Growing affluence and evolving maturity of health systems in Southeast Asia have led to a shift in disease burden — from acute and infectious, to predominantly non-communicable and chronic in nature.

Today, around 55% of all deaths in Southeast Asia are due to non-communicable diseases (NCD). Cancer alone leads to some 1 million new cases and around 700,000 deaths every year. As Southeast Asia’s population ages over the next decade, the burden of NCDs will only be exacerbated.

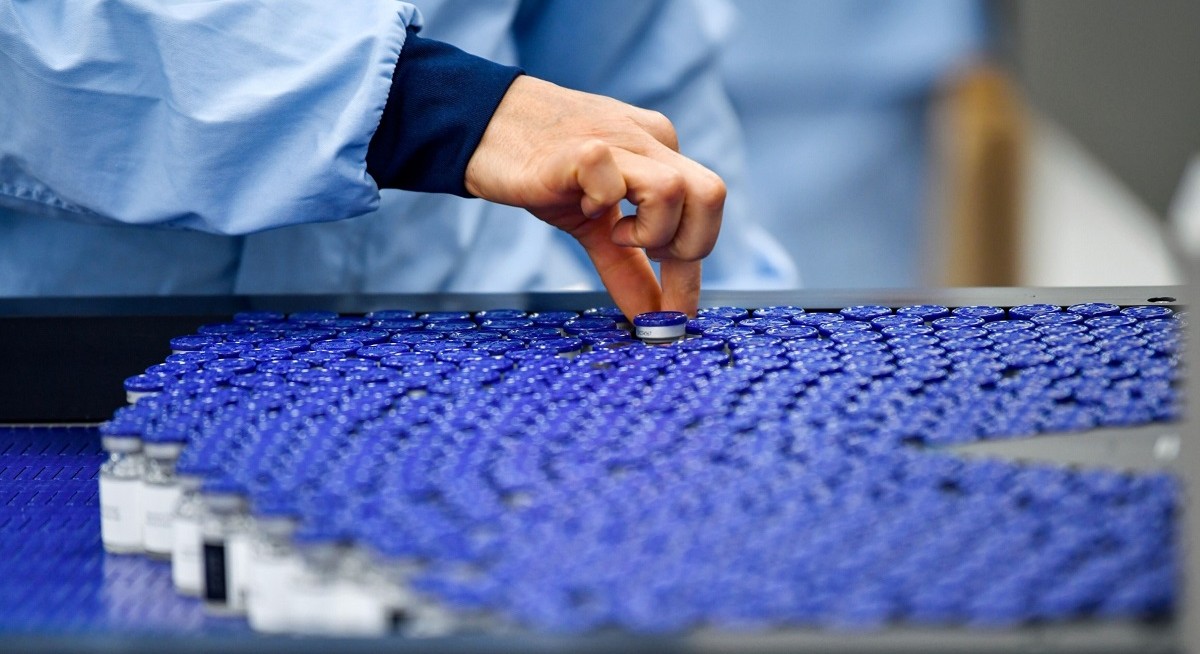

Globally, as NCD prevalence has increased, newer therapies such as biologics have been invented, which fundamentally alter the course of diseases, leading to improved quality of life and reduced mortality. Understandably, given the R&D investment and complexity to manufacture, these therapies are costly. However, as patents for innovator biologics have expired, biosimilars have emerged. Biosimilars — typically priced 30%–50%+ lower than innovator biologics — are relatively affordable alternatives that ensure similar clinical outcomes for NCDs.

With some US$160 billion ($214 billion) worth of innovator biologics set to go off-patent by 2030, the tailwind for biosimilar adoption is strong. However, the adoption of these life-changing biosimilars has been very limited in Southeast Asia. For example, biosimilars of rituximab, infliximab and adalimumab — used for the treatment of rheumatoid arthritis — have around 60%–90% penetration in EU5, have less than 5% penetration in most Southeast Asia markets.

This has been driven by three key challenges. Firstly, affordability continues to be a major barrier, even for the cheaper biosimilars, as most Southeast Asia markets require patients to pay out-of-pocket with limited public reimbursement or private insurance coverage. Secondly, clinician preference for innovator brands remains high. Clinicians often equate Innovator brands with quality, resulting in both prescribers and patients preferring originators over biosimilars. Finally, originators have deployed innovative schemes to compete with biosimilars, such as patient access programs and value-based pricing.

See also: Gen Z is rewriting the rules of wealth

Learnings from the globe — what drives biosimilar adoption?

Over the past decade, biosimilars have witnessed strong adoption globally, including Europe, China, South Korea, Japan and India. Three key factors have been instrumental in this adoption:

First, the establishment of public reimbursement: Payer preference for biosimilars has been instrumental in driving biosimilar adoption in EU like infliximab which gained up to 90% share in select European markets. In the UK, the NHS set a target of 80% infliximab biosimilar penetration in the first year of launch (2019), which led to some 90% penetration within the first year itself.

