SingPost is a leading postal and e-commerce logistics provider in Asia Pacific. Its portfolio of businesses spans from national and international postal services to warehousing and fulfilment, international freight forwarding and last-mile delivery, serving customers in more than 220 global destinations.

Headquartered in Singapore, SingPost has over 4,900 employees, with offices in 13 markets worldwide. Since its inception in 1858, the group has evolved and innovated to bring about best-in-class integrated logistics solutions and services, making every delivery count for people and planet.

Candace Li is a research analyst with the Singapore Exchange

1. SingPost is a logistics provider. Could you elaborate on the products/services that you provide for clients? SingPost’s International business revolves around global connectivity, much like Singapore’s role as a thriving global trade hub. Leveraging our extensive global postal network and commercial partnerships, we offer international cross-border e-commerce logistics solutions. In Australia, our logistics business caters to both business-to-business (B2B) and business-to-consumer segments, providing digitally enabled fourth-party logistics (4PL) supply chain solutions, as well as third-party logistics (3PL) and last-mile delivery solutions. Our subsidiaries in Australia include FMH (a leading 4PL operator in Australia with its 4PL solutions for B2B clients powered by a digitally enabled platform) and CouriersPlease (last-mile courier service provider with an extensive network covering over 90% of the population). In Singapore, SingPost is the national postal operator, providing essential postal service to the nation. 2. What/where are the key growth aspects for SingPost over the next 1–2 years? We have three key market pillars — Australia, International and Singapore. In Australia, the integrated logistics market is estimated at over A$100 billion ($88.9 billion) and growing. Our logistics business is gaining momentum, propelled by both organic and inorganic growth of FMH. We continue to explore potential opportunities and acquisitions as we unlock synergies between our businesses in Australia, which include FMH and CouriersPlease. The pandemic had severely impacted the International business and we are only beginning to see recovery in this segment. We have revamped our cross-border strategy and are re-engineering the business to tap into the global cross-border e-commerce market. We are developing a multimodal network with hubs outside of Singapore to enhance our cross-border e-commerce solutions. Besides offering postal solutions through our international postal network to about 200 markets worldwide, we are also widening our offerings with commercial solutions and more partnerships across the region. 3. Describe SingPost’s recent financial performance.

