Every crisis highlights vulnerabilities in a system and often they are variations of a theme, usually involving interest rates and debt. The Asian Financial Crisis (AFC) had its genesis in pegged exchange rates, large external deficits and high property and stock market valuations. On the other hand, the Global Financial Crisis (GFC) had its beginnings in a downturn in the property market that led to a financial crisis because of having taken on too much debt.

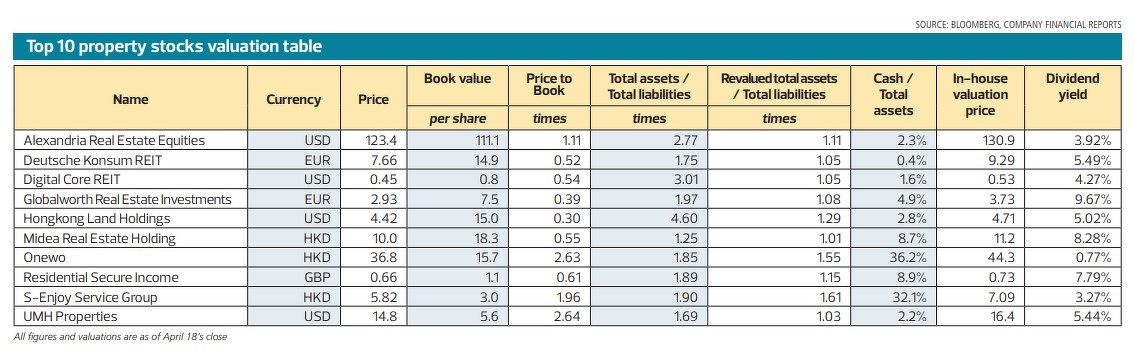

The REIT sector may be experiencing some headwinds now but there are still investment opportunities in the real estate sector — if you know where to look and what to avoid. Here are 10 global property stocks and REITs to track: Every crisis highlights vulnerabilities in a system and often they are variations of a theme, usually involving interest rates and debt. The Asian Financial Crisis (AFC) had its genesis in pegged exchange rates, large external deficits and high property and stock market valuations. On the other hand, the Global Financial Crisis (GFC) had its beginnings in a downturn in the property market that led to a financial crisis because of having taken on too much debt.

Every crisis highlights vulnerabilities in a system and often they are variations of a theme, usually involving interest rates and debt. The Asian Financial Crisis (AFC) had its genesis in pegged exchange rates, large external deficits and high property and stock market valuations. On the other hand, the Global Financial Crisis (GFC) had its beginnings in a downturn in the property market that led to a financial crisis because of having taken on too much debt.

Last year, the accelerated pace of rate hikes by the US Federal Reserve highlighted vulnerabilities in one of the star sectors of the Singapore stock market, the REIT sector. While property developers have weathered the rate hike cycle better, S-REITs with mainly foreign assets and excessive debt are seeking ways to recapitalise without triggering a default. A failure of these foreign S-REITs would be detrimental to both Singapore as a global REIT listing hub and the sponsors of these REITs.

Less than a year ago, the SGX Group had even declared that high-quality global sponsors — Manulife, Digital Realty and Daiwa — were listing their REITs in Singapore. For more than a decade, with a growing list of REITs drawn to it, the SGX has been promoting Singapore as a REIT-listing hub for global assets.

See also: Japan Hotel REIT raises Yen61.8 billion to acquire Hyatt Regency Tokyo

In September 2022, as part of celebrating the 20th anniversary of Singapore’s REIT sector, it was indicated that S-REITs had weathered the GFC and the Covid-19 pandemic.

A commonly-held view was that the GFC helped REIT managers focus on their capital management. Being conservatively leveraged and having well-spread debt maturities, comfortable interest coverage ratios (ICRs) and diversified sources of funding kept the sector relatively insulated from headwinds. However, these risk-mitigating factors do not seem to have counted for much in the face of the potential failure of a handful of REITs.

The interest rate cycle

See also: AIMS APAC REIT sells 8 Senoko South Road to tenant Sin Hwa Dee for $15 mil

Among the biggest problems S-REITs face is their large debt load. For REITs to have an aggregate leverage (the equivalent of loan-to-value or LTV ratios) of close to 40% is untenable as policy rates have risen at an accelerated pace.

