Megvii is moving forward even as other companies pump the brakes on their Hong Kong listing ambitions, wary of months of protests that have gripped the city. Alibaba Group Holding, a backer of Megvii’s, is among those that are gunning for a Hong Kong listing but have held back to gauge investors’ reception.

Megvii’s offering may face particular challenges. It would be the first in a coterie of Chinese AI companies to go public, raising money that would help further China’s effort to lead the sector by 2030. Donald Trump’s administration has raised the alarm about China’s ambitions in technology, which may erode the interest of US money managers in the country’s AI startups.

"It’s a bit political," said Mark Tanner, founder of Shanghai-based research and marketing company China Skinny. “Trump’s big concern is that China has the aspiration to be the leader in AI.”

Megvii’s filing will kick off the formal process for an IPO, though it could be months before its actual debut. Megvii competes with SenseTime Group – also backed by Alibaba – in facial and object recognition technology and Internet of Things software.

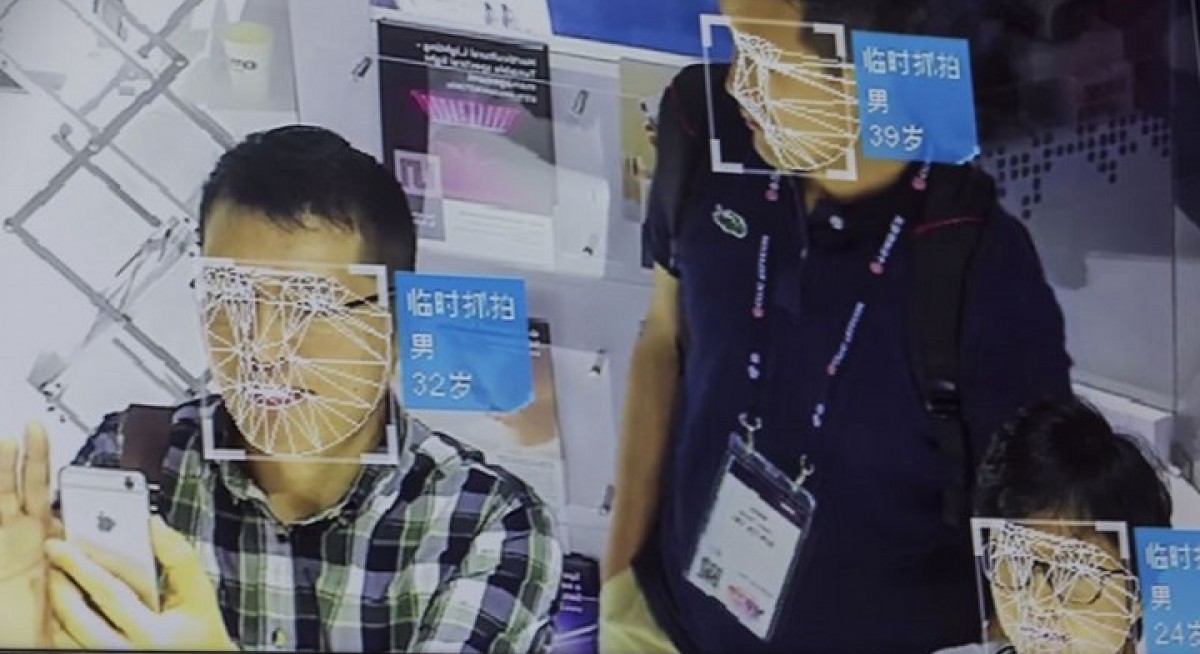

The seven-year-old outfit now provides face-scanning systems to companies from iPhone-maker Foxconn Technology Group to Lenovo Group and Ant Financial, the payments giant that supports Alibaba’s e-commerce business. Its facial recognition technology has provided verification services to more than 400 million people, Megvii said in a statement in January.

Beyond commerce, the company is also building software for sensors and robots. And the Chinese government is a client: Megvii’s AI technology has been used by authorities in more than 260 cities and helped police arrest more than 10,000 people, it said in January. The company last raised US$750 million in a Series D financing round in May from investors including China Group Investment, ICBC Asset Management (Global), Macquarie Group and a unit of the Abu Dhabi Investment Authority. Its other backers include Boyu Capital, Ant, SK Group, Foxconn, Qiming Venture Partners and Sinovation Ventures.

Megvii could have a first mover’s advantage.

"IPOs have been pretty disappointing in the past few months, but since AI is a hot category at the moment it could gain more traction," said Tanner.