Meanwhile, as Asians collectively cheered Michelle Yeoh’s “the pride of Chinese people everywhere” Oscar nomination on the third day of New Year, I couldn’t help but wonder how we often see the world through our biased lens, especially in the past through rose-tinted glasses.

Called rosy retrospection, the tendency to evoke the past in a more favourable light, exaggerating the good parts of our memories and minimising negative ones, afflicts the best of us in recalling past relationships, the golden age of Hong Kong, and even investment decisions.

It is also why we tend to replay past mistakes: To cling to perceptions and beliefs in the face of changed facts or hold on to lost causes or out of favour stocks!

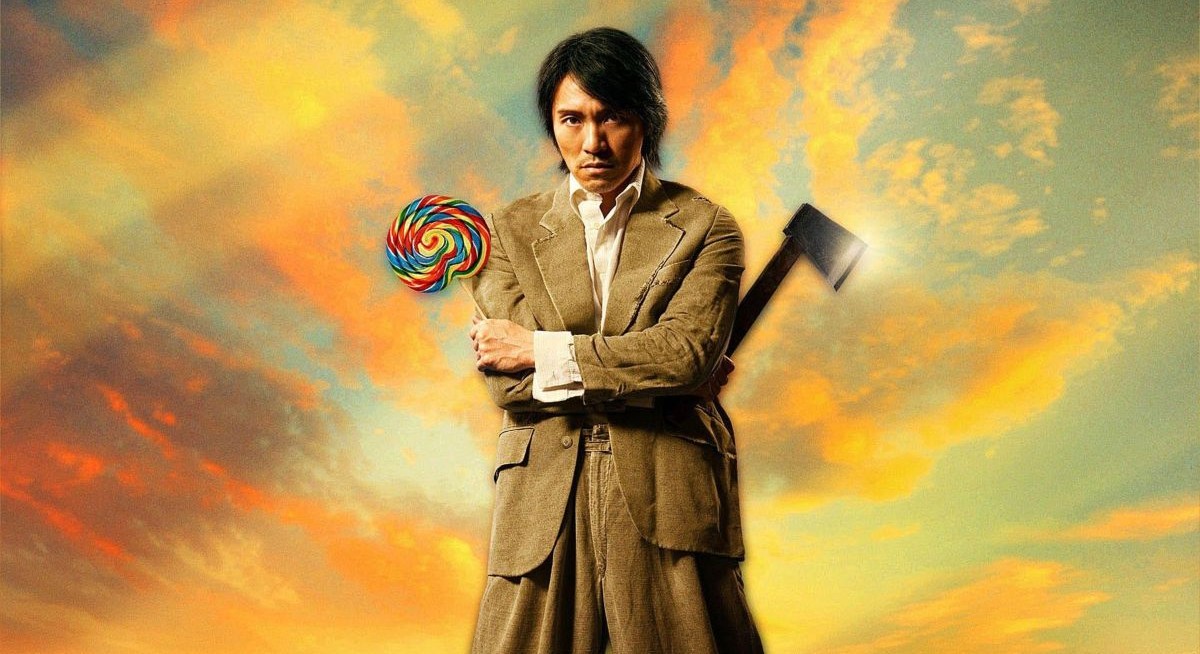

Flirting Scholar

See also: ‘Irrational exuberance’ stock gauge sparks fresh bubble worries

As I made my way through many auspicious four-word Chinese blessings over too many lo hei this season, there was a palpable cheer, which is a stark contrast after last year’s annus horribilis in global stock markets. Markets worldwide gained in a pre-Lunar New Year rally, dwarfed by the post-New Year charge upon markets reopening in China, Hong Kong and even Singapore!

The Straits Times Index (STI) was shy of touching 3,300 points on five occasions. Readers might recall how I suggested that this mark was about to be breached as the blue chips were taking turns to rally, leading to spillover to some mid and small caps. Even then, I was surprised by how quick it was to run to 3,400 points, with leaders and laggards amongst the index components taking turns to catch up.

I ended up selling into the rally. I hustled some profit on ETFs, blue chips and even contra-ed intra-day a couple of laggards I spotted for a 5% quick turn. True, there’s higher risk, but such gains are better than the currently popular one-year Treasury bills, whose latest yield has dipped below 4%. My hopeful buy-back orders were left in the dust — waiting for the market to catch a breath which hasn’t happened since.

See also: Global funds bet on Korean stocks’ big break on reform tailwinds

Left behind in a blue chip rally and coy about chasing, I have commenced trawling midcaps for still unfancied stocks and sectors. I found one in BRC Asia. Even as it rides on a recovery in the local construction sector, it is trading at mere single-digit P/Es while giving a yield of close to 10%. I am sure there are more pure Singapore gems to be found.

Also, in Singapore, a less volatile and calm port amidst a global inflationary and recessionary storm, there are less precipitous macro risks, companies that can benefit from an emerging post-Covid-19 China, and friend-sharing industrial policies of both the East and West.

Technicians now suggest that the STI’s 3,300-point could be a support, with 3,600 points a possible next upside target. That objective holds so long as no significant macro shocks and geopolitical surprises strike — a very big if. I kept my head firmly on my shoulder as I clipped each gain whenever I was up 3% to 5%. The Capricorn effect has traditionally lifted markets in January, but I resist the lure that the market will stay this way. If it is not a directional market per se, one has to hustle out a return by being mindful of risks.

