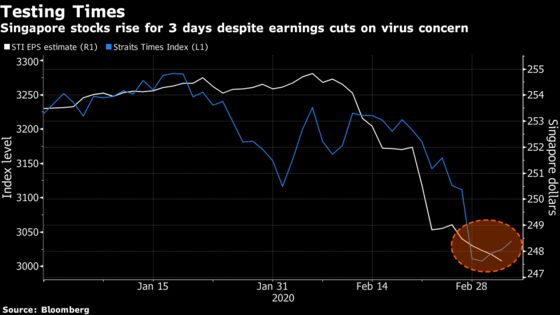

“Covid-19 could drive earnings contraction in 2020” compared with consensus expectations for 2.9% growth, Credit Suisse analysts Gerald Wong and Kwee Hong Ching wrote in a note dated Wednesday. Analyst estimate cuts so far factor in a virus impact of one quarter but “we expect further earnings cuts to come” due to weakness in tourism and a negative impact from Federal Reserve rate cuts, the analysts said.

Deaths from the illness surpassed 3,000 in China on Thursday, while California has called a state of emergency, underscoring the global spread. The world’s biggest economies have started delivering fiscal stimulus and rate cuts to counter the outbreak.

Singapore is seen as a model for virus containment thanks to its top-notch health system, strict tracking and prevention measures, plus a small population that’s largely accepting of government orders. Its government last month unveiled its most expansionary budget since at least 1997 to shore up the economy amid a lowered growth outlook.

The city-state’s Straits Times Index has fallen 5.8% so far this year compared with a drop of 11% for the MSCI Asean Index. The consensus estimate for 12-month forward earnings for companies in the Singapore equity benchmark has fallen 2.3% compared with a drop of 5.9% for those in MSCI’s broadest gauge of Southeast Asian stocks.

The city-state’s Straits Times Index has fallen 5.8% so far this year compared with a drop of 11% for the MSCI Asean Index. The consensus estimate for 12-month forward earnings for companies in the Singapore equity benchmark has fallen 2.3% compared with a drop of 5.9% for those in MSCI’s broadest gauge of Southeast Asian stocks.

Like Credit Suisse, Citigroup also warns of the impact from the coronavirus, with estimates generally assuming a “large one quarter hit thus far” for Singapore firms. The investment bank has received investor queries about whether the degree of earnings downgrades has beens adequate, analyst Patrick Yau wrote in a Tuesday note.

Even if estimates are cut further, however, the total downgrade may still be smaller than the 13% reduction due to SARS in 2003, Credit Suisse said.

“This is driven largely by our expectation of a resilient residential property market, which should limit earnings downside risks for the developers and banks,” the firm’s analysts wrote.