However, experts are increasingly anticipating a “Blue Wave” with Democrats likely to take both the House and the Senate. This would allow Biden to raise corporate taxes and regulations on businesses with little congressional opposition.

According to David Alexander Meier and David Kohl of Julius Baer, the likelihood of a “Democratic sweep” scenario, which would have the largest policy impact, is considerably high at 25%. The “Biden versus a split Congress” scenario has a 20% probability while the status quo is 15%.

Markets traditionally worry about tax hikes often pursued by Democratic Presidents. Speaking at a webinar organised by Bloomberg, president and CIO of Cambiar Investors Brian Barish thinks that Biden’s promise to raise corporate taxes from 21% to 28% would not be advisable, as the economic outlook remains uncertain. Managing director of Goldman Sachs Alec Phillips, however, believes that tax hikes are unlikely to kick in until 2022, with the final figure likely to be lower than the proposed 28%.

But a “Blue Wave” could also see more fiscal stimulus following the election should Democrats gain the Senate’s “power of the purse”. Democrat House Speaker Nancy Pelosi is trying to push through a US$2.2 trillion ($2.99 trillion) stimulus package, which according to Biden advisor Jared Bernstein, in a research note by Goldman Sachs, will be largely an infrastructure plan with a strong “green” component.

See also: What Trump 2.0 means for investors

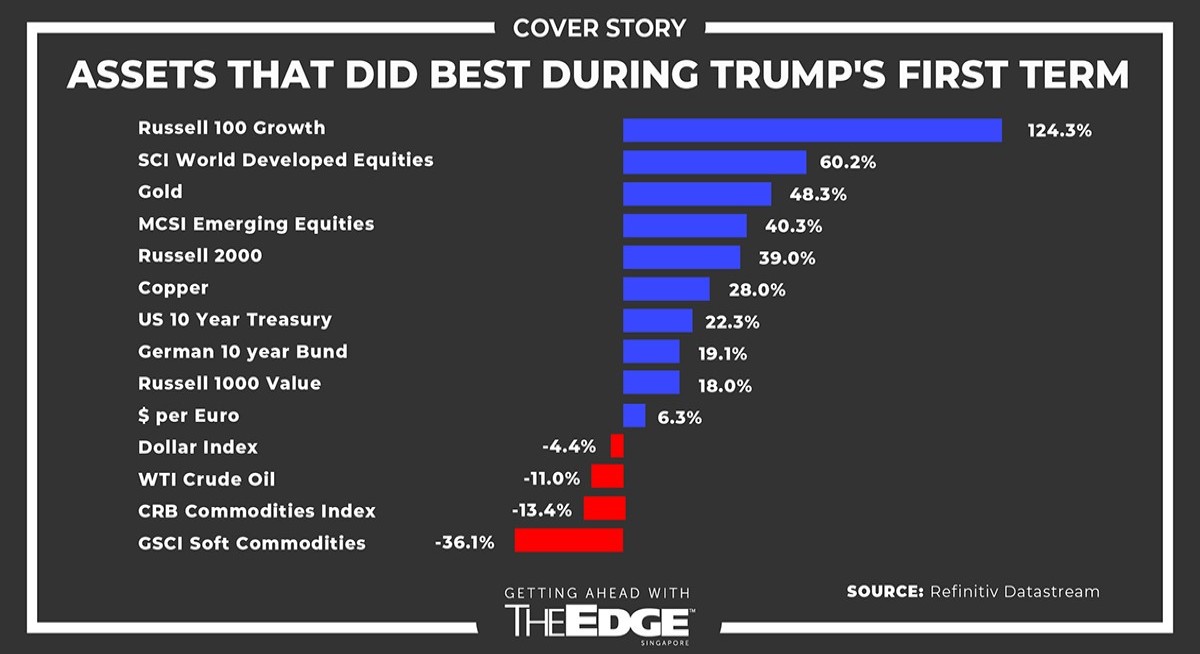

On the other hand, if Trump pulls another upset, there will be little changes to the White House’s economic policies. Should the status quo of a Republican Senate and presidency remain, fiscal stimulus is likely to be far less generous and be around the US$650 billion Republican package introduced in September, says Phillips. Nicola also anticipates further tax cuts should Trump be re-elected in November.

On the other hand, a Democratic Senate and Trump presidency could be negative on the markets as the House and the Hill sink into a gridlock over the stimulus. “If the Democrats sweep Congress and Trump wins, then markets would expect four years of policy gridlock which would pose risks since the recovery remains very dependent on fiscal policy,” warns Nicola.

Yet, there are some commonalities to Trump or Biden, and geopolitical uncertainty and a hawkish China policy will likely prevail under both. In line with Trump’s unilateralist foreign policy stance, Nicola sees him escalating tensions with China to secure his presidential legacy during a second Trump term. While Biden will likely also be hawkish on China, Eurasia Group president Ian Bremmer tells Goldman Sachs that Biden may take a more constructive stance towards China on common issues like climate change, preventing further escalation by improving bilateral dialogue.

However, Biden is not expected to make much progress on trade. “I don’t think US tariffs on China would just come off under Biden; China would have to provide something in return. So some initial momentum is possible, but likely only at the margins,” Bremmer says. Furthermore, perennial issues such as US-China technological rivalry and human rights could scupper progress. Biden’s desire to encourage US consumers to “Buy American”, adds VP Bank’s chief economist Thomas Gitzel, could also hinder future trade liberalisation efforts.

