Twitter is his go-to tool to disparage people he does not like, from rival politicians to his own cabinet ministers and ambassadors, businesses, actors, teenagers, the man on the street and even foreign leaders.

More importantly, he is the first US president to use social media to push policies instead of announcing them through official channels. Often, his blow-by-blow progress reports on ongoing policy deliberations (such as complex trade negotiations) create short-term volatility for prices of specific stocks and financial markets.

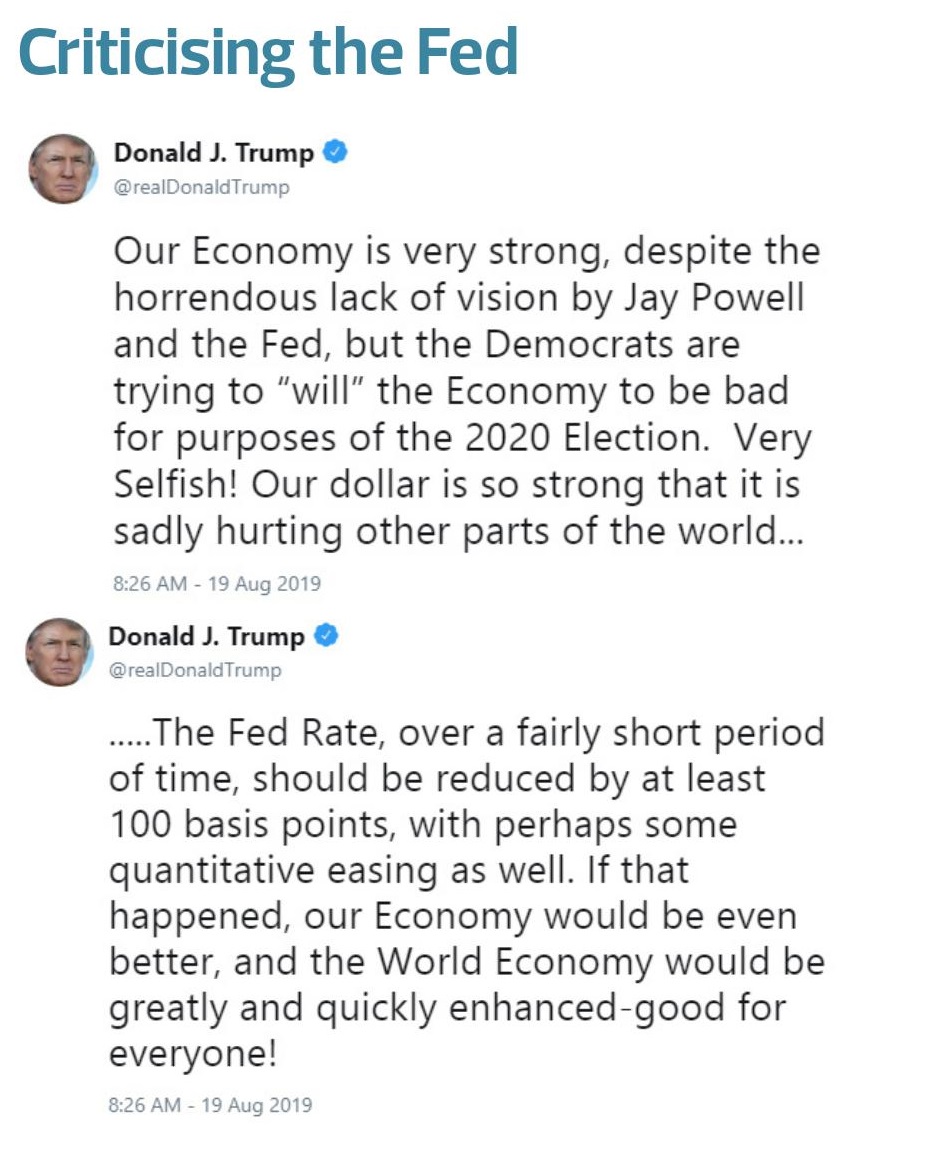

His frequent criticism of the US Federal Reserve chairman is widely seen as attempts to shape monetary policy, which should be the exclusive purview of the central bank. A study conducted by researchers at Duke University and London Business School (published in September 2019) presented market-based evidence of this — it proved a “statistically significant and negative” correlation between Trump’s Fed-related tweets and market expectations for interest rates (see tweets below).

