SEE: Why it might be a good time to invest in the US stock market following the Presidential elections

Next generation investors Tiger Brokers has so far seen a surge of new investors worldwide, especially among the young. The brokerage has three times more account openings in 3Q2020 as compared to 2Q2020, with more than 80% of new users under 45 years old. Generation Z, which comprises those aged between 18 to 24 years old, made up of around 15% of the company’s current one million customers worldwide. According to Tiger Brokers, 45% of Generation Z investors prefer long-term stocks like Apple, Boeing and Carnival while 35% are invested in REITs and ETFs across the US, Hong Kong and Singapore. Another 10% of Generation Z investors have sunk their money into high-volatility stocks such as Afterpay, Kodak and Vaccinex, while another 10% are invested in options. In Singapore, Generation Z makes up 30% of Tiger Brokers’ customers, following the launch of the Tiger Trade app in February. For 3Q2020, the most traded stocks by Generation Z here were Tesla, Apple, NIO and Medtech International. Despite the easy access to overseas markets, Eng says investors here generally tend to focus on the local stock market. Singapore Airlines, he notes, has been an actively traded stock in the last few months amid signs of an earlier recovery in the aviation industry. Real estate investment trusts and exchange traded funds are also popular among investors given the financial and economic uncertainty, he says.

Addressing pain points

Eng says Tiger Brokers was founded in 2014 to address certain pain points faced by its founder, director and CEO Wu Tian Hua. The latter was previously an engineer working for a multinational corporation in China. When he was given share options in the company, Wu found the process of opening a trading account to be tedious.

There were other inconveniences, too. Back then, many Chinese brokerages offered online trading platforms to investors to perform their trades. But none of them provided a mobile trading platform. Moreover, the fees to trade shares in foreign markets like the US were expensive. “So that’s when he actually started Tiger Brokers in China,” explains Eng. “He believes that investing should be more friendly and approachable by using a trading app such as Tiger Brokers.”

Tiger Brokers then saw an opportunity to expand into Southeast Asia. According to Eng, Wu saw similar pain points experienced by investors in the region. And so, Tiger Brokers set up operations in Singapore two years ago. Last year, it secured the Capital Markets Services license from the Monetary Authority of Singapore, potentially broadening the range of services it can offer here.

While Tiger Brokers may be a relatively young player in the online brokerage arena, Eng says the brokerage is backed by prominent investors. These financial backers are Chinese technology giant Xiaomi Corp, US-based Interactive Brokers and investment guru Jim Rogers, who in recent years has become a prominent investor in Asia.

But since Interactive Brokers itself is an online brokerage, would it not compete for customers with Tiger Brokers? Eng does not see this as a problem. “I think the market is big enough,” he says. “Everyone is offering a similar product. But it is how you differentiate yourself. Most importantly, we are able to achieve our vision and serve our customers.”

Addressing pain points

Eng says Tiger Brokers was founded in 2014 to address certain pain points faced by its founder, director and CEO Wu Tian Hua. The latter was previously an engineer working for a multinational corporation in China. When he was given share options in the company, Wu found the process of opening a trading account to be tedious.

There were other inconveniences, too. Back then, many Chinese brokerages offered online trading platforms to investors to perform their trades. But none of them provided a mobile trading platform. Moreover, the fees to trade shares in foreign markets like the US were expensive. “So that’s when he actually started Tiger Brokers in China,” explains Eng. “He believes that investing should be more friendly and approachable by using a trading app such as Tiger Brokers.”

Tiger Brokers then saw an opportunity to expand into Southeast Asia. According to Eng, Wu saw similar pain points experienced by investors in the region. And so, Tiger Brokers set up operations in Singapore two years ago. Last year, it secured the Capital Markets Services license from the Monetary Authority of Singapore, potentially broadening the range of services it can offer here.

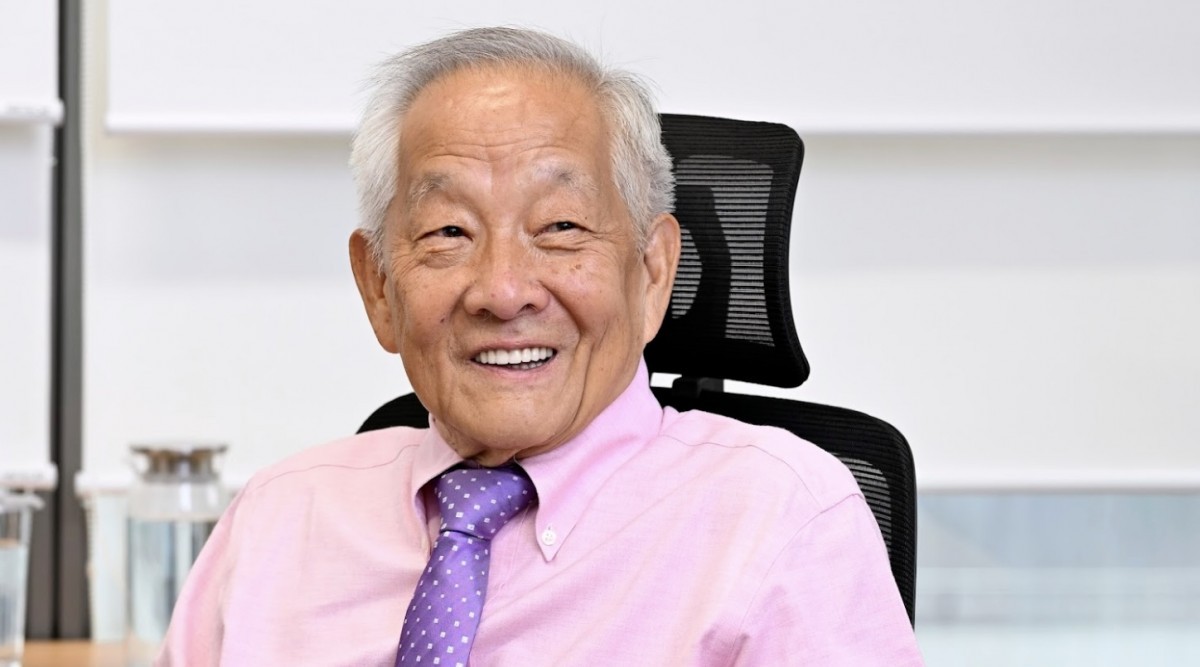

While Tiger Brokers may be a relatively young player in the online brokerage arena, Eng says the brokerage is backed by prominent investors. These financial backers are Chinese technology giant Xiaomi Corp, US-based Interactive Brokers and investment guru Jim Rogers, who in recent years has become a prominent investor in Asia.

But since Interactive Brokers itself is an online brokerage, would it not compete for customers with Tiger Brokers? Eng does not see this as a problem. “I think the market is big enough,” he says. “Everyone is offering a similar product. But it is how you differentiate yourself. Most importantly, we are able to achieve our vision and serve our customers.”