In FY2022, Jubilee incurred a loss of $2.2 million against a loss of $1.6 million in FY2021, arising from a fair valuation gain of $2.7 million netted off by losses on partial disposal and deemed disposal of its investments in shares of EG Industries amounting to $4.3 million.

This brings its FY2022 net loss to $3.8 million.

Loss per share stood at 1.44 cents and 1.26 cents for 2HFY2022 and FY2022 respectively, compared to loss per share of 0.80 cents and 0.72 cents for 2HFY2021 and FY2021 respectively.

Jubilee recorded revenue of $115 million for 2HFY2022, an 32.4% growth compared to the $87.4 million recorded in 2HFY2021.

See also: Zixin 1HFY2026 earnings double to RMB16.06 million

For FY2022, the company recorded revenue of $231 million, an 59.3% or $86 million increase from $145 million recorded in the same period last year.

Revenue for its Mechanical Business Unit (MBU) increased by $5.3 million to $30.4 million for FY2022. This was due to higher sales of consumer and construction products, as well as tool fabrication across the company’s manufacturing operations in Malaysia and Indonesia.

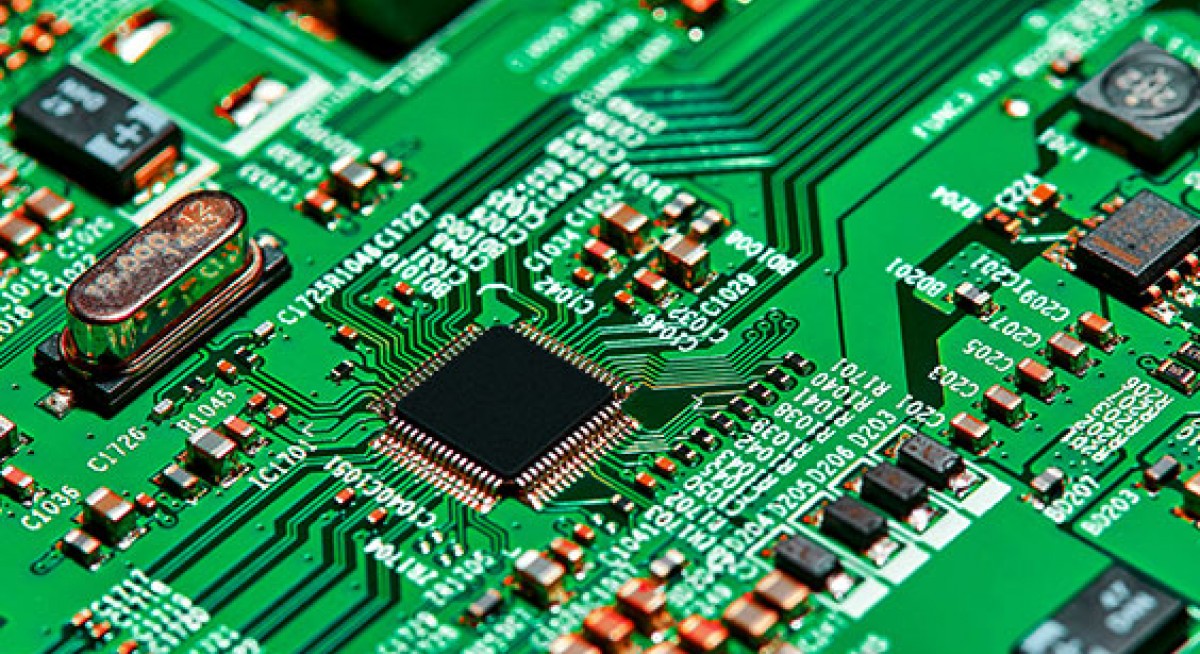

Amidst higher global demand for semiconductors, particularly in Jubilee’s key market of China, revenue for its Electronics Business Unit (EBU) increased to $200.7 million for FY2022.

See also: OCBC 1HFY2025 net profit falls 6% y-o-y to $3.7 bil

“The ongoing global chip shortage and supply chain disruptions have led to a rush to stockpile high demand chips amidst limited factory capacity and longer lead times. These circumstances continue to benefit the EBU given its extensive product portfolio and strong presence across Asia,” the company said.

The MBU’s gross profit was flat at $2.2 million for FY2022 while the EBU’s gross profit increased by $1.1 million to $6.4 million.

Overall, Jubilee recorded a 15.9% increase in gross profit from $7.5 million for FY2021 to $8.7 million in FY2022.

Jubilee’s executive chairman and CEO Datuk Terence Tea said the company expects to face continued headwinds including rising logistics and raw material costs, as well as continued lockdowns in its key market of China. “The company’s MBU has embarked on several initiatives to better manage cost and operational efficiency to mitigate higher raw material cost.”

Shares in Jubilee closed flat on May 30 at 4.2 cents.