In a Sept 8 report by Reuters, Intel announced it could invest as much as 80 billion euros ($123.85 billion) in Europe over the next decade to boost the region’s chip capacity and will open up its semiconductor plant in Ireland for automakers. Intel CEO Pat Gelsinger also said the company will announce the locations of two major new European chip fabrication plants by the end of the year. Reuters said there is speculation about possible production sites, with Germany and France seen as leading contenders, while Poland, where Intel also has a presence, is also in the picture. In October, Intel announced it is spending US$20 billion this year, including expenditure to be incurred for a new plant in Arizona. Most recently, on Dec 13, Intel announced it is spending US$7 billion to build a new plant in Penang, where it already has a significant presence for years.

“Industry players are responding to this (the chip shortage) by building capacity, driving yields and supply as rapidly as possible,” said Gelsinger on Dec 16. “Overall, the semiconductor industry this year will grow more than it has in the last two to three decades,” he told a press conference in Malaysia.

Intel’s aggressive spending is deemed necessary for it to boost its production capabilities so as to regain its lead as the industry leader. The downside, at least in the near term, will be lower profit margins. The company’s own estimate of gross margins of 51% to 53% in the coming few years is up to five percentage points off what analysts have been expecting.

“We have a couple of years to work through, but this is going to be a great outcome,” says Gelsinger at the company’s recent earnings call. “We think all of our aggressive lean-ins right now are going to be handsomely rewarded in the marketplace.”

See also: SoftBank seeks record loan of up to US$40 bil for OpenAI stake — Bloomberg

Meanwhile, TSMC also reported in July that it has plans to build new factories in the US and Japan, after previously announcing it will spend US$100 billion over the next three years to expand chip fabrication capabilities.

TSMC added it will expand production capacity in China and does not rule out the possibility of a “second phase” expansion at its US$12 billion factory in the US state of Arizona.

TSMC is one of the two largest fabricators of the global semiconductor chip supply, along with South Korea’s Samsung. The two companies together control about 80% of the global market share in foundries.

See also: StanChart unveils US$1.5 bil share buyback as profit misses

With TSMC promising all the capacity expansion, Samsung is not sitting still. Its so-called components business, which consists largely of semiconductors, contributed three-quarters of the company’s operating profit for the quarter ended Sept 30, or around US$13.4 billion.

The relative underperformance of the mobile and consumer electronics units was seen as the reason for the company to announce on Dec 7 a re-organisation to merge these two as one for more agile decision-making, while leaving the components business intact.

Samsung, meanwhile, has its own aggressive capex plans. On Nov 24, it announced it is spending US$17 billion to build new facilities and improve existing ones in the US, bringing its total commitment to more than US$47 billion since Samsung set up operations in the US since 1978.

But given that factories take time to build, and production takes time to come online, even if companies promise all this capacity, the million-dollar question may be: When will the chips shortage be over?

In a Nov 19 CNBC interview, JPMorgan said it expects the chip shortage to last into 2022, but that the situation should resolve itself by 2023. “We are not expecting 2023 to be in supply shortage,” Gokul Hariharan, co-head of Asia-Pacific technology, media and telecom research at JPMorgan, says.

Hariharan says things could improve in the second half of the year as more supplies come online, but the first six months could still see “pockets of shortage” across the industry.

“There is capacity coming online, not just from the foundry companies, but also from the [integrated device manufacturer] companies. All the US and European IDMs are also expanding their capacity — a lot of it is slated to come online from the middle of next year onwards,” he adds.

GlobalFoundries: Too late to the game?

