On July 29, the company reported revenue growth of 7.3% y-o-y to $52.3 million in 2HFY2020 and earnings of $2.89 million, from losses of $444,000 in the same period a year ago. Besides stronger operating results from its ready-mix concrete plants in China, the company enjoyed a lift from its Singapore logistics and warehouse business as demand increased, and is “sanguine” about the prospects, according to GKE in its earnings commentary.

GKE CEO Neo Cheow Hui tells The Edge Singapore that a government logistics provider, whom he declined to name, has taken up about 15% of his available warehouse space of 1.2 million sq ft for a “strategic stockpile” of medical supplies ranging from personal protective equipment (PPE) to hand sanitiser, which is meant to ensure that Singapore will have ample medical supplies to ride out the Covid-19 pandemic. The price to pay for this preparedness is not insignificant: The storage cost for the stockpile comes up to an estimated $200,000 a month, says Neo.

He adds that when the pandemic hit, the disruption in global supply chains initially caused a fall in the utilisation of warehouse space and logistics services for his company as customers faced delays in receiving their materials and supplies. The fall was reversed when about 95% of his warehouse space became utilised after winning the government contract.

‘Just in time’ manufacturing

Companies used to honing efficient supply chains with the mantra of “just in time” will now have to rethink this strategy. The idea of “just in time” is to keep a minimal level of inventory due to the storage costs involved. If 100 units of a certain item is needed 20 days later, that exact amount will be ordered and delivered just in time, neither too late, nor too early. Logisticians pride themselves on being able to orchestrate a seamless flow of goods across the supply chains.

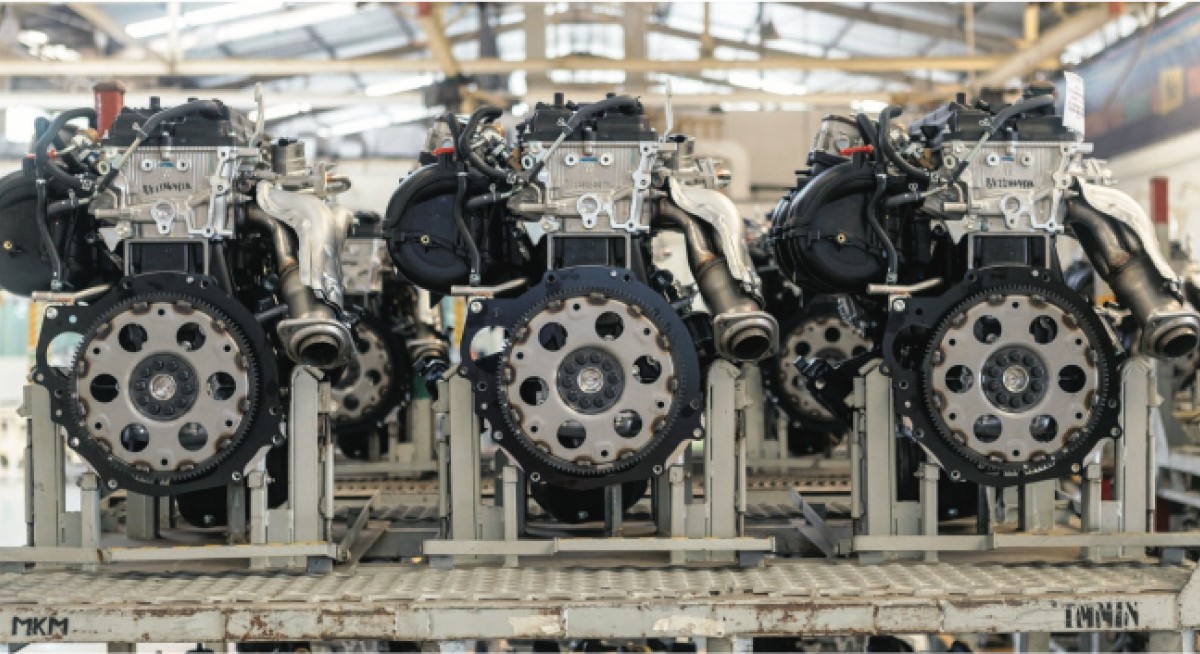

Big manufacturers, such as Toyota Motor Corp, also try and gain an advantage with economies of scale by aggregating the parts needed along the supply chains. “A car uses about 20,000 to 30,000 parts, and companies would aggregate parts to produce them at a competitive price,” said Hao Q Tien, deputy chief officer at Toyota Motor, at the DBS Asian Insights Conference on July 23. The parts come from all around the world, which means a delay for one part could bring the rest of the supply chain grinding to a halt.

