See also: SFF 2023 spurs discussion on generative AI and the future of finance

See also: MAS launches blueprint outlining technology infrastructure required to facilitate digital money transactions

Moving from the consumer space to B2B was “really the turning point” for Nium, says co-founder and COO Pratik Gandhi. “It gave us the ability to acquire that scale in a way that we could have never imagined.” Photo: Albert Chua/The Edge Singapore Nium, which is dual-headquartered in San Francisco, is also eyeing a secondary listing on the Singapore Exchange

S68 (SGX), says its co-founder and chief operating officer Pratik Gandhi to The Edge Singapore.

Nium, which helps companies handle payments, says it grew net revenue 2.7 times y-o-y to US$82 million in 2022 and its payout network supports 100 currencies and spans more than 190 countries.

Backed by both GIC and Temasek, Nium became Southeast Asia's first B2B payments unicorn following a US$200 million round in July 2021. The fintech company doubled its valuation to US$2 billion following the close of its Series D round in early 2022.

Z74 (SingTel).

As fintechs begin to chip away at banks’ dominance in the global payments ecosystem, Gandhi says the sector has not been “completely mapped”, suggesting further new markets could develop. According to him, Nium sees a US$60 trillion market opportunity for B2B cross-border transactions.

“Most of this is dominated by banks today,” says Gandhi, whose career has spanned long in the financial services sector. “Payments are not really transparent, they’re not quick and they’re expensive.”

Gandhi refers to the incumbent global messaging network for cross-border payments, Swift, or the Society for Worldwide Interbank Financial Telecommunication. Swift has long been criticised for being inefficient, as it sends transactions through multiple correspondent banks.

In its place, Nium has created a global network that is largely integrated into each country’s payments system. When this is not possible, Nium has tied up with banks directly, says Gandhi.

But unlike banks, Nium “doesn’t do hundreds of things” like lending and wealth management. Instead, its focus is on what Gandhi calls “mission-critical payments”, such as payroll. Financial institutions were Nium’s priority clients last year, as it focused on helping them target new markets with instant bank payouts and expand into emerging markets. Its clients in this industry include the likes of Aspire, Mastercard, Rippling, Payoneer, Amadeus and eDreams.

Nium’s payout network supports 100 currencies and spans more than 190 countries. According to Gandhi, nearly 70% of such payments are now processed in real-time.

Stars and stripes

Besides putting their money in Nium, GIC and Temasek are hedging their bets by also investing in fellow payments peer Stripe. In March, the Irish-American company announced that the two heavyweight Singaporean investors had joined its Series I fundraise, raising more than US$6.5 billion at a lofty US$50 billion valuation.

Interestingly, Stripe says it does not need this capital to run its business. Instead, it will be used to provide liquidity to current and former employees and address employee withholding tax obligations related to equity awards, resulting in the retirement of Stripe shares that will offset the issuance of new shares to Series I investors.

Founded in 2009 by Irish entrepreneur brothers John and Patrick Collison in Palo Alto, California, the fintech company has earned a reputation for its big backers, which include Elon Musk, Peter Thiel and VC firms Sequoia Capital, Andreessen Horowitz and SV Angel.

Stripe is, in essence, a global payment and treasury network that powers payments and financial automation. This includes setting up payment infrastructure for businesses of all sizes; powering complex business models, such as marketplaces and subscriptions; preventing fraud; automating billing, invoices and tax calculation; and more.

Present in almost 50 countries, Stripe’s enterprise users include Amazon, Ford, Salesforce, BMW and Maersk. The company claims it handles more than 500 million API requests a day, “often upwards of 10,000 per second”. Globally, businesses on Stripe processed more than US$817 billion in volume in 2022, up 26% y-o-y.

The number of new businesses joining Stripe increased by 19% in 2022, and the company claims more than “1,000 new ventures” were launched each day. According to Stripe, 55% of businesses that came on board in 2022 were based outside of the US.

Singapore-headquartered online marketplace Carousell has been a client since October 2020. In the three years since, Carousell’s in-app transactions have more than tripled in Singapore and Malaysia, while cases of fraud have plummeted to fewer than three in every 10,000 transactions, says Stripe.

Most recently, Stripe’s partnership with Meta-owned messaging app WhatsApp has enabled “a select group of Singapore-based businesses” to pay using credit and debit cards or PayNow — all without leaving the app. Some market watchers believe that Stripe will see wider usage as it functions as a lubricant for the e-commerce industry.

The poster child of Temasek

Long before Nium and Stripe, however, was Adyen, a poster-child favourite of Temasek, which has invested in them since 2014. Founded in 2006 by Dutch billionaire Pieter van der Does, Adyen’s unique selling proposition is that its technology cuts out three middlemen from the value chain of payments — the payment gateway, risk management and acquisition — so that clients can reach merchants faster and at lower cost.