His frequent criticism of the US Federal Reserve chairman is widely seen as attempts to shape monetary policy, which should be the exclusive purview of the central bank. A study conducted by researchers at Duke University and London Business School (published in September 2019) presented market-based evidence of this — it proved a “statistically significant and negative” correlation between Trump’s Fed-related tweets and market expectations for interest rates (see tweets below).

His tweets on China and trade, in particular, have sent stock prices surging or tumbling on more than one occasion (see chart below). For instance, his threats/actual announcements for tariffs on China in March 2018 (1), May 2019 (6) and August 2019 (8 and 9) sent the market broadly lower. These are typically followed by tweets where he clearly intents to talk the market back up.

And investors and traders have taken note. JPMorgan Chase & Co tracks the effect of Trump’s tweets on financial market movements with its “Volfefe Index”. According to the bank, “We find strong evidence that tweets have increasingly moved US rates markets immediately after publication.”

To be sure, there are many other more fundamental reasons underpinning financial market movements. But we would bet that more than a few smart traders have profited by trading on the short-term volatility generated by Trump’s tweets.

Indeed, we too have made good predictions on the “positivity” or “negativity” of his next tweet over the past year. It is no secret that Trump watches the stock market movements closely and credits himself for its success.

Case in point, he made 56 direct references to how well the stock market was doing in the past year alone. Put it another way, he reminded us of this fact at least once every week, on average. That is why we are almost certain that he will follow a market-negative tweet with one that would send prices higher anew. There were even instances when he allegedly tweeted fake news to bolster market confidence.

Case in point, he made 56 direct references to how well the stock market was doing in the past year alone. Put it another way, he reminded us of this fact at least once every week, on average. That is why we are almost certain that he will follow a market-negative tweet with one that would send prices higher anew. There were even instances when he allegedly tweeted fake news to bolster market confidence.

Better yet, imagine if one knew hours ahead what Trump will tweet.

Why are we writing this piece? His tweets work and he wants the US stock market to go up, whether via trade agreements, monetary policies, or other means. This is one reason why our portfolio is US-centric presently. Given that this is an election year, he is going to do everything possible to sustain the US market rally.

Wall Street started the new year with a bang, with the Dow Jones Industrial Average gaining 330 points on the first trading day of 2020. But the flare-up in geopolitical tension between the US and Iran — after the US killed a key commander of the elite Islamic Revolutionary Guard Corps — then sent stocks tumbling around the world. Stocks are rebounding now that tensions have calmed somewhat. All three main US indices are still up for the year to date.

At this point, we believe there is no reason to panic. There is low probability of an all-out war. Volatility will rise. But the fallout should be limited and will not derail the US economic expansion or tip the world into recession.

Crude oil price rose in a knee-jerk react ion but has since fallen back to below US$66 per barrel — right around where it was trading before the flare-up. Unless prices are sustained at much higher levels, inflationary pressure would be limited. This will, in turn, allow global monetary policies to stay accommodative. Major central banks are still printing money and adding to liquidity.