According to Neo, this approach will not work with critical supplies such as medical PPE. There is no way to accurately predict when exactly such additional stock will be needed. As such, users have no choice but to stockpile these supplies so that demand spikes can be met.

However, stocking up on all kinds of supplies is not a solution. “Despite what the world saw in the pandemic, that we cannot go from a ‘just in time’ model to a ‘just in case’ model where companies stockpile items indefinitely to maintain a buffer,” says Anne Petterd, head of international commercial & trade, Asia Pacific, at Baker McKenzie, in an interview with The Edge Singapore. “No one has the storage space or money to maintain a three-month supply of everything.”

As such, Petterd said companies will have to choose between what is essential and what is not. They have to consider if the goods they need can be obtained from other sources and if they are interchangeable with equivalent products. If both criteria cannot be fulfilled, then it is likely that there is a need to stockpile these materials.

A 2017 article in the journal Health Security proved uncannily accurate when it said: “Like most goods in the US, the PPE market supply is based on demand. The US PPE supply chain has minimal ability to rapidly surge production, resulting in challenges to meeting large unexpected increases in demand that might occur during a public health emergency. Additionally, a significant proportion of the supply chain is produced offshore and might not be available to the US market during an emergency because of export restrictions or nationalisation of manufacturing facilities.”

Case in point: about half of the world’s face masks are made in China. And when China became the pandemic epicentre, the mask supply dropped just as global demand spiked. The supply of swabs used in diagnostic tests also was affected when the pandemic hit, because Copan Diagnostics, one of the largest swab manufacturers, is based in Lombardy, Italy — one of the initially hardest-hit regions in Europe.

Adding to the uncertainty over the global supply chain outlook is the trade tensions between the world’s two largest economies, the US and China. Since 2017, the two countries have slapped trade tariffs totalling about US$735 billion ($999 billion) on each other, for goods ranging from soybeans to aluminium. Despite a Phase One trade deal signed between the countries, tensions flared again when Trump accused China of spreading the virus to the US.

When the pandemic hit, countries scrambled to limit exports of medical PPE to conserve the supplies for their medical staff and to combat the rapidly spreading virus. The US, for example, invoked a Korean-War era law to order mask manufacturer 3M to increase imports of masks to the US and pause exports to other countries.

Diversify, decouple Petterd expects the world to see a shortening of supply chains that will endure even after the pandemic has passed. Companies will start to reshore back to their home ground the production of essential goods — like medical PPE, technology, and items they deem critical to national interests — instead of relying on manufacturers at presumably lower-cost locations. As most analysts and companies have observed, supply sources will need to be diversified to guard against supply shocks. “Now the idea of a single source, even though it might be the most efficient and most cost-effective, may not be the most responsible or resilient in terms of supply chains,” said William Fung, group managing director of Li and Fung, at the DBS Asian Insights Conference. The company has for decades played the role of a deft supply chain manager, providing all kinds of garments and goods to US department stores from its network of factories in Asia. The shifts in supply chains, coupled with concurrent trade tensions, will have mixed implications, says ratings agency Moody’s. While some companies see less business, others, like GKE, will be able to grab new opportunities made available. Specifically, trade diversification is likely to favour Asean economies over time, while the reshoring of supply chains closer to consumer markets — especially in sectors with heightened security requirements such as pharmaceuticals — could move productive capacity away. “We expect many governments and companies will reduce their dependence on China in global value chains moving forward, driven by the coronavirus outbreak, the China-US trade conflict, and heightened national concerns over economic security,” says Moody’s analyst Deborah Tan. “While the technological capabilities of the Asean region still lag those of more advanced Asian economies, particularly in electronics, a general openness to foreign direct investment and lower production costs will offer some advantages.”

See also: Namibia orders Elon Musk's Starlink to cease all operations in the country

Singapore Senior Minister Tharman Shanmugaratnam agrees. “Fundamentally, we have now the opportunity of building a more resilient and more integrated Asian supply chain, in other words, an Asian production region, as well as Asian markets that are open to the world,” he said at the Standard Chartered Asean Business Forum on Aug 25. Tharman also noted as the Chinese economy moves higher in the value chain, it will give rise to the need for labour-intensive production to relocate outside China. But according to Moody’s, an exodus of foreign companies from the Chinese markets is unlikely, even as companies step up efforts to mitigate supply chain risks. This may be a real opportunity for other countries in Asia. Petterd observes that one country that has benefited from the diversification of supply sources from China is Vietnam, but also notes that this does not spell doom for China, as these countries cannot match up to the scale of the Chinese market and manufacturing capacity. So, how should businesses aim to manage their supply chains after the pandemic passes, and what should they note when a semblance of a normal world, whatever it may be, finally comes? The pre-Covid supply chains will not return, and neither will the more cordial relationship between the US and China that predated the Trump administration. Trade tensions between the two will outlast the pandemic and the Trump administration, Tharman says. He notes that US-China relations have deteriorated rapidly across not only trade, but also over issues like diplomatic tussles over Hong Kong and Taiwan. Meanwhile, Fung believes that the future of supply chains will be divided into two broad spheres: those that are of a security concern, and those that are not. For example, commercial products which might be repositioned for military use will have to be handled separately. Consumer goods, such as shoes, will be less affected, as they are not very crucial and still very labour-intensive, he adds. Alex Capri, visiting senior fellow from NUS Business School, predicts that most decoupling will take place where US firms re-shore themselves to protect themselves from possible intellectual property theft, real or otherwise.

Sustainable, digitalised The supply chain of the future will not just be about the costs of producing an item, or even the quality of products. Increasingly, consumers are demanding that the goods they buy are manufactured with sustainability in mind. Investors, especially from the younger generation, are paying more attention to sustainability. “For the first time since WWII, we sense a shift in which climate and the environment — not growth — will become the priority of governments and their citizens, as shortages of food, clean water and air become existential questions,” says Saxo Bank’s chief economist Steen Jakobsen, in an interview with CNBC. With more consumers wanting to know where and how certain goods are made, a manufacturer has to show that its products are ethically and sustainably sourced and made. The new requirements of an effective, sustainable supply chain have been summed up by Capri in “group of Ts”: “Transparency, traceability, truth, trust, technology, and talent.” As these demands are placed on supply chains, Fung says, the supply chain of the future will be nudged towards digitalisation. “Up to now, most of the technology has impacted the consumer interface of the supply chain. If you look at what e-commerce and the Internet has done to the demand side and the consumer side, that whole area has been rapidly digitalised,” he says. Indeed, the world has seen an exponential rise of e-commerce sites, delivery services, Statista records that e-commerce alone has seen an almost four-fold increase in sales from 2014 of US$1.33 billion to US$4.2 billion in 2020, and the figure is expected to rise to US$6.54 billion by 2023. Even so, the supply chain that is keeping this whole ecosystem moving still uses a lot of manual work. “Frankly, that supply chain is basically still analogue,” says Fung. He believes that the current model of keeping inventory to supply this fast-moving demand is not sustainable, as demand will outstrip supply and inventory levels. “We need to digitalise the rest of the upstream supply chain. So a digitalised supply chain works with a digitalised marketplace. That is the fundamental source of the ‘supply chain of the future’ concept.” In other words, the supply chain of the future will use predictive analytics to forecast consumer demand, and then translate it to an optimal amount of supply. The more data it is given, the more accurate its predictions. Companies using robotics, sensors and AI will be able to predict demand and adjust their supply stream, which in turn will mean a minimised inventory for suppliers. In fact, supply chains will no longer be chains: With digitalisation, they will become “supply loops” where the cycle from supplier to logistics provider to customer is self-sustaining, says Fung.

See also: Electricity consumption by global data centres to double by 2030: Deloitte

Left to right: GKE CEO Neo Cheow Hui, Baker McKenzie Head of International Commerce and Trade, Asia Pacfic Anne Petterd, and Li and Fung Group MD William Fung.