Adyen, whose largest shareholder is Temasek, says that it has not made a single acquisition in its 17 years of existence. “Our technology is spectacular,” says Priyanka Gargav, country manager for Singapore. Photo: Adyen Unlike other payment platforms, Adyen boasts that it has not made a single acquisition in its 17 years of existence. “Our technology is spectacular,” says Priyanka Gargav, country manager for Singapore, “and if we did that, our entire single platform would get compromised”. Ayden has clocked in several significant milestones to date — in 2011, it recorded its first year of profitability five years into its inception. In 2014, the company announced a funding round of US$250 million led by growth equity firm General Atlantic, which was joined by existing investors Temasek, Index Ventures and Felicis Ventures. Three years later, it surpassed EUR100 billion ($144.83 billion) in processed volume, and shortly after, in 2018, it was listed on the Amsterdam Stock Exchange at EUR240 per share. In 2021, its net revenue hit EUR1 billion. In FY2022, Adyen posted EUR1.3 billion in net revenue, representing 33% y-o-y growth, despite the ensuing global macroeconomic trends in the last two years. But Adyen’s growth trajectory hit a speed bump recently. For the six months ended June 30, Adyen reported net revenue of EUR739.1 million, an increase of 23.1% y-o-y from EUR608.5 million recorded for 1HFY2022. Despite the topline growth, however, earnings held steady at around EUR282.2 million, as Adyen incurred higher costs, especially wages. “While we see the changing industry tides reflected in this period's results, we remain focused on building Adyen for the long term. Global digital brands continue to emphasise that online payments are a vital part of their commerce strategies at present and in the future, which further underpins our conviction in our sizeable, untapped opportunity,” says Adyen in its earnings commentary on Aug 17, as it stresses its “historical investments” on its “single platform”. From the perspective of its customers, Adyen enables an experience known as “unified commerce”, which means a business based out of Singapore only has to work with one provider — Adyen — if they wish to access different markets. Typically, Adyen works with customers who are valued for high growth, high reliability and quality, and very good customer experience across multiple countries, online and offline. These include Expedia, Klook, Uber, McDonald’s Online and Singapore Airlines

C6l.

Adyen’s processed volume for 2022 reached EUR767.5 billion, up 49% y-o-y, comparable to Stripe’s US$817 billion in volume in the same calendar year. However, when asked about the competition in the space, Gargav maintains that Adyen is looking to be an enabler for their clients.

‘Acquiring platform as a service’

The payments ecosystem is not linear, and some platforms, like Stripe, run on another payments unicorn. Stripe is a “long-term partner” of PPRO, says Tristan Chiappini, vice-president APAC at PPRO. “We provide Stripe with access to local payment methods via our payments infrastructure.”

Founded in 2006 and based in London, PPRO gained unicorn status in early 2021 and counts among its investors Citi Ventures and PayPal.

At present, it works with 100 payment service providers and banking partners in the industry to serve hundreds of thousands of global merchants, which generates billions of dollars worth of transactions on a monthly basis.

Partners like Citi, PayPal and Alipay depend on PPRO to accelerate growth, boost conversions and simplify digital payments, says Chiappini.

Simply, PPRO offers a modular infrastructure that lets partners launch their own solutions within six months. PPRO can also plug into their existing infrastructure to solve specific issues.

This “acquiring platform as a service” is one of PPRO’s two major product categories — the other is accepting and managing payments.

According to Chiappini, 20% of online shopping carts are abandoned because the customer’s preferred payment method is not offered at checkout. “PPRO enables our partners to enhance their checkout conversion rates by solving the complexity of adding these locally-preferred payment methods via one API, one contract and a single settlement.”

PPRO also allows businesses to deploy “hundreds of products” from “dozens of third-party providers and their APIs”, says Chiappini. “This can be done using clicks and not code.”

Known as PPRO’s “service orchestration layer”, Chiappini likens this to an “industrial-strength app store” for banks, acquirers and payment service providers. This also allows businesses to add and swap out third-party applications quickly, he adds. “For example, instead of trying out just one fraud provider, our service orchestration layer allows partners to try and test out multiple providers, switching and replacing them without going through tiresome contractual processing.”

