We remain bullish on stocks. By the time this article is published, the US may already have a clear winner for the presidential election. Historically, the stock market has moved higher in the longer term, regardless of the winner. In the short term, either side will pass a stimulus package in the weeks ahead, smaller if Republicans retain control of the Senate.

There is ample liquidity in the world, while interest rates will remain near zero with monetary policies staying extremely loose.

Real interest rates have been on a broad downtrend since peaking in the early 1980s (see Chart 1). For the better part of this period, we see a corresponding decline in fund allocations to bonds — which is unsurprising because, as interest rates fall, stocks become more attractive. That is, until the global financial crisis.

Since then, more money has flowed into bonds — as a percentage of total invested funds — even as interest rates continued to drop. Why? Investors were no longer buying them for yields but rather for capital gains in anticipation of even lower rates.

See also: When the majority votes with the minority’s wallet, capital walks

Without a clear uptake in private investments, there is no reason to anticipate a reversal of the present trend.

Negative-yielding bonds are guaranteed to lose money if held to maturity. However, bond prices will rise as yields fall, giving investors capital gains. It has been a very profitable trade, but we think the market is nearing a limit.

Even though negative interest rates were once unthinkable, there is a practical limit on how low they can go — specifically, whether further policy rate cuts can be transmitted to lending rates, already at historical lows, to stimulate credit. And if not, there is no justification for further lowering of rates, especially considering its negative impact on financial institutions’ profitability.

See also: Brains, beds and balance sheets: Where human capital becomes hard currency

If interest rates are indeed nearing the floor, as we think they are, then this will cap capital gains for bonds from hereon. With limited capital gains and near-zero or negative yields, there will be little reason left for investors to chase bonds.

This suggests more investors will turn to stocks for better returns. The current yield differential between stocks and bonds is about 3.5%, well above the historical average of 0.52% for the past 60 years or so.

Furthermore, the global economy is holding up better than feared, which improves the outlook for stocks. According to IHS Markit, global factory output rose at the fastest rate in 2½ years in October, building on the recovery in 3Q2020 (see Chart 2).

Click here to see the charts in detail

Forward-looking indicators such as business expectations and new orders rose. While services are taking the brunt of the hit, consumers are spending on goods, including big-ticket items such as cars.

Despite the latest resurgence in Covid-19 cases, we think the underlying optimism is not unwarranted. Ultimately, the pandemic is a transient event. Countries such as South Korea, China and Singapore have managed to contain the outbreak, offering a glimpse of the future for the rest of the world. In addition, there is increasing clarity on vaccines and treatments for Covid-19.