A winning hand

Despite the growing consensus of a “Blue Wave”, Asian investors worry more about a contested election, which could introduce significant market volatility. Speaking at the webinar, Bloomberg journalist Ishika Mookerjee says fears of “shy Trump voters” triggering a disputed result has sent investors fleeing to hedges such as gold and “put” options against fast-growing US equities. Interestingly, Asian equities are seen as a safe haven too, since these are seen as relatively insulated from uncertainty in the US while benefiting from strong Chinese growth.

In the forex space, given how US Treasuries are seen as less of a risk-off hedge, Citigroup is turning to the Australian dollar (AUD) to hedge against election risks, notes Mookerjee. The AUD and Swiss franc (CHF) pairing, in particular, will serve as an effective hedge since it is more correlated to stocks, with “put” options against the AUD serving as a good defence against an equity slide.

Eli Lee, head of investment strategy at Bank of Singapore (BOS), recommends going long on the Japanese yen (JPY) and AUD as an effective election hedge. Kathy Matsui, vice chair of Goldman Sachs Japan, expects strong Renminbi (RMB) performance under a “Blue Wave” versus the weak greenback, which is also seen to come under pressure should US corporate taxes be raised.

“Higher corporate taxation risks eroding the last line of defense for a strong US dollar. Superior earnings dynamics was a key reason for US dollar strength in the past decade,” remark Kohl and Meier of Julius Baer. OCBC forex strategist Terence Wu also notes that rising US-China tensions under a Trump administration could see investors seek refuge in the greenback. However, he warns that there is in fact little correlation between a president’s political affiliation and long-run USD performance.

DBS, noting how Chinese government bonds (CGBs) have taken on hedging qualities since the Global Financial Crisis, recommends this asset class as yet another alternative hedge vis-a-vis US Treasuries. Should a “Blue Wave” take place, the largely normalised yields of CGBs should offer more stability than US Treasuries, whose yield curves could experience further steepening in anticipation of further fiscal stimulus in early 2021. While US Treasury yields could dip in any other scenario, DBS argues, the 230 base point yield cushion of CGBs would see minimal opportunity costs for investors holding CGBs relative to US Treasuries.

Lee of BOS moreover proposes that investors adjust their stock portfolio weights from growth and momentum plays, towards cyclical and value counters in industrial and infrastructure — especially those with strong balance sheets that can maximise gains from the recovery. He sees greater regulatory pressure after the election on both US technology and healthcare sectors, though he argues that they should also maintain core positions in key growth sectors to profit from future growth.

But not all investors see the election as a risk to be hedged against. Dyer of M&G Investments believes that with markets already pricing in increased volatility arising from the election, there are potential upsides that investors can seize on should the polls prove smoother than expected. “We overweight equities versus fixed income in our portfolio and we are happy to hold that risk,” he tells The Edge Singapore. He also notes that a surprise Trump victory could see markets stumble slightly, creating acquisition opportunities for investors.

Should Biden win the White House as expected in November, UBS sees equities leveraged to “infrastructure spending with a focus on green initiatives, transportation infrastructure, and 5G buildouts,” benefitting from Biden’s green infrastructure plan; healthcare firms may also gain if Biden looks to expand healthcare coverage. A surprise Trump victory, on the other hand, would benefit energy and financial counters; these counters could experience a “relief rally” that tighter Biden regulations have been avoided. Defence companies could also see more support if Trump stays president as he pursues higher defense spending.

But with so much uncertainty ahead, it is perhaps better to place safe bets that will perform well regardless of who is elected. Bloomberg’s Mookerjee says North Asia technology counters remain popular among investors as a relatively certain source of high growth amid significant global uncertainty, though Biden’s more constructive foreign policy would benefit this sector. Matsui of Goldman Sachs flags the attractive valuations of Japanese equities too, recommending technology growth stocks, as well as cyclicals like steel, machinery, automobiles and insurance.

Do the elections really matter?

But while markets have been greatly excited by the high stakes of the polls, investors shouldn’t tailor their portfolios specifically to the results. “Although the November election looms large, it should not be the determining factor in constructing investment portfolios,” says UBS, noting that investors should remain vigilant as to new developments in the run-up. This is especially since Barish of Cambiar Investors warns that the upcoming polls will be unusually hard to call, with the risk of a contested outcome potentially prolonging market uncertainty.

Viraj Desai, senior manager, portfolio construction at TD Ameritrade, remarks that the elections are only relevant to investors insofar as they affect one’s long-term investment goals. But even so, the polls are only one part of the picture. He points out that macroeconomic fundamentals play a more decisive role in portfolio risks and earnings.“Consider rebalancing based on the larger fundamental environment — not based on which candidate or party appears to be winning or losing in an election year,” he suggests.

In fact, many investors believe that it is the US Federal Reserve policy — which sets monetary policy independently from the US government — rather than the next President that will be more important for markets. “Over the past eight years, the performance of the economy and markets have been more influenced by the Fed rather than by the White House,” argues Nakamura of Lombard-Odier. With the Fed vowing to keep rates low till 2023, markets will enjoy significant support from the flood of liquidity, regardless of who wins the White House.

Perhaps investors should not think too much about the polls and focus on building a strong portfolio. Or, they should be hedging against either possibility. “The cause of present uncertainty may be unique. But we’ve been through other bouts before. For investors, the key is always the same: Stay focused on what you can control — your personal goals and time horizon, and make sure you have a plan in place to get you there — no matter what life, elections, and markets may throw at you,” advises Fidelity Investments.