On the surface, there appears much for businesses to be concerned about: Biden’s campaign website promises doubling the minimum wage from US$7.25 to US$15 ($9.95 to $20.55) an hour and raising taxes on corporate America. UBS estimates that raising the corporate tax rate to 28%, alongside other proposed tax changes, would lower S&P 500 profits by 8%. Sean Markowicz, strategist at fund manager Schroders, sees a Biden presidency potentially increasing the appeal of non-US equities after years of US equities outperforming the rest of the world.

A self-professed fan of the Democrats, cryptocurrency investor Michael Novogratz nevertheless warned that a Biden presidency could end the present stockmarket rally, fuelled by “silly levels” of liquidity in the wake of the Covid-19 pandemic. “Those frenzied bubbles normally end with policy response. Usually it’s the Fed’s action, but action on raising taxes could end this froth,” said the self-confessed disciple of the Centre-Left in an interview with Bloomberg.

But DBS chief economist Taimur Baig does not see US economic policies changing materially despite strong tailwinds for the Democratic Party. With the Democrats having to win at least four Senate seats from the Republicans to control the Senate, there is still a good chance that a Democratic administration may have to “cohabit” with a fiscally conservative Upper House, forcing Biden to compromise on tax hikes. The selection of “centrist” Kamala Harris as his VP nominee will also mean that Biden will be under less pressure from within his team to implement more radical policies during his tenure.

Businesses could also benefit from Biden’s plan to increase infrastructure investment, setting aside a US$2 trillion accelerated investment to build new infrastructure for sustainable growth. With his campaign website promising at least 3.75 million new jobs for the US economy, increased consumption spending from newly-employed Americans would benefit US growth and the economy as a whole. It is also worth noting that Biden has experience tackling a recession before, helping President Barack Obama lead the US recovery from the Global Financial Crisis.

But there is actually little evidence that Democrats are bad for markets. “On a shorter-term basis, a Republican presidency may, on average, be more positive for US equities. But in the longer term, historical data shows that a Democratic victory is actually positive for the S&P 500,” observes DBS CIO. While their estimates show an average 1.4% rally during a Republican victory and a 1.2% loss during a Democrat victory three months after the elections, 24-month returns see the Democrats yielding a significant 25.9% average while the Republicans yield only 6.4%.

Moreover, McLean director of investment analysis Bob French says that it does not matter whether the Democrats or Republicans win control of Congress. According to studies done in 2016, the difference between a Democrat or Republican Congress for stock performance is not statistically significant. While markets tend to do better when the same party controls both Congress and the presidency with a 14.52% return per year, the optimal scenario for markets is a Democratic president with a Republican Congress — with a 15.94% annual return.

Different stock classes are likely to benefit differently, however, from which party controls the White House. For instance, while oil stocks are likely to perform better under a Republican president, a Democratic presidency will favour sustainable investments like green energy instead. In Asia Pacific, Asia ex-Japan ESG leaders are likely to do well under a Biden presidency, as will the China smart infrastructure theme, says UBS chief investment office (CIO).

“We expect short-term pressure on Japanese carmakers if a Biden presidency reverses earlier tax cuts, but a greener agenda would also favor environmentally friendly cars, where Japanese producers and Asian battery and equipment providers are world-leading. Chinese solar companies should also benefit from the US quest for carbon neutrality by 2050,” it continues. Changes in US corporate tax rates will impact Asian companies active in the US, UBS CIO says, especially Japanese carmakers.

The research house also predicts that a reduction in trade uncertainty and a potentially weaker greenback under Biden would see positive tailwinds for Asian currencies. In such a scenario, Asian investors should reduce exposure to the US dollar. A Blue or Red wave outcome will likely lead to a somewhat larger increase in US interest rates and inflation expectations, thereby driving rates up in Asia Pacific as well, boosting the attractiveness of Asia Pacific fixed income.

Still, Markowicz warns investors that a president’s party alignment is in itself not exclusively good or bad for markets. What matters more perhaps is the policies that each chooses to enact as part of their individual platforms instead, with policy changes likely to take place over the next four years based on log-rolling with the minority party in Congress. But that is unlikely to stop punters from using the stock market to predict who will gain the presidency come November.

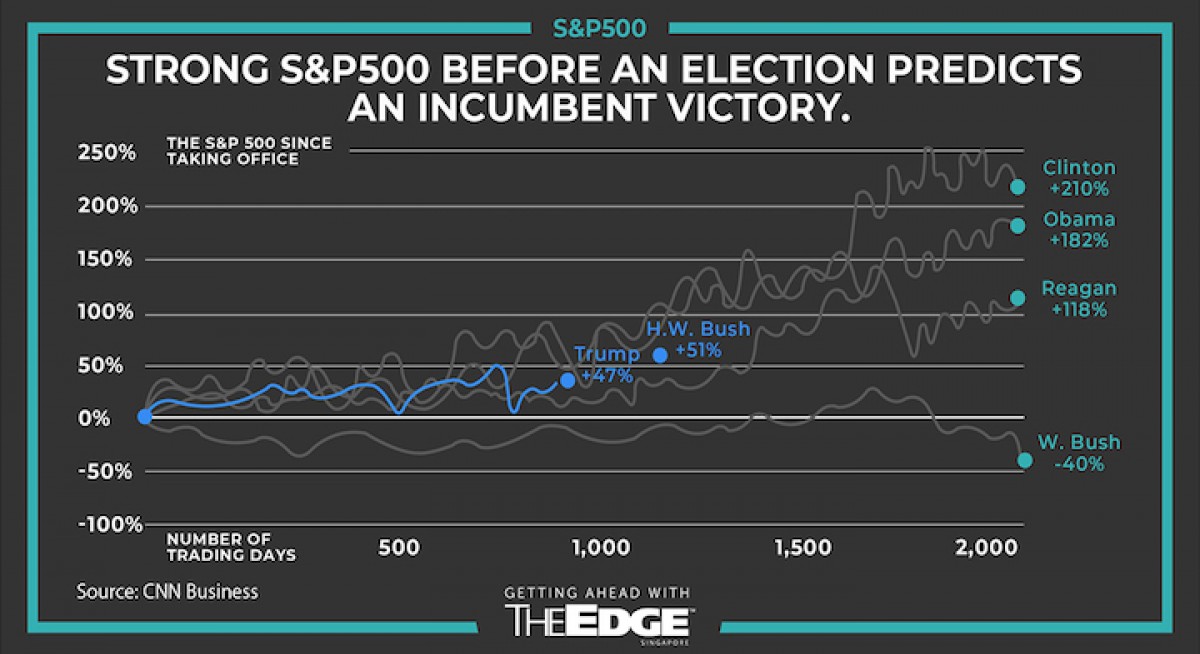

“When the S&P 500 Index has been higher the three months before the election, the incumbent party usually won, while when stocks were lower, the incumbent party usually lost,” says Ryan Detrick, a senior market strategist at LPL Financial. Christoph Siemroth, an economics lecturer at the University of Essex, notes that market predictions are currently pricing in a Biden-Harris ticket with a 59% chance of victory. Since 1928, out of 23 elections, the markets have been wrong only three times.

Read also: