Many asset managers are shifting toward making sustainability criteria an essential part of their strategies. Challenges abound even without the issues posed by inconsistent global definitions. Disagreements about responsible investing recently led to a walkout of 11 people at NN Investment Partners, a US$313 billion Dutch fund manager.

“Capital needs to reach where it’s actually needed,” Stanislas Pottier, chief responsible investment officer at Amundi Asset Management, said on the sidelines of a conference in Singapore last week. Big money managers sometimes face difficulties investing in emerging-market assets due to “strict risk profile constraints, a lack of standard definition of green, inadequate data and disclosures.”

Unlocking a potentially huge pool of available capital would allow emerging economies, many of which are in Asia, to access funds for developing hospitals, roads and schools as well as for moving toward more environmentally friendly sources of energy.

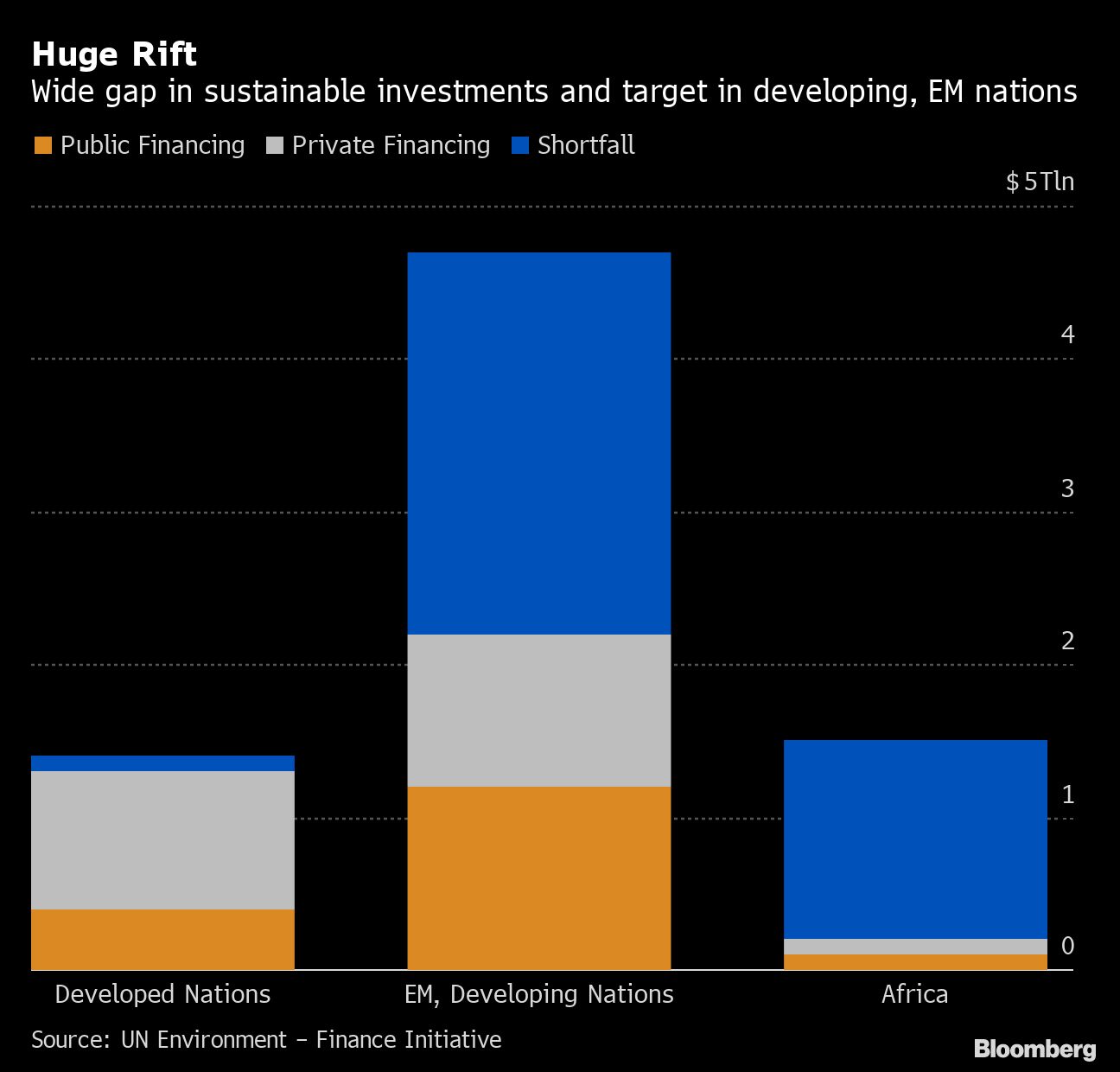

“The problem is this capital is unable to make its way to the emerging markets mainly because of definitions, data and, most importantly, the mismatch of investment need,” said Daniel Klier, head of sustainable finance at HSBC Holdings Plc, the biggest underwriter of green, social and sustainability bonds this year. “About two-thirds of the investments needed every year need to go to emerging markets, but we are only doing around 20%.”

To ease choked-up fund flows, many market participants say that so-called transition bonds can help develop responsible investing, particularly in Asia. This type of debt would allow companies shifting toward cleaner energy to access capital, and provide a broader range of potential investments.

Transition bonds essentially provide a stepping-stone for issuers that might not be ready to sell green or sustainable debt yet.

“We have long-term global pension money and need to facilitate its flow into emerging markets through new instruments that support sustainable goals,” said Geraldine Buckingham, head of the Asia-Pacific region at BlackRock. “We need regulators to collaborate globally as this is a global challenge. They are bridging the gap left by other stakeholders who may not factor in the long-term impact of these challenges.”