Higher interest rates impact both REITs and developers in three main ways. Firstly, higher interest rates cause interest expenses to rise. This is likely to be a gradual rise as developers and REITs usually have staggered debt expiries. But even if the Fed pauses its rate hike cycle now, interest expense will continue to rise for developers and REITs this year.

Secondly, higher interest rates impact capital values because discount rates rise. Discount rates are used in discounted cash flow (DCF) valuations of properties in both developers and REITs. The higher the discount rate, the more cash flow an asset needs to generate just to maintain its valuation. If cash flow falls or the discount rate rises, or both happen, valuations are likely to fall.

The third impact is on the cost of capital. Many companies use a combination of debt and equity to finance their business and business expansion. The overall cost of capital — or the weighted average cost of capital (WACC) — combines the cost of all capital sources. Higher interest rates raise the cost of capital.

Most stocks and REITs take their pricing off risk-free rates. These are indeed falling. However, stresses in the system remain because the price of a stock or REIT is a combination of risk-free rates, market sentiment, business fundamentals and the ability of the stock or REIT to finance those fundamentals.

Value traps

As an observation, REITs used to trade closer to their net asset values (NAV) than developers. Often, the valuation of a stock is premised on how liquid its balance sheet is. As an example, CapitaLand Integrated Commercial Trust (CICT), which has retail malls, offices and integrated developments primarily in Singapore with a smattering in Germany and Australia, is trading pretty close to its NAV of $2.05 as at December 31, 2022. This is partly because of its ability to realise its book value.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

Last year, CICT divested JCube at $340 million compared to its Dec 31, 2021 valuation of $280 million to $282 million. In 2021, CICT divested its 50% stake at One George Street for $640.7 million, compared to a valuation of $1.18 billion for 100% of the property. This demonstrates its ability to monetise the value of its properties, underscoring the valuations.

Not all property-based entities can realise their valuations. In 2020, developer OUE divested LA Bank Tower for US$430 million (or $597.7 million at that time), below the book value of US$650 million as at Dec 31, 2021. However, OUE had acquired the property for US$367.5 million or $459 million in 2013. Hence, although OUE recorded a revaluation loss, the divestment price was higher than the acquisition price. Still, the transaction did not do OUE any favours. As at Dec 31, 2022, OUE’s NAV stood at $4.35 compared to its trading price of around $1.21. This huge discount does not necessarily imply that the stock is cheap. It could also point to a value trap.

Value traps occur when low prices are consistently accompanied by low multiples such as P/NAV. OUE is trading at a P/NAV of 0.28x.

How a value trap works

Unitholders of Manulife US REIT (MUST) are particularly anxious as their REIT’s NAV as at Dec 31, 2022 is 57 US cents and the stock is trading at a P/NAV of about 0.36x. This is especially alarming given that its aggregate leverage is close to 50% and its manager has articulated that it was challenging to divest the properties at their last valuation.

“There are unleveraged buyers out there for an asset like Figueroa,” said Tripp Gantt, CEO of MUST’s manager during a results briefing in February, referring to the 35-story office building in Downtown Los Angeles’ South Park District, which is also MUST’s third-largest asset by property valuation as at end-2021.

“They are not very active in the market and they are looking for winners so Figueroa is not their target. And at what price could we sell Figueroa? We are in a price discovery now. Selling an asset at a steep discount would crystallise that loss which you cannot get back and we want to avoid that,” Gantt added. “The reason why we didn’t sell anything in 4Q2022 was that prices didn’t meet our objective.”

Despite these warnings and the challenges and lack of liquidity in the US office sector, some analysts appear to think that trading at 50% to NAV is a good thing for investors. They could be right, or wrong.

As it has been said, valuation is not an exact science. In December 2022, valuers revalued Figueroa at US$211 million ($281.5 million), down 33% y-o-y. Its acquisition price was US$284 million in May 2016 and the property was revalued upwards to US$302 million as at Dec 31, 2016. MUST have three IPO properties including Figueroa that were acquired from Manulife. The other two were Michelson, valued at US$292 million as at Dec 31, 2022, versus its acquisition price of US$317.8 million, and Peachtree, valued at US$205 million at Dec 31, 2022, versus its acquisition price of US$175 million. The third was Exchange that MUST acquired from its sponsor in 2017 for US$313 million and at Dec 31, 2022, it was valued at US$290 million.

