SINGAPORE (Dec 20): The telco sector has seen quite a shake-up this year as new entrant TPG Telecom starts to spin up its 4G network, while incumbent M1 was successfully taken private.

While the award of the fourth telco licence to TPG by the Infocomm Media Development Agency of Singapore (IMDA) was expected, the decision by Keppel Corp and Singapore Press Holdings to privatise M1 stunned many. The offer was formally made in December last year under a jointly owned vehicle, Konnectivity.

M1 was Singapore’s smallest telco. Konnectivity said if the status quo was maintained, M1 might stagnate and shareholder value would continue to decline as it grappled with the launch of TPG and new mobile virtual network operators (MVNOs). The offer was completed on April 29.

M1 reported a 3.7% y-o-y increase in revenue to $1 billion for FY2018 ended March 30, 2019 in its last publicly released results. However, earnings fell 8.5% y-o-y to $131.3 million, owing to higher customer acquisition and retention costs, higher headcount from the expansion of its corporate segment as well as higher repair and maintenance expenses.

Meanwhile, TPG started its network rollout this year, hitting the regulator’s milestones for coverage by mid-year. During its pre-launch trial, it announced that it was giving away unlimited data and free SIM cards to 20,000 customers in a promotional campaign.

A report by research firm OpenSignal in July found issues with TPG’s upload and download speed. Its quality of service was also rated the lowest among the four telcos. But with customers still using the network for free, the telco has little to fear about negative feedback from subscribers.

At StarHub’s 3QFY2019 ended Sept 30 results briefing, it was revealed that TPG was paying to use its infrastructure to achieve IMDA’s coverage requirements. In fact, TPG had also paid Singapore Telecommunications for access to its infrastructure, which was revealed at Singtel’s results briefing for 2QFY2020 ended Sept 30.

As it gears up for a commercial launch next year, TPG has yet to reveal any plans or prices. What TPG as well as StarHub and Singtel can expect is to contend with MVNOs such as Circles.Life and Zero1 for subscribers.

In terms of network experience, Singtel topped M1 and StarHub for 4G availability and upload speed experience, according to a report by OpenSignal titled “Singapore Mobile Network Experience Report December 2019”.

However, M1 topped the charts for latency experience, providing the most responsive network. All three telcos tied for voice app experience, while Singtel drew with M1 for video experience, and with StarHub for download speed experience.

“The mobile network experience of users on Singapore’s three established leading operators continues to move onwards apace, despite not yet launching 5G,” says OpenSignal.

While OpenSignal did not include TPG in the report, it “compared the experience mid-year and found TPG user speeds were much slower than [those of] Singtel, M1 and StarHub”. In its measure of how the TPG user experience had changed as the company moved closer to launch, it also “found a mixed story, with some metrics worsening — perhaps a result of more network usage — and others like Video Experience remaining fairly stable”.

5G up for grabs

The other significant development in the telco sector is the availability of two nationwide 5G network licences. This time, IMDA has taken a different approach. Rather than carrying out a spectrum auction like it did previously, the regulator will solicit for bids through a request for proposal (RFP).

The bidding is open to all current network operators in Singapore, who will have to submit their plans and designs for their 5G network deployment, with IMDA choosing two proposals. Besides the nationwide licences, IMDA is also offering two localised licences for 5G networks in industrial areas for commercial use.

Analysts expect M1 and StarHub to submit a joint bid to defray capital expenditure costs, as brand-new equipment is needed to operate the 5G network. Singtel is widely expected to submit a proposal on its own. Regardless of who wins the licence, the licensees are expected to sell spectrum to other operators who failed to get a licence.

Leasing spectrum from an operator will also require capital expenditure by the losing telcos. So far, both StarHub and Singtel have kept mum about their plans for the 5G network operator licence. The deadline for submission of proposals is Jan 21, 2020.

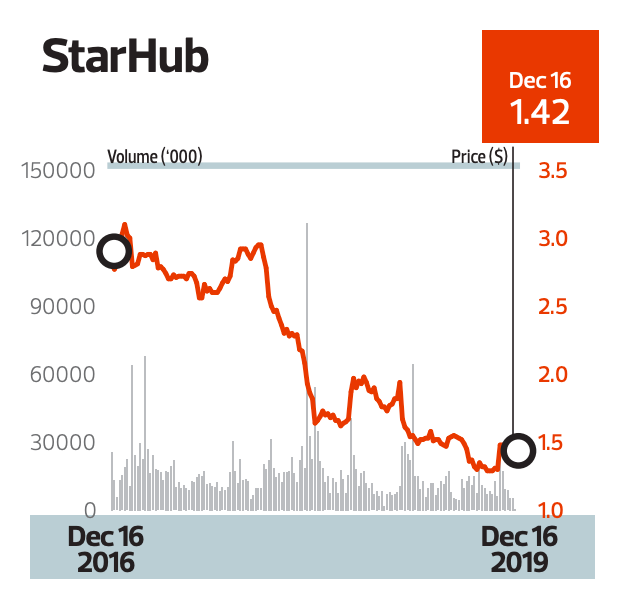

Lifted up by enterprise segment and associates

For 3QFY2019 ended Sept 30, StarHub’s total revenue fell 1.6% y-o-y to $572.6 million, while earnings improved 1.7% y-o-y to $58 million. StarHub’s mobile, pay-TV and broadband revenues declined. Revenue from mobile services fell 11.1% y-o-y on lower IDD (International Direct Dialling), voice and excess data usage; and lower roaming and data subscriptions and VAS (value-added services), though this was partially mitigated by an increase in plan subscriptions and enterprise SMS revenues.