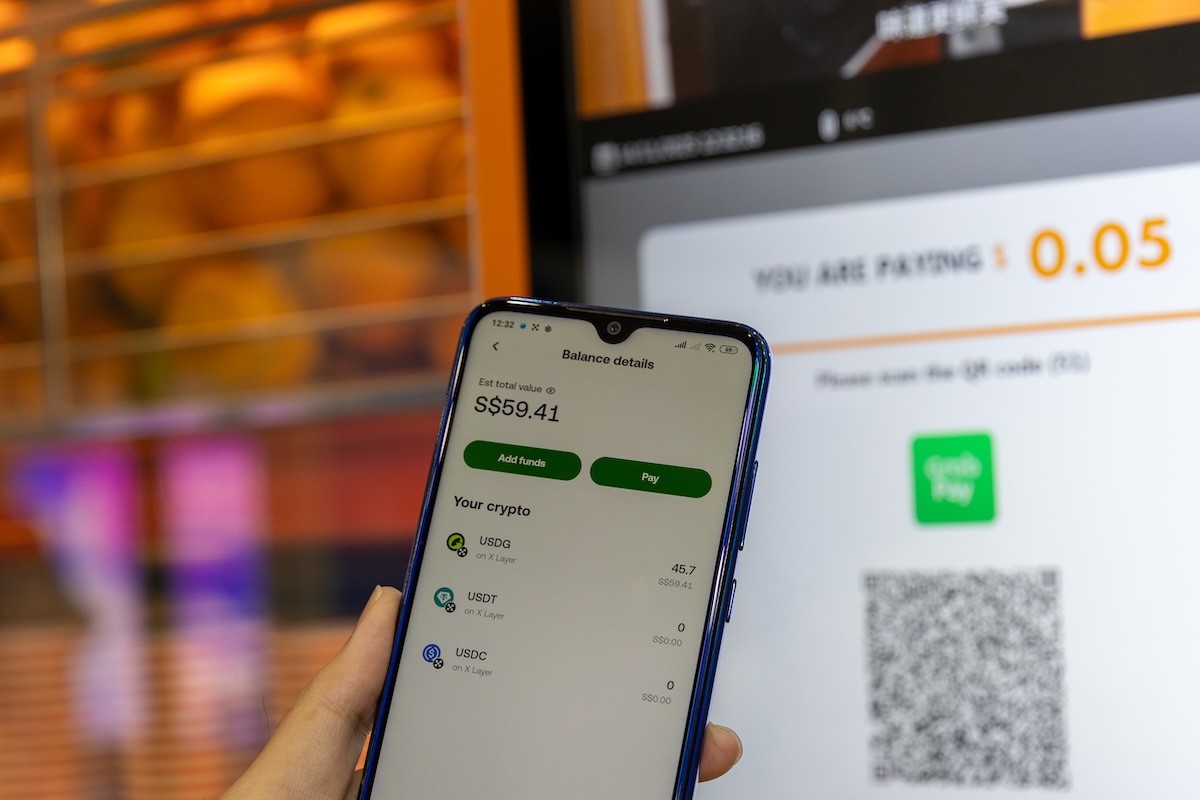

Over the past year alone, PPRO has integrated APAC payment methods like GoPay (Indonesia), GrabPay (Malaysia), Touch ‘n Go (Malaysia), Toss Pay (South Korea), Zip (Australia), and most recently, UPI (India).

“We are anticipating more integrations in the pipeline as APAC continues to be a market with the biggest growth potential for us,” says Chiappini. “Partners include the likes of Worldpay, Airwallex, Stripe, Alipay and ByteDance, to name a few.”

Purpose over prestige

Even with multiple unicorns featured in this story, few players have managed to enter China. Nium’s Gandhi calls it “one of the most exciting areas for any payment company, or any company, for that matter”.

One Singapore-headquartered “soonicorn” bearing a French name has achieved exactly that. Thunes, or “pocket money” in French, opened its Beijing office on June 15.