See also: Airbnb's makeover as a super app of experiences

Second, clear regulatory framework for biosimilars approval & usage: Markets with strong biosimilar adoption have laid out clear regulatory frameworks for both approval and usage of biosimilars. For example, the European Medicines Agency (EMA) has been a pioneer in establishing clear regulations for biosimilars approval since 2004. Over the years, EMA has also periodically updated the framework based on accumulated experience in approving biosimilars in the EU. In Asia Pacific, the South Korean regulator (Ministry of Food and Drug Safety) established guidelines for biosimilar approval as early as 2009, using inputs from the EMA framework. This has enabled a flourishing local biosimilar ecosystem including companies such as Samsung and Celltrion.

In addition to clear regulatory approval frameworks, successful countries have also allowed the interchangeability of biosimilars. For example, Germany introduced legislation in 2019 to encourage the substitution of biologics in pharmacies. As a result, infliximab biosimilar penetration in Germany rose to 60%+. In Japan, no specific regulations on interchangeability exist, but switching between reference products and biosimilars is permitted, subject to clinical decision-making by physicians.

Third, concerted efforts to drive clinician adoption: Key Opinion Leaders (KOLs) play a critical role in biosimilars adoption. Across successful biosimilar markets, evidence-based discussions with KOLs, supported by real-world data, have been critical to influencing prescriber behaviour. For example, EMA has collaborated with European Commission (EC) to develop educational resources on biosimilars for healthcare professionals and patients. The EC organises yearly biosimilars-focused conferences, where stakeholders share experiences with biosimilars and discuss potential policy changes. Additionally, pharmaceutical companies (pharmacos) have proactively engaged with hospital formularies and procurement teams to drive adoption, for example, in China and India.

Increasing adoption of biosimilars in Southeast Asia

The adoption of biosimilars, which significantly impact the management of NCDs, is crucial to benefit millions of patients in Southeast Asia. This will be challenging, necessitating efforts from multiple stakeholders including payers, regulators and pharmacos.

First, public payers need to enhance reimbursement for biosimilars: Most public health insurance schemes and systems in the region are under cost pressures, providing limited reimbursement for biosimilars and innovator biologics. Understandably, a large outlay for biosimilars amid competing priorities is a tough choice faced by public health administrators.

This state of frugality thus requires innovation. Payers in the region could attempt to use budget impact and/or cost-benefit studies to negotiate with biosimilar players and reduce procurement costs. Secondly, they could consider institutionalising stringent clinical guidelines to ensure access to the right patient pool (based on factors including disease stage, biomarkers, co-morbidities and age) and prevent overuse/misuse. Finally, payers can explore innovative financing models such as value-based pricing or outcomes-linked payouts.

Sink your teeth into in-depth insights from our contributors, and dive into financial and economic trends

Second, policymakers need to address the question of interchangeability: Over time, most countries in southeast Asia have developed clear regulatory frameworks for biosimilars approval. However, there is continued lack of clarity when it comes to interchangeability of biosimilars. Hence, in clinical settings, physicians and pharmacists lack clear directions on when they can substitute the originator biologic product with an approved biosimilar. Developing clear guidelines on interchangeability will allow greater prescriber comfort and, in turn, greater adoption of biosimilars.

Besides regulatory and policy support, pharmacos keen on biosimilars need to take on three key initiatives.

First, establish win-win commercial partnerships: Local Southeast Asian pharmacos have strong market know-how, local relationships, and extensive sales footprint which allow them to successfully “educate” clinicians and providers on biosimilars. Many pharmacos in India, China, and Korea, meanwhile, have developed a strong pipeline of biosimilar products, which they are looking to commercialise in this region. For Southeast Asian pharmacos, forging a trusted partnership with marquee biosimilar players to commercialise their products will be an important win-win in developing the biosimilar space.

Second, advocate and shape the public policy on biosimilars: A key barrier to the adoption of biosimilars is the lack of awareness among payers, who are hesitant to reimburse biosimilars. The pharmacos of this region can make a two-pronged effort. First, engage proactively with payers using real-world data and evidence to demonstrate the lifetime cost-benefit of biosimilars, including the economic impact on reduced morbidity. Second, engage with patient groups and NGOs to convey the benefits as well as safety of biosimilars, in turn, enabling these groups to advocate for reimbursement of these life-saving medications.

Third, reinvent the sales operating model to change prescriber behaviour: Unlike generics, biosimilars are complex therapies that require prescribing specialists to be convinced. In general, prescribers in Southeast Asia continue to be relatively unfamiliar with the benefit of biosimilars, and their interchangeability with innovator products. Driving this education will require pharmacos to invest in medical capabilities — Medical Science Liaisons and Medical Advisors, and scientific upskilling of sales teams. While this comes at a cost, a lean operating model — with close collaboration between medical and sales teams to optimise the number of prescriber calls and usage of digital prescriber engagement tools — could help make the outreach efficient.

There is a strong need and latent demand for biosimilars in Southeast Asia. It is time that stakeholders make a concerted effort to uncover and serve this demand to benefit the millions in Southeast Asia suffering from NCDs.

Anurag Agrawal is a partner and associate director at the Boston Consulting Group; Partha Basumatary is a principal at Boston Consulting Group