For more stories about where money flows, click here for Capital Section

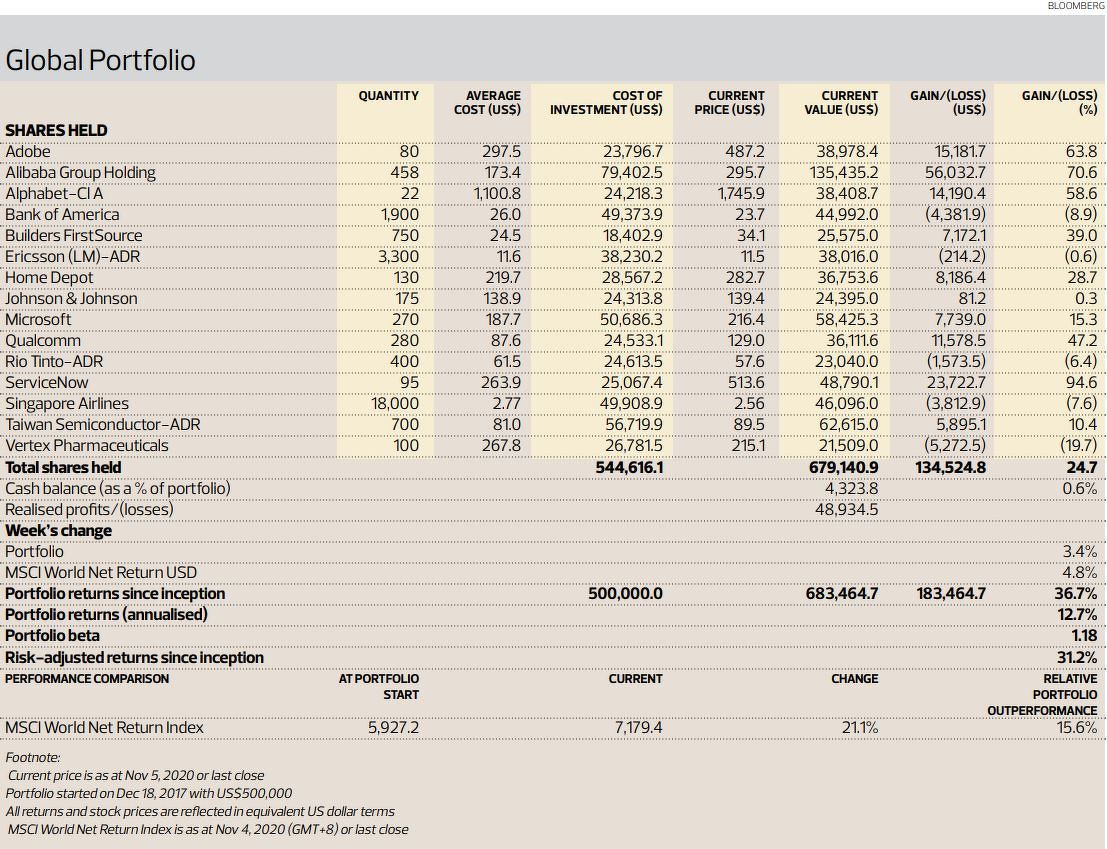

The Global Portfolio gained 3.4% for the week ended Nov 5, recovering some of the losses from the previous week. The gains lifted total portfolio returns to 36.7% since inception. This portfolio continues to outperform the benchmark MSCI World Net Return index, which is up 21.1% over the same period.

The biggest drag on the portfolio last week was Alibaba Group Holding. Its shares fell 4% in reaction to the shock suspension of the initial public offering (IPO) of associate Ant Group two days before the stock was slated to make its debut on the exchanges in Shanghai and Hong Kong. The IPO, set to be the world’s largest on record, was pulled for regulatory reasons in China.

Specifically, regulators are addressing the issue of fintech companies such as Ant undertaking lending business without the proper capital adequacy requirements of banks — simply by being classified as tech companies instead of financial institutions. We think the regulators are right — substance over form.

Given the massive size of Ant’s lending business, it could pose systemic risks to the financial system and the broader economy. Tackling the issue head-on is the responsible thing to do, promoting governance and protecting against systemic shocks as China opens up to the world.

In fact, regulators globally are facing similar problems to level the playing field across various industries — such as ride hailing (Uber) and hospitality (Airbnb). They are playing catch-up with tech companies that have capitalised on the regulatory vacuum to disrupt the incumbents.

All the other remaining stocks in the Global Portfolio finished in positive territory for the week. The top gainers were Alphabet (+15.6%), Builders FirstSource (+11.8%) and Microsoft Corp (+6.8%).

Read Also: 958 Brokers' Digest

It’s the methodology, stupid

Regular readers of this column would notice that we have written quite a bit on glove makers in recent months. Stocks in the entire sector have done remarkably well in this pandemic, with surging demand far exceeding supply, resulting in sharply higher margins and supernormal profits.

Unsurprisingly, investor interest is strong, chasing stock prices to recordhigh levels and propelling glove makers into the league of mega caps. This has also left many research analysts playing catch-up with their earnings forecasts and price targets — to continue justifying a “buy” on these stocks. As we have said previously, we have no issue with analysts and investors capitalising on this momentum. Momentum trading is a legitimate strategy that can be lucrative — provided you understand and accept the inherent risks.

As analysts, what we do take exception to is how this is being done — valuing the stocks by applying historical average price-to-earnings multiples to current supernormal profits. This is, dare we say, the dishonest way to justify higher and higher target prices. When glove makers’ super profits normalise in a year or two — as they inevitably must — a very reasonable, even cheap, PE multiple today will become unreasonably high.

This is why it is worth highlighting a recent report by Maybank IB on Hartalega Holdings. The company reported profits that were more than five times higher y-o-y in its latest quarter. It would be simple to apply a historical PE to this supernormal profit and come up with a high price target. Instead, the analyst changed the “valuation methodology to DCF (from PE) to better reflect Hartalega’s long-term cashgenerating capability”.

At last, a report that calls out the irrational valuations of applying PE to unsustainable peak profits. It is not a question of accuracy — discounted cash flow is based on projections of multiyear cash flows, which is inherently hard to predict — but methodology.

Valuations cannot be based on one or two years’ worth of profits but what is sustainable in the longer term. This is why analysts always adjust profits for one-off gains and losses. We can only hope that this report will serve as a timely reminder and wake-up call to others.

Valuations cannot be based on one or two years’ worth of profits but what is sustainable in the longer term. This is why analysts always adjust profits for one-off gains and losses. We can only hope that this report will serve as a timely reminder and wake-up call to others.

Disclaimer: This is a personal portfolio for information purposes only and does not constitute a recommendation or solicitation or expression of views to influence readers to buy/sell stocks, including the particular stocks mentioned herein. It does not take into account an individual investor’s particular financial situation, investment objectives, investment horizon, risk profile and/or risk preference. Our shareholders, directors and employees may have positions in or may be materially interested in any of the stocks. We may also have or have had dealings with or may provide or have provided content services to the companies mentioned in the reports.