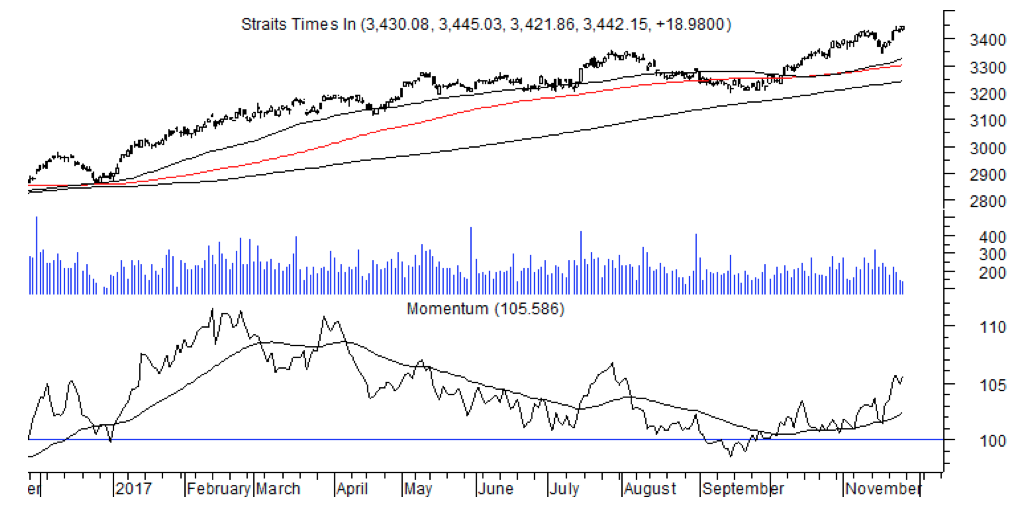

Straits Times Index (daily)

The STI (3,442) rose by around 100 points during the past week, after falling to a level slightly below support at 3,350. An earlier break above this level indicated a target of 3,500, which remains on track. The retreat has helped to establish support at 3,340.

Although the STI has recovered, its chart structure continues to look “corrective”. This is confirmed by ADX which continues to fall. A falling ADX implies a sideways trend. Elsewhere, short term stochastics is falling and is in mid-range. The 21-day RSI rebounded but its trend is still downward.

Quarterly momentum looks healthy as its recovery phase remains intact. The long-term annual and 24-month momentum are also intact as are the moving averages.These indicators reconfirm the STI’s uptrend and upside target of 3,500.

See also: Singapore assets remain a safe haven as volatility engulfs bitcoin and gold

Midas Holdings (14.8 cents) short term oversold

This counter started the week at 19.6 cents, and ended it at 14.8 cents, for a loss of 24%. On Friday Nov 24, the counter formed a hammer on the candlestick chart on very high volume. This suggests that there could have been a selling climax during Friday’s session, given that price fell to an intra-day low of 13.5 cents, but recovered to close not too far below the opening price of 15 cents.

The 21-day RSI is at 23, its lowest level in three years. Quarterly momentum is also at its lowest level in this time period. These oversold levels should help to trigger a temporary rebound. Overall though, annual momentum is weak, and the rebound may not be able to get prices back to 19.6 cents in a hurry.

See also: Roundophobia could set in as STI approaches 5,000 but uptrend should stay intact

Singapore Press Holdings ($2.72) prices stabilise

Prices are still weak, but they appear to have stabilised, and are attempting to hold above the 50-day moving average at $2.70. In turn the 50-day moving average has turned up marginally, from $2.69 to $2.70. Further confirmation of stabilisation is still required and any recovery is not going to be immediate.

ADX is still falling, and is at 13, a three year low, The DIs are neutral. If ADX turns up while the DIs remain neutral, prices should be able to rebound. If so, the $2.69-$2.70 level would be established as support. The 100-day moving average, currently at $2.78, will be the next milestone if prices are able to rebound.