The transformation of SingPost is reflected in the FY2022/23 ended March results with record revenues of $1.9 billion, up 12.4% y-o-y. The Logistics segment made up 70% of the revenue in FY2022/23, compared to 38% in FY2019/20, reflecting the transformation of the group into a logistics business. Close to 86% of revenue was generated internationally as the group expanded into global markets. The Logistics segment experienced a remarkable 32.4% y-o-y revenue growth and 91.3% y-o-y operating profit growth. This was mainly driven by contribution from FMH which performed well on the back of organic business wins and inorganic growth, as well as contributions from the freight forwarding business. The Post & Parcel segment recorded its first full-year loss of $15.9 million in FY2022/23, due to declines in delivery volumes coupled with increased operating expenses due to inflationary pressures. SingPost is working with the Infocomm Media Development Authority (IMDA) to review costs and the postal operation model. We will be seeking approval for postage rate adjustments to better reflect the true cost of the letter mail business. 4. How would the recent additional stake acquisition of FMH affect the company’s resources and financials? Australia has been the largest contributor to SingPost’s transformation and the growth of the Logistics segment. Within the Logistics segment, the most important driver of transformation has been the investment in FMH. FMH is now a significant contributor to both revenue and operating profit of the group. FMH has been growing organically through business wins and inorganically through strategic and niche acquisitions which built its 3PL network. We are working to reap further synergies with the integration of our businesses in Australia. 5. What do you think are some key drivers or trends in the business segments and in the market that you operate? As a result of the pandemic, the global e-commerce market has grown significantly and continues to show strong growth opportunities. In the International business, the group sees opportunities in the global cross-border e-commerce logistics market which is forecast to grow at a CAGR of 25% over 2022-2038 to US$3 trillion ($4 trillion), according to Vantage Market Research. In Australia, the integrated logistics market is estimated at over A$100 billion and growing. The last-mile delivery market (a segment of the integrated logistics market) is estimated at over A$10 billion. The e-commerce market in Australia is also estimated to grow to over US$64 billion by 2027 (according to Statista), while the e-commerce market in Singapore is expected to grow to US$14 billion by 2027 (according to Meta/Bain & Co report). 6. What is the group’s strategy to achieve its long-term goal of establishing the international logistics business? The International Post & Parcel segment was adversely affected by the Covid-19 pandemic with border closures and lockdowns in many countries. Prior to the pandemic, the business was profitable and growing. Our customers’ buying patterns and supply chains have changed due to the long disruption to air freight capacity via Changi. This means that our traditional International Post & Parcel business must evolve. We are now re-engineering the business to be more commercial, backed by postal solutions. We offer global connectivity through the international postal network covering 192 markets around the world. In addition, we now extend beyond postal offerings with attractive commercial solutions in select growing trade lanes, especially into Asia Pacific. We are also rebuilding the International business with an asset-light approach to tap the global cross-border e-commerce supply chain and logistics market. We leverage commercial partnerships and the international postal network. We are setting up a multimodal network with hubs in key areas instead of the previous single transshipment hub in Singapore. In addition, we are looking to invest in technology to enable the International business, much like our successful Australia business. 7. How is the company looking to expand its Australia and International business segments? Both the Australia and International pillars have different growth opportunities and attributes, and both are important. In Australia, the group is building a technology-enabled business-to-business-to-consumer integrated logistics network, and the building blocks are in place with FMH and Couriers- Please. We are looking to reap synergies among our businesses there and scale the business. The group will continue to explore opportunities to further build our network and scale. For the International business, our brand of logistics facilitates e-commerce retail and helps businesses broaden their reach. Our International business is a supply chain that we have built to serve customers moving e-commerce exports from China to everywhere in the world. SingPost has leveraged its cross-border strategy and will continue to develop the business to tap trade flows from West to East, as well as within Asia Pacific. 8. What is the outlook on the business segments in the Singapore market? In Singapore, the postal-only business is structurally challenged. Similarly, the e-commerce delivery industry in Singapore is fragmented and does not yield an attractive return. We have optimised both postal and e-commerce logistics delivery networks and infrastructure to maximise the operating leverage, which is our competitive advantage. SingPost is working with the authorities towards a framework for the long-term commercial viability of the postal service. As announced in Parliament, SingPost and IMDA are working together to review costs and the operating model, including optimisation of the post office services. SingPost is seeking postage rate adjustments to better reflect the true cost of the letter mail business.

See also: AvePoint unifies enterprise data with SaaS platform, providing security and resilience

1. SingPost is a logistics provider. Could you elaborate on the products/services that you provide for clients?

SingPost’s International business revolves around global connectivity, much like Singapore’s role as a thriving global trade hub. Leveraging our extensive global postal network and commercial partnerships, we offer international cross-border e-commerce logistics solutions.

In Australia, our logistics business caters to both business-to-business (B2B) and business-to-consumer segments, providing digitally enabled fourth-party logistics (4PL) supply chain solutions, as well as third-party logistics (3PL) and last-mile delivery solutions. Our subsidiaries in Australia include FMH (a leading 4PL operator in Australia with its 4PL solutions for B2B clients powered by a digitally enabled platform) and CouriersPlease (last-mile courier service provider with an extensive network covering over 90% of the population).

In Singapore, SingPost is the national postal operator, providing essential postal service to the nation.

2. What/where are the key growth aspects for SingPost over the next 1–2 years?

We have three key market pillars — Australia, International and Singapore.

In Australia, the integrated logistics market is estimated at over A$100 billion ($88.9 billion) and growing. Our logistics business is gaining momentum, propelled by both organic and inorganic growth of FMH. We continue to explore potential opportunities and acquisitions as we unlock synergies between our businesses in Australia, which include FMH and CouriersPlease.

The pandemic had severely impacted the International business and we are only beginning to see recovery in this segment. We have revamped our cross-border strategy and are re-engineering the business to tap into the global cross-border e-commerce market.

