Autologous bone grafts, which are deemed the “gold standard” for bone reconstruction, are not always readily available. Similarly, permanent implants, made using materials such as titanium, which are commonly used for such purposes, may result in infection, fractures and other late/delayed complications, thereby requiring patients to undergo costly revision surgeries.

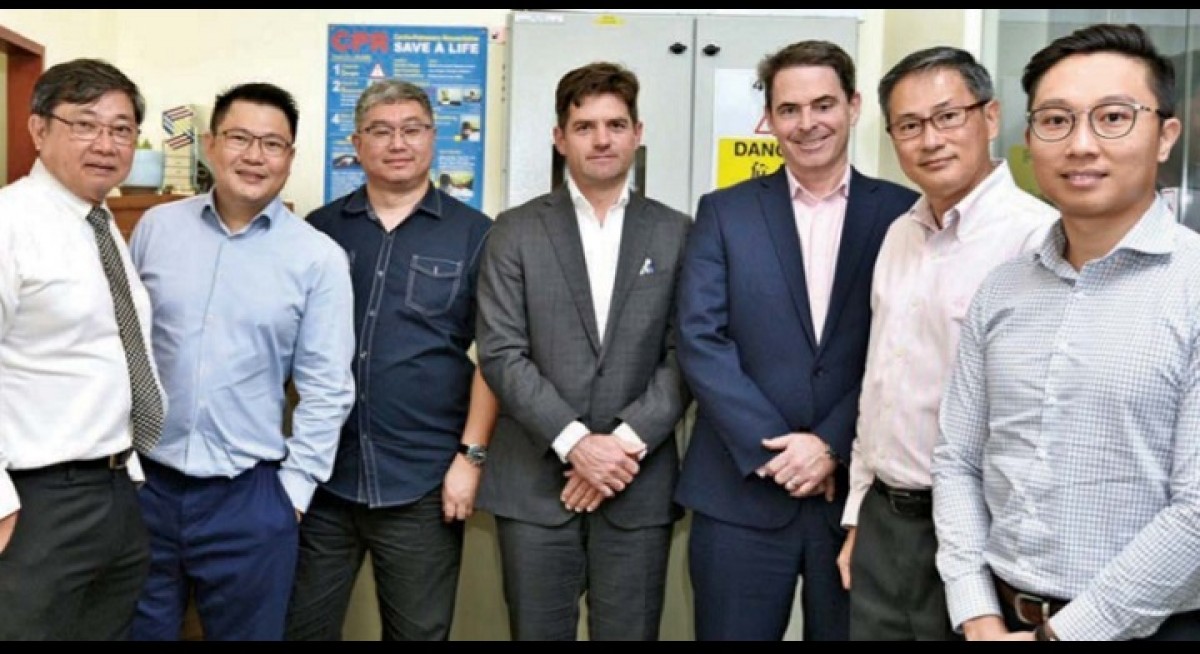

[Main image: (From left) Professor Teoh Swee Hin (Chairman of Board of Directors of Osteopore), Dato Seri Marcus Liew (Asia Cornerstone Asset Management Co), Dato Ken Low (Asia Cornerstone Asset Management Co), Dr Michael Wagels (Deputy Director of Plastic and Reconstructive Surgery from Princess Alexandra Hospital), Stuart Carmichael (Director of Ventnor Capital), Goh Khoon Seng (CEO of Osteopore) and Dr Lim Jing (Chief Technology Offi er of Osteopore)]

The Singapore-based company uses a proprietary 3D printing process to fabricate biomimetic microstructure with bioresorbable material to create a cell-friendly environment that facilitates natural bone regeneration.

“We make a home for the cells to grow, and the home has got interconnected rooms. They can communicate and the vessels, the plumbing lines can come in, and waste products can go out,” says Professor Teoh, who is the founder and chairman of Osteopore. “And over time, when the architecture is done, the scaffolds disappear,” he adds.

Safe and efficacious

Over the past 12 years, the company has accumulated a long track record of successful clinical experience in craniofacial application. More than 20,000 products have been successfully implanted and several more in new first-in-human surgical applications in dental and orthopaedic reconstruction.

Equally important, the follow-ups have been carefully tracked and the results demonstrate clinical benefits for the patients. “We are confident that the products are safe and efficacious,” says Osteopore’s CEO Goh Khoon Seng, who was an Adjunct Associate Professor at NTU’s SCBE.

Osteopore’s regenerative implants are viable alternatives to permanent implants

The technology offers key benefits to the wider healthcare community, specifically in tackling the persistent rise of healthcare costs. The majority of patients seek treatment in the public healthcare system and, inevitably, substantial subsidies from the government are required to offset the costs.

