I believe this has much to do with our improved exports and outlook, and in particular Bank Negara’s new ruling (announced in December), which mandates that at least 75% of all export proceeds to be converted into the local currency.

Prior to this, many exporters kept their sales in US dollars, either onshore (in foreign currency accounts) or offshore. There are reasons for this, such as to pay for future imports of raw material, intermediate goods and capital equipment, as well as to repay foreign currency loans – and perhaps also on speculations that the longer-term downtrend of the ringgit will persist.

The result has been stagnant forex reserves for the country despite its running trade surpluses year in, year out.

The positive impact of this forced conversion of export earnings on the ringgit is clearly evident, particularly at the initial stages.

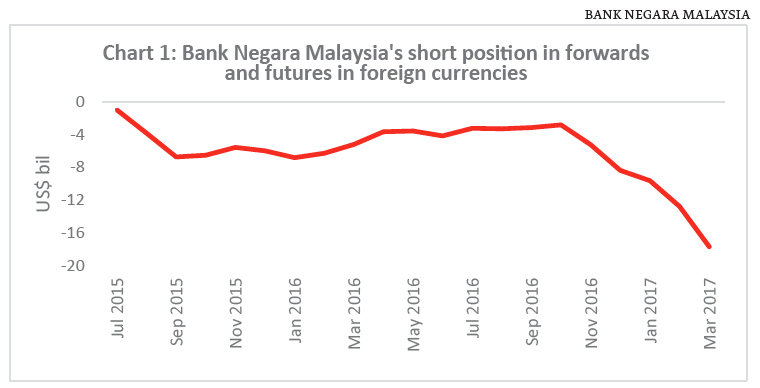

I believe the sharp rise in Bank Negara’s short-term US dollar borrowings (in the form of currency swaps) is, at least in part, the central bank’s way of managing the surge in ringgit demand.

Bank Negara’s outstanding short position hit an all-time high of nearly US$18 billion ($25 billion) at end-March (see Chart 1).

It is likely that exporters may also be selling forward their future US dollar earnings (as conversion is now required by law) given the prevailing expectations of greenback weakness in the near term. This adds to demand for the ringgit.

The strong demand for ringgit is driving its appreciation against the US dollar.

Whilst it is true the greenback has weakened against most currencies in recent weeks, we’ve also outperformed our neighbours.

Chart 2 shows the ringgit outperforming the Singapore dollar when benchmarked against the US dollar.

To continue reading,

Sign in to access this Premium article.

Subscription entitlements:

Less than $9 per month

3 Simultaneous logins across all devices

Unlimited access to latest and premium articles

Bonus unlimited access to online articles and virtual newspaper on The Edge Malaysia (single login)

Related Stories

- Outlook for the ringgit: Between structural drag and cyclical relief

- A stronger currency should come from gains in relative competitiveness, not higher interest rate differentials

- Ringgit can strengthen near term but are we addressing the secular decline?