We are developing a multimodal network with hubs outside of Singapore to enhance our cross-border e-commerce solutions. Besides offering postal solutions through our international postal network to about 200 markets worldwide, we are also widening our offerings with commercial solutions and more partnerships across the region.

3. Describe SingPost’s recent financial performance.

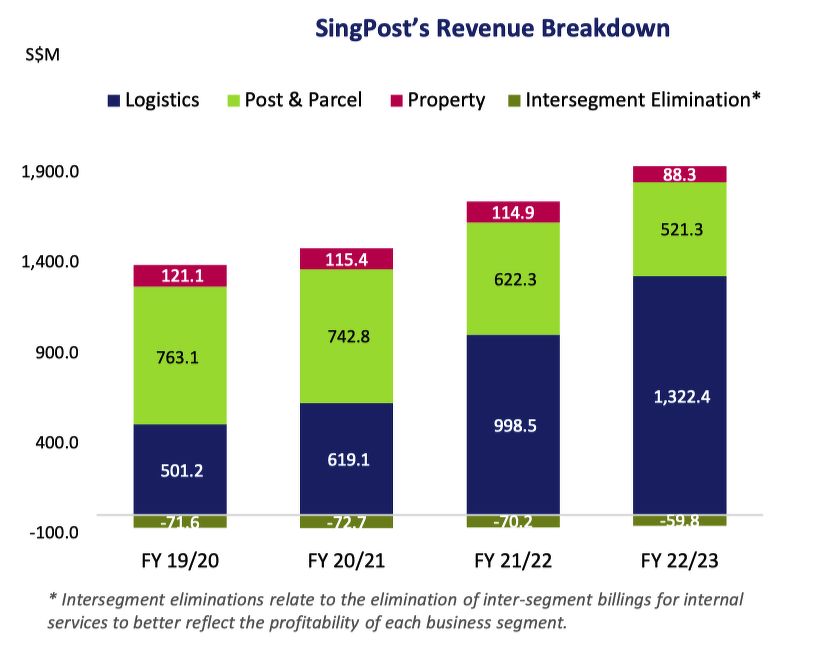

The transformation of SingPost is reflected in the FY2022/23 ended March results with record revenues of $1.9 billion, up 12.4% y-o-y. The Logistics segment made up 70% of the revenue in FY2022/23, compared to 38% in FY2019/20, reflecting the transformation of the group into a logistics business. Close to 86% of revenue was generated internationally as the group expanded into global markets.

The Logistics segment experienced a remarkable 32.4% y-o-y revenue growth and 91.3% y-o-y operating profit growth. This was mainly driven by contribution from FMH which performed well on the back of organic business wins and inorganic growth, as well as contributions from the freight forwarding business.

The Post & Parcel segment recorded its first full-year loss of $15.9 million in FY2022/23, due to declines in delivery volumes coupled with increased operating expenses due to inflationary pressures. SingPost is working with the Infocomm Media Development Authority (IMDA) to review costs and the postal operation model. We will be seeking approval for postage rate adjustments to better reflect the true cost of the letter mail business.

4. How would the recent additional stake acquisition of FMH affect the company’s resources and financials?

Australia has been the largest contributor to SingPost’s transformation and the growth of the Logistics segment. Within the Logistics segment, the most important driver of transformation has been the investment in FMH.

FMH is now a significant contributor to both revenue and operating profit of the group. FMH has been growing organically through business wins and inorganically through strategic and niche acquisitions which built its 3PL network.

We are working to reap further synergies with the integration of our businesses in Australia.

5. What do you think are some key drivers or trends in the business segments and in the market that you operate?

As a result of the pandemic, the global e-commerce market has grown significantly and continues to show strong growth opportunities.

In the International business, the group sees opportunities in the global cross-border e-commerce logistics market which is forecast to grow at a CAGR of 25% over 2022-2038 to US$3 trillion ($4 trillion), according to Vantage Market Research.

In Australia, the integrated logistics market is estimated at over A$100 billion and growing. The last-mile delivery market (a segment of the integrated logistics market) is estimated at over A$10 billion.