Goh believes that Osteopore’s regenerative implants are viable alternatives to permanent implants. “This technology can help minimise or totally eliminate future secondary treatments or revision surgeries, and their associated costly fees. The patient may be discharged from regular follow-up at the doctor’s discretion after the implant has fully degraded,” he says.

If more patients get discharged from regular follow-ups, this means that surgeons, who are always pressed for time, can devote more attention to treating new patients instead. “The hospital resources may be optimised, and the surgeons have a sustainable solution for the patients,” says Goh.

In a relatively short span of time, Osteopore has garnered many awards, certifications and recognition. First, the company secured permits from regulators, including the US-510k FDA, CE Mark and KFDA, for craniofacial applications, as well as published 10-year successful clinical outcomes. The company has gained the confidence of key opinion leaders from markets in Singapore, Vietnam, Korea, India, Germany and Australia.

In 2004, Osteopore received the Far Eastern Economic Review Gold Award; in 2016, the company was named Entrepreneurial Company of the Year by Frost & Sullivan Singapore; and in 2017, it was recognised as a Company with Cutting Edge Technology by IQVIA.

2018 was a bumper year for Osteopore. Within this one year, it secured Patents for Good, in recognition of contributions to societal needs; it was given an Honorary Mention in the WIPO-IPOS IP Awards 2018; and was recognised with the Business Model Innovation Award by the Singapore Business Federation.

IPO plans

Now, with its proprietary technology, a proven use case, and obvious business prospects, Osteopore is ready for its next big step. According to BCC Research, the bone grafting market is worth some US$4.5 billion ($6.17 billion). This is the kind of market opportunity Osteopore aims to capture and to do so, the company plans to go for an initial public listing on the Australian Securities Exchange (ASX).

The money raised will be used for international expansion, obtaining regulatory approvals for new products and market access, and marketing and distribution activities in markets with significant potential including the US, where the company has received FDA 510(k) clearance to sell there.

According to Stuart Carmichael, Director of Ventnor Capital, Osteopore is looking to raise A$5 million in this coming IPO. The shares will be offered at 20 Australian cents per share. At the time of listing, the company’s implied market capitalisation will be about A$20 million ($18.7 million). The IPO prospectus will be made public in June, and the actual listing is likely to be in August.

The growth prospects of Osteopore has attracted the attention — and investment — of Dato Seri Marcus Liew of Hong Kong-based Asia Cornerstone Asset Management, whose forte is to invest in the region’s small and medium-sized enterprises, before they turn into the next Alibaba or Netflix.

Liew is taking part in both the pre- and post-investment rounds of Osteopore’s IPO. He is confident that the company, with its unique technology, occupies a good spot in what he calls a “sunrise industry”.

More importantly, Liew is very impressed by the passion and commitment of Professor Teoh, the founder. To fund the company’s R&D efforts in the early years, Professor Teoh took the drastic step of mortgaging his own house. ‘That’s a very stupid thing I did, and I am stuck with it,” says Professor Teoh with a mock grimace.

Liew adds that this is the kind of commitment from entrepreneurs that impresses professional investors like himself. “When we hear episodes like this, it really makes us look up to their integrity and commitment. If they are willing to put their neck on the chopping board, we are in as well,” he explains.

Launch pad

While the company is based in Singapore, Osteopore’s board, investors and management believe it makes more sense for it to list in Australia. According to Carmichael, ASX has been actively wooing companies based in Singapore and other markets in Asia-Pacific. “ASX is very receptive to early-stage technology companies and has very strong liquidity compared with several other stock exchanges in the region,” he says.

In addition, Osteopore has identified Australia as one of the key markets it wants to expand into. The company has a strong connection with Queensland University of Technology as well as with various clinical-related collaborations.

Professor Teoh’s decision-making process is guided by facts and observations. He points out that the sector is much livelier in Australia, with 69 medtech companies trading on the ASX. “There must be something there, based on the statistics, and there’s this appetite among investors for medtech innovators. People seem to take Australia as the launch pad — and it has a reputation for being that,” explains Professor Teoh.

The way Liew sees it, Osteopore differs from many other medtech companies that are either planning to list, or have just listed. This company, he notes, is already at a stage where it is a successful commercial entity. In contrast to many other medtech companies trying to go for an IPO, this is quite rare.

“The company has already built the foundation. It is no longer about taking investors’ money to fund R&D for the product; Osteopore’s product is ready, and the IPO is really about raising funds for business development,” says Liew.