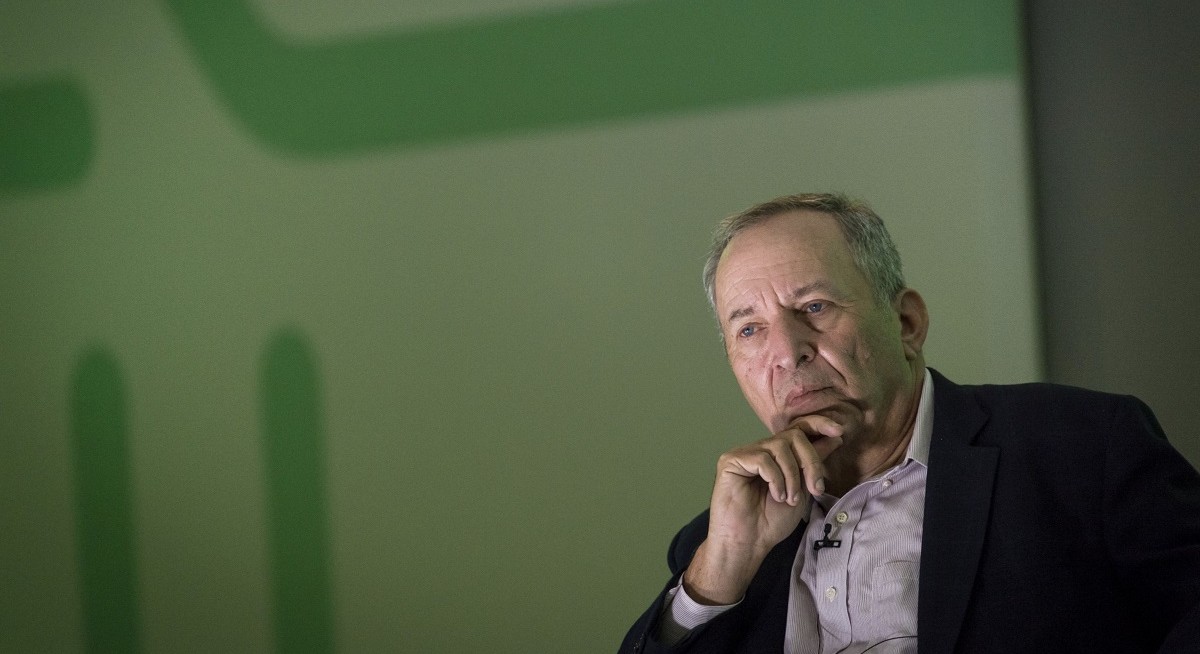

“Whether there’s going to be another move necessary or not, I think that’s a judgment they should be holding off on until the very last kind of moment,” he said of Fed policymakers, whose next decision comes May 3.

Summers discounted Friday’s March jobs report, which he said reflected the strength of the economy early in the first quarter but is now less relevant given prospects of a tightening in credit. The data showed another firm gain for US payrolls, with the unemployment rate dipping to 3.5%.

By contrast, weaker-than-expected purchasing manager surveys for manufacturing and services released this week showed a bigger slowdown in activity than expected. The ISM’s factory gauge hit the lowest level since the spring of 2020. Other data this week showed a slide in job openings and an increase in the trend for jobless claims.

“We’re getting a sense that there is some substantial amount of constriction in credit,” said Summers, a Harvard University professor and paid contributor to Bloomberg Television. “Recession probabilities are going up at this point. And I think the Fed’s got very, very difficult decisions ahead of it — with very much two-sided risk.”

See also: US Fed cuts rates by quarter-point; Powell says jobs market no longer 'very solid'

Those two-sided risks reflect the consequences of the economy overheating, Summers said. He called on the Fed to engage in a broad review of its internal models, which failed to anticipate the surge in inflation that began in 2021 and didn’t capture the risks emerging in the banking system that came into focus with Silicon Valley Bank’s collapse last month.

“The Fed needs to engage in some serious soul searching,” Summers said. “Business as usual at the Fed has not been successful over the last two and a half years.”

Among the tasks for the US central bank is an entire reconsideration of how savings are intermediated into lending, Summers said. A key takeaway from the SVB disaster was how that lender’s deposit base was much less sticky than many had anticipated. The collapse also spurred a broader pattern of depositors searching for higher returns on their funds.

“We’ve had a financial system that has been based on the willingness of large numbers of households to earn almost nothing on their money — and I’m not sure that’s going to persist,” Summers said. “The Fed needs to do some very fundamental reflection on what kind of financial system they want to see us move into.”