Singapore-headquartered Thunes announced a partnership with Tencent in November 2022, bringing its collections service to one billion WeChat and Weixin users. “Tencent also has a wallet — WeChat Pay. We help them receive money from abroad into their wallets,” says CEO Peter De Caluwe. Photo: Thunes Thunes is valued at over US$900 million following a US$72 million Series C round that closed in July with participation from Visa and EDBI. According to the company, it provides global payment rails that enable Chinese-licenced banks, payment service providers, marketplaces and businesses to make faster, more affordable transactions. According to China’s central bank, the cross-border use of the renminbi reached RMB9.7 trillion yuan ($1.83 trillion) in 1Q2022, up 8% y-o-y. Swift reports that the renminbi’s share of global payments placed fifth at 2.77% in June, up from 1.81% some five years ago — although the dominant currency being shuffled around remains, unsurprisingly, the US dollar. To capture China’s “enormous economic potential”, Peter De Caluwe, CEO of Thunes, brought the former Swift head of China, Daphne Huang, as their senior vice-president of Asia-Pacific in November 2021. In November 2022, Thunes announced a partnership with Tencent, bringing its collections service to 1 billion WeChat and Weixin users. “We help them collect [money] from emerging markets for the games they sell; we help them pay out to consumers. Tencent also has a wallet — WeChat Pay. We help them receive money from abroad into their wallets,” says De Caluwe. Two growth stories in China remain De Caluwe’s focus: the inflow of foreign currencies through SME transactions into China, and the outflow of the renminbi to foreign markets. Thunes may be just shy of joining a league of global payments unicorns, but according to De Caluwe, acquiring “4%, 5% or 10%” of cross-border volume in China “is way more valuable than saying I’m worth a billion”. “It’s where we focus.” Outside of China, Thunes has 20 global offices with 350 employees, and its proprietary network reportedly connects 132 countries, 4 billion bank accounts and some 3 billion digital wallets. Just like how PPRO powers Stripe, Thunes does the same for Revolut via a partnership that began some two years ago. Like others, Thunes also provides fraud detection and compliance technologies via an acquisition of Tookitaki back in 2022. On the corporate front, EDBI’s investment into Thunes comes with no strings attached, such as an obligation to list here, says De Caluwe, who rejects the idea of going public for now. “Currently, we are much more focused on growing the business. We have capital from private investors; there’s no need to go public.” As Thunes’ valuation nears unicorn status, De Caluwe insists he values purpose over prestige. Its Series C round raised its valuation from some US$794 million, at a time “when a lot of businesses did down rounds or flat rounds”, says De Caluwe. “Whether we pass the US$1 billion mark or not, we are not going to open a bottle of champagne for it. I’ll open a bottle of champagne if we can raise money in the current market conditions.” Swift speeds up Despite all the taunts and jibes made towards Swift by challenger fintechs, the global financial messaging service provider remains the incumbent juggernaut at the heart of the world’s banking system. Headquartered in Belgium, Swift connects more than 11,500 banking and securities organisations, market infrastructures and corporate customers in more than 200 countries and territories. Swift has also been wielded as an international geopolitical weapon. After Russia invaded Ukraine in February 2022, Russian banks were cut off from the Swift system as part of a wide set of sanctions. Even so, in 2022, Swift processed more than 11.24 billion messages on its core messaging service, up 6.6% over the year. Some 1.63 billion messages came from Asia Pacific, representing 14.4% of the year’s total. Compared to both listed and unlisted fintechs that are flush with cash, Swift can claim to be a “neutral cooperative”; it is overseen by the G-10 central banks (Belgium, Canada, France, Germany, Italy, Japan, The Netherlands, the UK, the US, Switzerland and Sweden) as well as the European Central Bank. In addition, the Swift Oversight Forum is composed of central banks from other major economies, including MAS. Now, Swift is attempting to live up to its name. On Aug 22, Swift reported that 89% of transactions processed on its network reach recipient banks within an hour, well ahead of speed targets set by the Financial Stability Board (FSB) to achieve one-hour processing for 75% of international payments by 2027. But there is still more to be done at the industry level, says Swift. “At present, only 60% of wholesale payments reach customer accounts in that time frame due to delays at the beneficiary leg caused by issues including regulatory controls, batch processing and opening hours of market infrastructures.” Swift’s survey of “7,000 consumers and small businesses” in Australia, China, Germany, India, Saudi Arabia, South Africa, the UK and the US found that 79% of consumers and 76% of SMEs expect an international payment to be completed within an hour or less. The results of the online survey, released in July, reveal that only 24% of consumers and 15% of SMEs expect payments to be instant. However, expectations for speed are likely to increase as more domestic market infrastructures move to instant payments, says Swift. Customers “overwhelmingly” look to banks first when making an international payment, says Swift. While 87% of SMEs and 81% of consumers prefer banks, three-quarters of respondents said they would consider switching to a different provider if they received a better offer. At 50 years old, Swift’s response to challenger fintechs is its own “competitively-priced” cross-border payments solution. Launched in 2021, Swift Go has onboarded more than 630 banks across 130 countries. Low-value cross-border payments, such as sending money to family abroad or a small business trading with overseas partners, have “very real, everyday implications” for people around the world, says Thierry Chilosi, chief strategy officer at Swift. “Our research confirms there is a real opportunity for financial institutions to offer compelling solutions that combine simple and transparent digital front-end experiences with secure, reliable, and fast back-end processing. This is exactly why we developed Swift Go with our community to facilitate fast and predictable low-value international payments, and we will keep innovating in this space to ensure payments of all sizes can flow across the globe without friction."

_0.jpg)