StarHub’s pay-TV revenue dropped 24.8% y-o-y for 3QFY2019 because of lower subscriber base and average revenue per user, owing to migration from cable to fibre and other promotional activities. Indeed, StarHub’s pay-TV service has seen challengers from OTT (over the top) streaming players such as Netflix, as well as the loss of the Discovery Network in August 2018. StarHub says its pay-TV service is likely to continue to see challengers as Disney’s streaming service, Disney Plus, and Apple TV slowly start their global rollout. Broadband revenue also saw a decline of 7.8% y-o-y, owing to lower ARPU as a result of promotional activities encouraging the switch to fibre.

On the other hand, StarHub’s enterprise revenue saw an uplift of 16.7% in 3QFY2019. This was driven by higher revenues from cybersecurity services and managed services. However, this was partially offset by lower revenue from voice services, internet services and domestic leased circuits.

In August, StarHub and the founders of D’Crypt sold their stakes in the cryptographic tech firm to StarHub’s joint-venture partner Temasek Holdings for $100 million. StarHub will receive $65 million for its 65% stake. As part of the deal, Ensign InfoSecurity — the JV company — will be issued preference shares and be fully entitled to the economic rights of D’Crypt. Following the transaction, StarHub will hold a 60% stake in D’Crypt through Ensign.

StarHub said the transaction is set to complement D’Crypt’s and Ensign’s cybersecurity capabilities, enhancing the platform and solutions offered under Ensign. This will also allow D’Crypt to further expand regionally with Ensign’s help.

The telco also managed to record $120 million in cost savings as at end-3QFY2019 and expects more savings along the way as it puts its transformation programme into action. “Looking at our transformation progress, we are pleased to note that the programme is tracking well and may likely exceed the targeted $210 million gross savings by FY2021. Some of the savings are being redirected to fund our digital transformation and new acquisition opportunities and enhance our customers’ overall experience when using our products and services,” says Peter Kaliaropoulos, StarHub’s CEO.

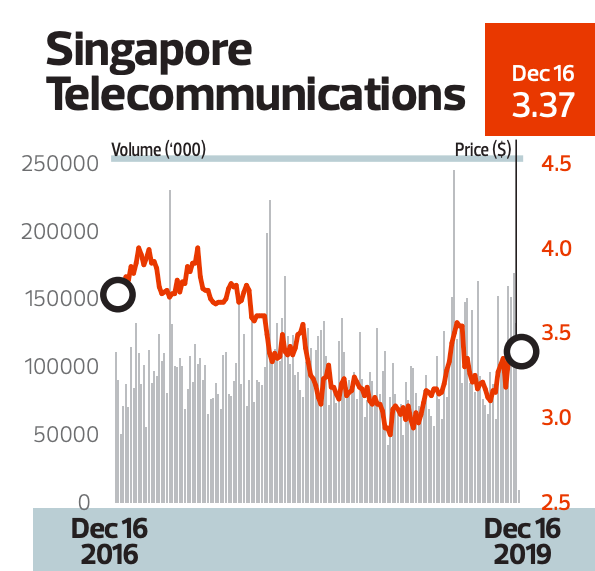

Meanwhile, Singtel reported its first quarterly loss of $688 million in 2QFY2020 ended Sept 30 after the Supreme Court of India recently ordered associate Bharti Airtel to pay spectrum and licence fees. Without the provision, Singtel’s underlying profit would have gone up by 3.1%, thanks to its other businesses, notably those of its associates.

Nevertheless, Singtel’s top line held steady, with revenue dipping just 3% y-o-y to $4.15 billion as its consumer business in the two main markets of Singapore and Australia remained resilient in the face of tough competition.

“The weak global economic environment has affected the industry, although on a positive note, our diversified earnings base and cost management have lifted our performance,” says Chua Sock Koong, group CEO of Singtel.

“We remain focused on delivering better customer experience and deepening customer engagement. While we expect the current challenging conditions to continue into 2020, we will invest to strengthen our market position, enhance our core networks and build strategic capabilities to capture growth, and be 5G-ready,” she adds.

For now, Singtel is guiding that the group will remain profitable for FY2020 ending March. And as a sign of its healthy cash flow, Singtel plans to keep its interim dividend payout of 6.8 cents a share. It is also guiding for a total full-year payout of 17.5 cents — unchanged from last year.