Sink your teeth into in-depth insights from our contributors, and dive into financial and economic trends

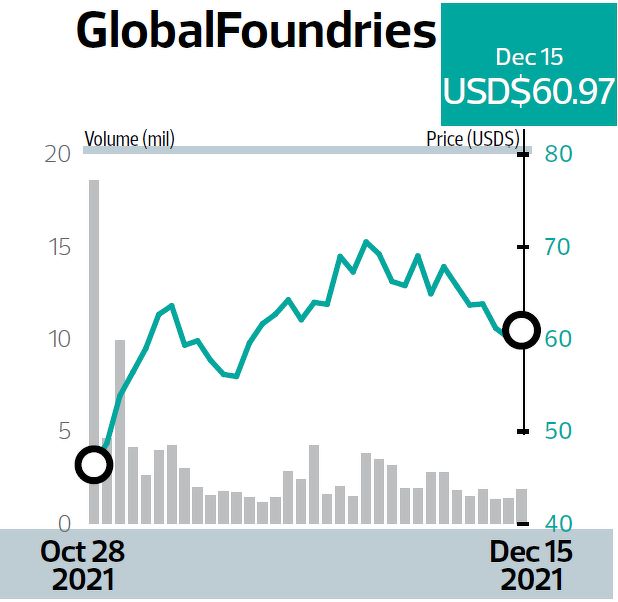

Another player that has stepped into the limelight is GlobalFoundries, which debuted on the Nasdaq on Oct 28 with a market value of over US$25 billion.

In June, the company also announced that it will invest US$4 billion to build a new wafer fabrication plant in its Woodlands campus, which will mark its first expansion in Singapore in over 10 years.

But unlike the big players, GlobalFoundries — which was formed via a combination of other chip-making businesses including Singapore government-linked Chartered Semiconductor Manufacturing — is not competing on manufacturing the most advanced chips, such as those used in smartphones and laptops.

Instead, since 2018, it has been focusing on making less advanced but less costly older generation chips, which are used in applications like displays, radio communications and power regulators.

“The industry has painted itself into a corner by focusing on single-digit nanometre,” says CEO Tom Caulfield, arguing that there is good business to be made by not chasing after the cutting edge. “Today, we have cars sitting in a parking lot missing chips made on 45nm or 65nm.”

While some may think that a rising tide lifts all ships, Tim Culpan in an Oct 5 Bloomberg article takes aim at GlobalFoundries, saying that even with manufacturing lead-times blowing out to a record 21 weeks and prices being pushed upwards — clear signs that demand outstrips supply — the company still cannot manage to make a profit.

GlobalFoundries, before its IPO, did not turn a profit in the last three years, reporting sales of US$4.85 billion and a loss of US$1.35 billion in 2020. Revenue came in at US$5.81 billion and losses were at US$1.37 billion in 2019, but that was an improvement from a loss of US$2.77 billion, with revenue of US$6.2 billion, in 2018. In the first six months of 2021, the company recorded a loss of US$301 million, compared to US$534 million in the same period a year earlier.

Bloomberg’s Culpan says that “peaks and troughs are a natural aspect of this industry... [But] this time, we are seeing a super-cycle spurred by faster telecommunications networks, cloud computing and streaming content, and electronically equipped cars… But even then, it [GlobalFoundries] still posted a US$198 million operating loss [in the first six months of 2021]”.

“Seasonality, industry overcapacity, reductions in demand, and declines in average prices are all outlined in its filing under ‘risk factors’. If you want a playbook for how to lose money in a chip boom, just read GlobalFoundries’ prospectus,” writes Culpan. “And if it does manage to pop its head above water, keeping it there may be a struggle.”

Clearly, investors did not seem bothered. GlobalFoundries’ IPO was priced at US$47 per share. It started trading in late October, and closed on Dec 15 at US$60.97.

Clearly, investors did not seem bothered. GlobalFoundries’ IPO was priced at US$47 per share. It started trading in late October, and closed on Dec 15 at US$60.97.

Local stocks ride the demand wave

While Singapore may not have a TSMC, Samsung or Intel to call its own, the Republic does have companies that investors can invest in, so as to ride this growing demand for semiconductors.

Companies like AEM Holdings, UMS Holdings and Frencken Group all service customers that require the use of these precision-made pieces of silicon. For example, AEM is understood to be the test-handler for Intel, and UMS makes semiconductor tools and counts Applied Materials to be its biggest customer. Frencken Group also makes semiconductor equipment, and services clients like ASML, Siemens and Philips.

