return index, which is up 31.2% over the same period.

Rio Tinto was the top gainer for the week, up 5.9%. Other notable gainers include Qualcomm (+4.1%) and Vertex Pharmaceuticals (+3.9%). On the other hand, Alibaba Group Holding (-5.9%), Builders FirstSource (-5.6%) and Singapore Airlines (-2.6%) were the three big losers last week.

Rio Tinto was the top gainer for the week, up 5.9%. Other notable gainers include Qualcomm (+4.1%) and Vertex Pharmaceuticals (+3.9%). On the other hand, Alibaba Group Holding (-5.9%), Builders FirstSource (-5.6%) and Singapore Airlines (-2.6%) were the three big losers last week.

Disclaimer: This is a personal portfolio for information purposes only and does not constitute a recommendation or solicitation or expression of views to influence readers to buy/sell stocks, including the particular stocks mentioned herein. It does not take into account an individual investor’s particular financial situation, investment objectives, investment horizon, risk profile and/or risk preference. Our shareholders, directors and employees may have positions in or may be materially interested in any of the stocks. We may also have or have had dealings with or may provide or have provided content services to the companies mentioned in the reports.