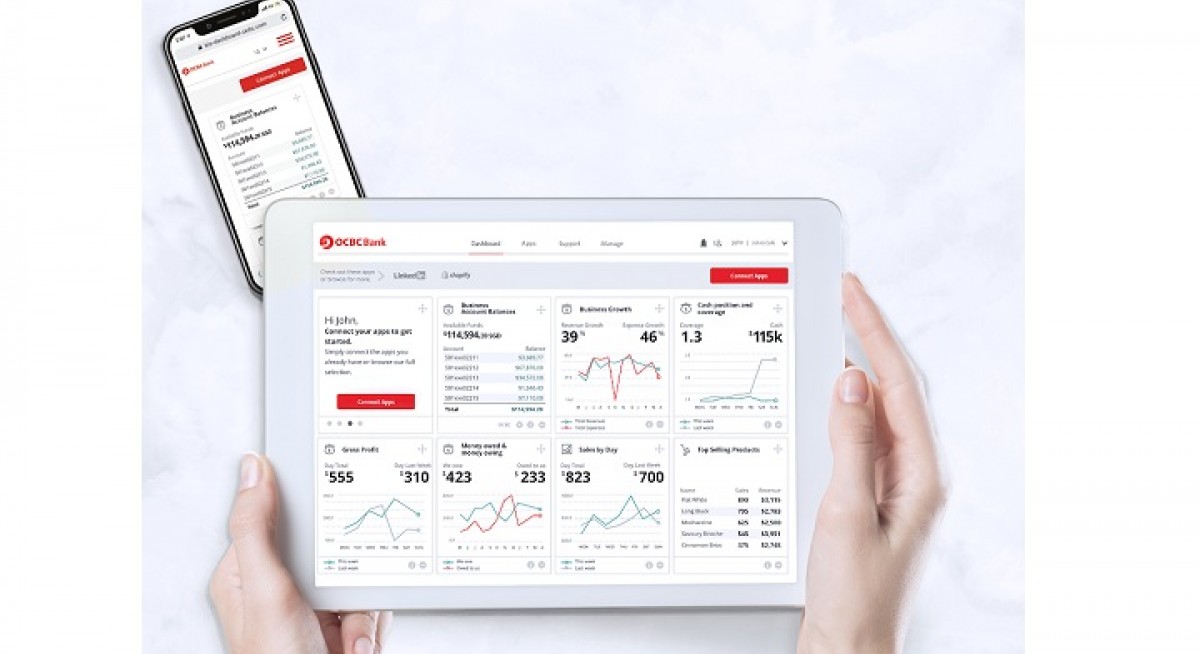

Currently, OCBC Bank has integrated more than 40 business apps, where costs range from nothing to approximately US$200 ($270.63) per month, onto its new web-browser based platform.

This also includes the bank’s digital banking platform, Velocity@ocbc.

In a press release on Monday, OCBC Bank says having the dashboard will enable business owners to see key information on all aspects of its business in one place.

It further breaks down information silos within the organisation and empowers business owners to make more informed decisions such as by monitoring email marketing campaigns and analysing the same campaigns effectiveness with different online tools more easily, and at once.

See also: Namibia orders Elon Musk's Starlink to cease all operations in the country

Currently, the new dashboard is free for all OCBC SME customers, who also have the option of signing up for any two out of four apps – namely Xero, MailChimp, Shopify and Quickbooks – free exclusively through the dashboard over the first 12 months.

According to the bank, these four apps have strong customer endorsement and are well-suited to accelerating the digital transformation journey of SMEs.

“Running a business requires owners and managers to keep track of many aspects – sales, inventory, human resources and banking. Knowing this, we developed the dashboard so that SMEs can get a holistic view of the business. We anticipate that this will become a ‘command centre’ for them – something that they will keep accessing every day – as it provides real, actionable insights in one place,” comments Melvyn Low, head of Global Transaction Banking, OCBC Bank.

“This dashboard is part of OCBC’s effort to go beyond banking in order to build an ecosystem that SMEs can tap on to fulfil their growth ambitions,” he adds.