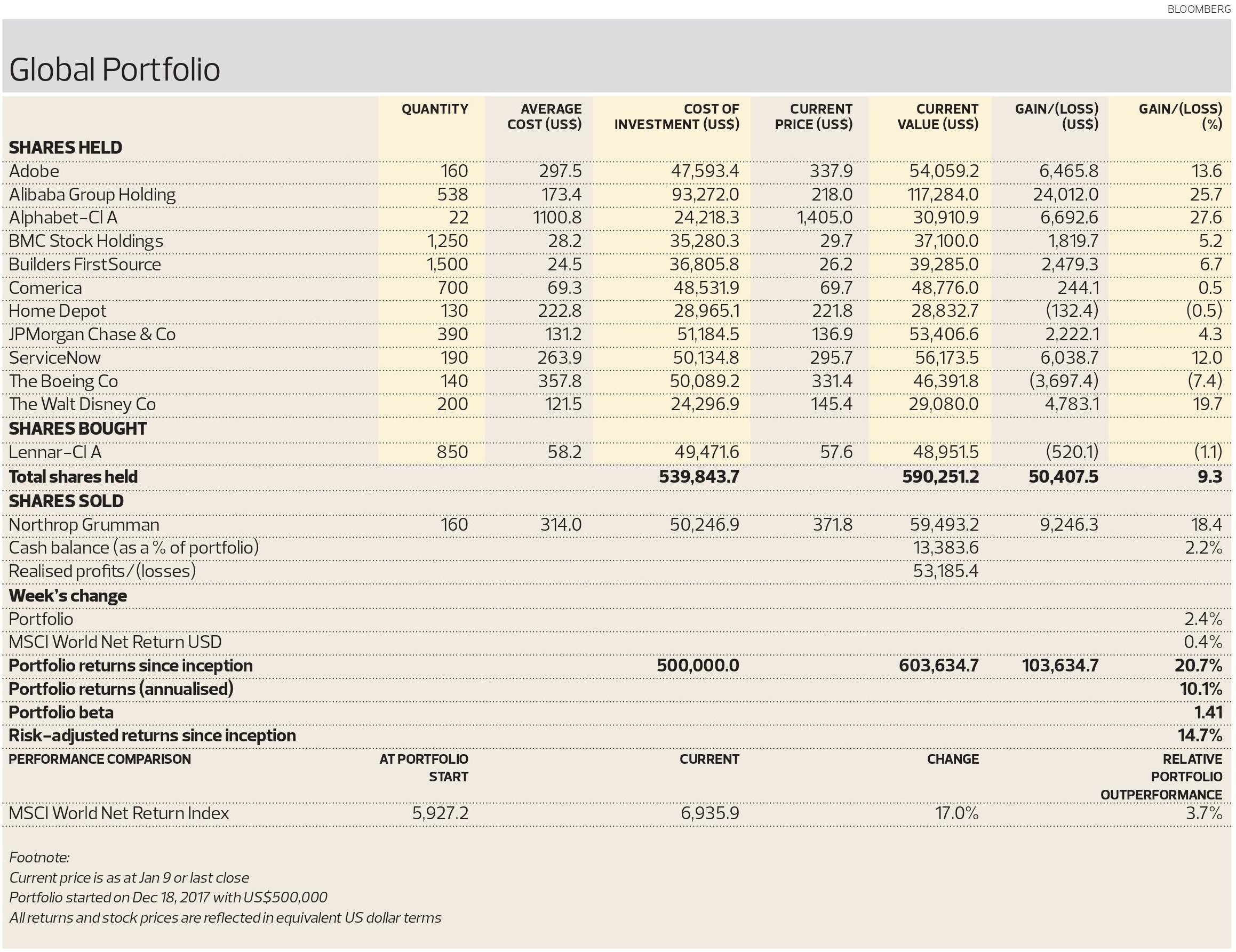

The best-performing stock in our portfolio last week was, unsurprisingly, Northrop Grumman. Defence stocks rose strongly on the back of the heightened geopolitical tensions.

We capitalised on Northrop Grumman’s price surge and locked in an 18.4% gain on the stock. In its place, we acquired a homebuilder, Lennar Corp. Most of our stocks ended higher for the week, save for Comerica (-2.9%) and JPMorgan (-1.8%).

The Global Portfolio is up 2.4%, compared with the 0.4% gain for the MSCI World Net Return Index. Last week’s gains lifted total portfolio returns to 20.7% since inception. The portfolio continues to outperform the benchmark index, which is up 17.0% over the same period.

The Global Portfolio is up 2.4%, compared with the 0.4% gain for the MSCI World Net Return Index. Last week’s gains lifted total portfolio returns to 20.7% since inception. The portfolio continues to outperform the benchmark index, which is up 17.0% over the same period.

Tong Kooi Ong is the chairman of The Edge Media Group, which owns The Edge Singapore.

Disclaimer: This is a personal portfolio for information purposes only and does not constitute a recommendation or solicitation or expression of views to influence readers to buy/sell stocks, including the particular stocks mentioned herein. It does not take into account an individual investor’s particular financial situation, investment objectives, investment horizon, risk profile and/or risk preference. Our shareholders, directors and employees may have positions in or may be materially interested in any of the stocks. We may also have or have had dealings with or may provide or have provided content services to the companies mentioned in the reports.