All for the Winner

Oddly this time, I am not alone. At the recently concluded World Economic Forum in Davos, sceptics were aplenty. Year to date, the MSCI World Index has already returned 6%, extending the returns enjoyed by those brave enough to venture in last October at the lows to 20%.

Indeed, as many equity investors threw in the towel then and parked what was left of their cash to lock in 4% fixed deposits and T-Bills, equity markets started to find a footing and rally to their chagrin.

Year to date, the Nasdaq, S&P, Hang Seng and Hang Seng Tech have chalked up handsome double-digit gains amid hopes that central bankers will reach peak rate rises and stop increasing, potentially even reducing it by year. Even slow and steady Singapore added 4.3%, coupled with continued strength against the US dollar, building on last year’s success.

Sink your teeth into in-depth insights from our contributors, and dive into financial and economic trends

Many I have met over this new year were ebullient over the recent 40% rebound enjoyed by Hong Kong from its low last October. Some with rose-tinted glasses waxed lyrical about how there was more excitement and potential profits from trading shares up North.

A few bankers even rolled out the old chestnut story of “let’s list in Hong Kong for better valuation as there is no hope in Singapore”. A few chaps still nursing 30% to 50% red ink from 2021 favourites like Tesla and Alibaba Group Holdings, buoyed by some recent success, even had their confidence and swagger back. I wonder.

Interestingly, as a testament to the better risk-adjusted return in Singapore, the oneyear returns of the respective indices are Nasdaq (–15.6%), S&P (–8%), Hang Seng (–4%) and Hang Seng Tech (–15.6%), with Singapore holding flat +4.5%. The rebounds notwithstanding, have seen North Asia lag the STI by up to 30% since the pandemic began in 2020.

Nicolai Tangen, head of Norway’s US$1.3 trillion ($1.7 trillion) sovereign wealth fund, is one among many who is convinced that whilst a lot of froth from 2021 may have been blown off markets, the US Federal Reserve (Fed) may very well restart rate rises — implying a very long slow grind of low returns may lie ahead. The Fed, paraphrasing John Maynard Keynes, “can stay hawkish longer than you can remain solvent”.

In The Financial Times on Jan 28, Katie Martin succinctly sums up why the smart money is still wary of the equity revival — the high impact tail risk of the Fed.

If this plays out, the bear market rebound of the platform tech stocks will have higher volatility down the road. Real profits and cash flow will continue to be king. As the increasing layoffs in the tech sector are signalling, 2021’s bed of roses equity story on a hopeful path to profitability is long gone.

From Beijing with Love

Leaving geopolitical speculations and Fed guessing aside, one potential economic cloud is on the horizon. That is the US debt ceiling that will be reached by July, notwithstanding US Secretary of the Treasury Janet Yellen’s pre-emptive emergency measures, which commenced with little fanfare last week — to stretch out the dollar.

A mere technicality in normal times for the US Congress to raise it de facto for the US government not to default, this year looks like a replay of 2011 minimally when former US President Barack Obama and the Republican-controlled House entered into brinkmanship which caused a painful wobble. Right to the end, there was a risk of shutting down the US government and destroying the basis of “risk-free” benchmarking for financial markets — US Treasuries into financial Armageddon.

Compared to 2011, partisanship in a polarised American political system is now on steroids. Kevin McCarthy, the current US Republican Speaker of Congress, elected by the skin of his own party’s teeth, is being held hostage by the party’s extreme right-wing. He will likely play a “Trillion Dollar Chicken” game and push negotiations to the wire. Timing-wise, this will increasingly be on the front pages from May and meander into the July summer months with lower liquidity.

It is, therefore, timely to consider if it is better to cut some 2021 losses suffered in the Western markets on this rebound and re-allocate to businesses that will thrive in this environment or lighten up after the spring.

The current Western narrative prefers to focus on losses suffered in China because of the reopening. Yet, President Xi Jinping looks to be re-engaging the world with the panda extending economic olive branches to all (including Australian coal and wine imports) — except Taiwan.

As argued before, China — having spent 2020 to 2022 flushing out excesses in its tech and property sectors — has rebased itself through shared prosperity and is now re-engaging the global economic world on a steadier footing. It is on an opposite cycle, with the West digesting the inflationary effects of Covid-19 fuelled fiscal and over-extended loose monetary policy. It also holds a lot of US Treasuries.

Vice-Premier Liu He’s speech in Davos suggests that China’s focus on the economy has led to more optimism that China is coming back. I remain a China bull, but I believe that common prosperity also means not too hot or cold. The peak prices of Baidu and Tencent Holdings, like Alphabet and Meta Platforms, are not likely to be seen again, certainly not this year.

So while Chinese markets are counter-cyclical to the West, taking profit and recycling requires some kung fu, the order of the Rabbit to hustle and not purely allocate. After all, I have always believed — no one ever lost money by taking a profit! We may miss the next leg up, but I’d instead not carry the can down.

Chew Sutat retired from Singapore Exchange after 14 years as a member of its executive management team. During his watch, the exchange transformed from an Asian gateway into a global multi-asset exchange and he was awarded FOW’s lifetime achievement award. He serves as chairman of the Community Chest Singapore