The e-commerce market in Australia is also estimated to grow to over US$64 billion by 2027 (according to Statista), while the e-commerce market in Singapore is expected to grow to US$14 billion by 2027 (according to Meta/Bain & Co report).

6. What is the group’s strategy to achieve its long-term goal of establishing the international logistics business?

The International Post & Parcel segment was adversely affected by the Covid-19 pandemic with border closures and lockdowns in many countries. Prior to the pandemic, the business was profitable and growing.

Our customers’ buying patterns and supply chains have changed due to the long disruption to air freight capacity via Changi. This means that our traditional International Post & Parcel business must evolve.

We are now re-engineering the business to be more commercial, backed by postal solutions. We offer global connectivity through the international postal network covering 192 markets around the world. In addition, we now extend beyond postal offerings with attractive commercial solutions in select growing trade lanes, especially into Asia Pacific.

We are also rebuilding the International business with an asset-light approach to tap the global cross-border e-commerce supply chain and logistics market. We leverage commercial partnerships and the international postal network. We are setting up a multimodal network with hubs in key areas instead of the previous single transshipment hub in Singapore. In addition, we are looking to invest in technology to enable the International business, much like our successful Australia business.

7. How is the company looking to expand its Australia and International business segments?

Both the Australia and International pillars have different growth opportunities and attributes, and both are important.

In Australia, the group is building a technology-enabled business-to-business-to-consumer integrated logistics network, and the building blocks are in place with FMH and Couriers- Please. We are looking to reap synergies among our businesses there and scale the business. The group will continue to explore opportunities to further build our network and scale.

For the International business, our brand of logistics facilitates e-commerce retail and helps businesses broaden their reach. Our International business is a supply chain that we have built to serve customers moving e-commerce exports from China to everywhere in the world. SingPost has leveraged its cross-border strategy and will continue to develop the business to tap trade flows from West to East, as well as within Asia Pacific.

8. What is the outlook on the business segments in the Singapore market?

In Singapore, the postal-only business is structurally challenged. Similarly, the e-commerce delivery industry in Singapore is fragmented and does not yield an attractive return. We have optimised both postal and e-commerce logistics delivery networks and infrastructure to maximise the operating leverage, which is our competitive advantage.

SingPost is working with the authorities towards a framework for the long-term commercial viability of the postal service. As announced in Parliament, SingPost and IMDA are working together to review costs and the operating model, including optimisation of the post office services. SingPost is seeking postage rate adjustments to better reflect the true cost of the letter mail business.

9. Sustainability and ESG have increasingly been a key focus. How is SingPost committed towards sustainability?

We remain committed to and guided by the group’s purpose of Making Every Delivery Count for People and Planet and are positioning the group for sustainable growth for the long term. We view sustainability as a key differentiating factor that can give us a strong competitive advantage.

We have set targets to achieve net-zero carbon emissions: Scopes 1 and 2 for our operations in Singapore by 2030; and Scopes 1, 2 and 3 for our global operations by 2050.

In our Singapore business, delivery to the letterbox through our postal infrastructure has a much lower carbon footprint compared to individual doorstep deliveries. We have embarked on various decarbonisation initiatives to reduce our carbon footprint, improve operational efficiencies and lower utility costs. These initiatives include solar panel installation at our e-commerce logistics hub and electrification of the delivery fleet.

In addition, there is the opportunity for us to lead and offer commercial sustainability products and solutions, and we are working to do so over the next few years.

Various sustainability pathways are being explored in different markets. With investment in sustainability initiatives, we expect to achieve operational efficiency which will result in longer-term savings and/or returns on investment; and business growth as we tap opportunities, as we see higher demand from our customers.

10. What is SingPost’s value proposition to its shareholders and potential investors? What do you think investors have overlooked?

We hope to highlight the transformation of SingPost in recent years. SingPost has transformed from being a predominantly postal business into a logistics business over the last four years. Logistics has grown its share of the business from 38% in FY2019/20 to 70% in FY2022/23.

In addition, SingPost has evolved from being Singapore-centric to an international business with 86% of revenue now derived outside of Singapore.

Candace Li is a research analyst with the Singapore Exchange.