In 2018, MUST acquired two properties from its sponsor, Penn, for US$182 million, and Phipps for US$205 million. As at the end of December 2022, Penn was valued at US$156 million. In total, MUST acquired US$1.48 billion of properties from its sponsor and paid almost US$50 million in management fees to its sponsor. The base management fee is calculated at 10% of distributable income. Since the performance fee is based on DPU growth, MUST has only paid its manager performance fees once since its IPO in 2019.

On April 12, MUST’s manager announced it was divesting a property in Oregon for US$33.5 million to its sponsor and that the divestment fee has been waived. The property was acquired in 2021. MUST will make a small loss of US$0.4 million on the divestment but the divestment has stymied the decline in MUST’s unit price.

Undervalued or value traps?

How then do we spot a value trap? Whatever the type of asset, a couple of points stand out when avoiding value traps. Firstly, look at debt and Debt/Equity or the D/E ratio; secondly, look at the ability to generate sufficient cash flow to cover interest cost; thirdly, the interest rate cycle needs to be monitored closely as higher interest rates tend to stress highly-geared developers and, more importantly, REITs; and lastly, watch the market and business cycles.

There is a fine line between value traps and undervalued stocks and like valuation, its calculation is an art more than a science. Ideally, D/Es should be as low as possible, at around 50%; ICRs should be as high as possible just in case market conditions turn adverse. Low D/Es and high ICRs would leave the developer or REIT with a comfortable margin.

Perhaps, REITs should take a page out of the credit analysis done by banks when they evaluate their customers. Banks stress-test their customers’ cash flows and ICRs under various scenarios. This would include inflation, higher for longer interest rates, and under what is termed macroeconomic variable (MEV) models. A couple of years ago, banks were required to stress-test their mortgage books against interest costs of 4%. During the ultra-low interest rate environment between 2018 and 2021, banks used mortgage rates of 3% to check the viability of their customers’ mortgage repayments.

For identifying stocks, the starting point for most retail investors is likely to be D/E, followed by ICR, then D/E under various stress scenarios which could include, for instance, lower E because of losses impacting retained earnings. As for aggregate leverage, most financial covenants have LTVs at 40%–50% but they could rise if valuations fall — as they have done for some developers and REITs. It is therefore always sensible to keep a buffer. Developers have buffers because they do not pay out all their earnings and can grow retained earnings even during periods of stress.

Separately, ICRs in most loan covenants are at the 1.5x to 1.75x level. The Monetary Authority of Singapore requires REITs to have a floor of 2.5x for their ICRs if these REITs want to raise their LTVs — which are the equivalent of aggregate leverage — to 50%. REIT managers need to be cognisant that valuations can fall in times of rising interest rates. This is because the discount rates used in valuations also rise, requiring cash flows to rise further to compensate for higher discount rates, failing which valuations fall.

In the following pages, The Edge Singapore has picked a basket of 10 real estate stocks. The stocks in our list have stress-tested valuations. That is, the properties are discounted for occupancy based on major tenant exposure, including the top three tenants. How would the assets do without the top three tenants? The more tenants a property has, the less risk. We have also adjusted for shorter WALEs (weighted average lease expiries) and volatility of net property income (NPI). In addition, we have our usual “Big REIT table” so readers can compare the current LTVs, ICRs and D/E of each REIT as well.

Disclaimer: This company is for information purposes only and does not constitute a recommendation or solicitation or expression of views to influence readers to buy or sell stocks, including the stocks mentioned herein. This stock does not take into account the investor’s financial situation, investment objectives, investment horizon, risk profile, risk tolerance and preferences. Any personal investments should be done at the investor’s own discretion and/ or after consulting licensed investment professionals, at their own risk.

See the 10 stocks below:

- Alexandria Real Estate Equities: REIT with stable distributions and unique proposition

- Deutsche Konsum REIT: Insulated from market downturns

- Digital Core REIT: Undervalued despite vacancy threats

- Globalworth Real Estate Investments: Banking on real estate in Romania and Poland

- Hongkong Land: Undervalued Hong Kong developer with prime assets

- Midea Real Estate Holding: Sound metrics riding on industry turnaround

- Onewo: Property manager with loads of cash and a unique business

- Residential Secure Income: REIT with defensive UK portfolio, scale and valuation

- S-Enjoy Service Group Co: Real estate services firm seen to ride China's recovery

- UMH Properties: Owner of manufactured home communities offers stable yields