Clearly, investors and analysts have taken a liking to these companies, as seen by their share price growth and optimistic reports.

AEM has seen its share price jump from $3.45 at the beginning of the year to $5.14 as of Dec 15, a 32.9% gain YTD, while UMS also saw a similar surge from 86.4 cents at the start of 2021 to $1.47 at Dec 15, a 41.2% climb. Frencken, while recording a lower increase, still saw a jump from $1.32 from Jan 1 to $1.92 as at Dec 15.

Maybank Kim Eng analyst Lai Gene Lih is positive on the overall sector, although he reminds investors to be “selective” in a Dec 1 report. He has given most companies in the sector, like AEM, UMS and Frencken, a “buy” rating. However, he has a “hold” rating for Venture Corp, and a “sell” for Valuetronics.

Noting the supply-side bottlenecks as a major constraint, Lai explains that he prefers AEM, UMS and Frencken for exposure as they are believed to face less supply-side bottlenecks than downstream players.

And even though these companies are not semiconductor manufacturers per se, Lai sees no shortage in demand for their products or services. If AEM can sustain 3QFY2021-4QFY2021 quarterly revenue run rate in FY2022, this infers a revenue of about $700 million-$800 million, he estimates. “Over FY2022-2023, we believe upside drivers include Intel’s expansion plans in Penang and Costa Rica, as well as the node migration to Intel 4 in 2HFY2022,” he adds.

Lai goes on to say that in his view, UMS’ revenue upside can be unlocked if it is able to beef up its workforce sufficiently, on the back of robust demand outlook, and Frencken and Venture’s analytical and medical customers remain upbeat about FY2022 prospects.

He also forecasts that the chip shortage will last well into the second half of 2022, but expects companies like UMS and Venture to be sequentially stronger in 4QFY2021, as they have resumed full workforce production since late 3QFY2021.

With vaccinations, he is more optimistic about the easing of labour bottlenecks than components, as many chipmakers expect shortages to last into 2H2022 before easing in 2023. The key risk to this view is if the Omicron variant results in the re-introduction of worker production limits and/or continues to limit worker immigration.

For the entire sector, Lai says the impact of Omicron towards supply chains and earnings is a risk that he is monitoring.

While he has a “hold” call on Venture, he thinks the company is one to watch when the shortages ease. “Venture reiterated that the demand outlook is strong but the key impediment remains chip shortages. Inventory has been creeping up, which we believe comprises so-called “work-in-progress” (WIP) goods, as well as buffer stock.”

He explains that alleviation of components shortages may help Venture speed up the rate of completing WIP products and translate into earnings upside.

Other analysts are also equally optimistic about these stocks. In a Nov 15 report, DBS analysts Ling Lee Keng and Chung Wei Le maintained their “buy” call and raised their target price on AEM from $4.90 to $6.04, saying that Intel, as AEM’s key customer, is ready to commit significant investments to ensure that it is at the forefront of the growing semicon industry. As such, they believe that this will translate into higher revenues for AEM.

For UMS, UOB Kay Hian notes that while Covid-19 restrictions in its Malaysian factories affected production from August to October, it was able to utilise the production capacity of subsidiary JEP to mitigate the shortfall.

The company is also positioning itself to capture the “acceleration of global chip demand and sustained strong growth in capex investments by global foundries”, according to UOB Kay Hian.

To take advantage of the secular upturn, UMS expects to increase production capacity at its new Penang site, which is scheduled for completion in 3QFY2022. Initial production will ramp-up in 2HFY2022, and full production will come on-stream from 2023 onwards.

Be it local or international, analysts from around the world will try to gaze into their crystal balls to discern just how this shortage will play out. But, just like the California Gold Rush, not everyone will strike gold in the sector. The more established and entrenched companies seem to be the biggest winners, while those who are late to the game just might get squeezed out.