To be announced in Parliament on Feb 18, market watchers, economists, businessmen and ordinary citizens will look closely at the mitigating measures tabled by Deputy Prime Minister and Finance Minister Heng Swee Keat when he makes his fifth Budget speech.

Heng has already said Budget 2020 will look into helping industries - such as the transport and tourism sectors that are burdened by the knock-on impact of the virus outbreak.

The ministerial taskforce also announced it will extend relief measures to businesses and will “continue to keep a close watch on the situation and implement decisive measures as soon as needed”.

First reported in China’s Hubei province late last year, the coronavirus has infected more than 28,000 people in over 10 countries around the world and killed more than 560.

Chinese authorities have responded to the pandemic by quarantining entire cities and suspending outbound group tours. Singapore's largest trading partner is China, and Singapore is also a popular destination for Chinese holiday makers. As a result, most of Singapore's 28 confirmed cases are from China.

While no fatalities have so far been reported here – unlike the 33 deaths due to SARS – the outbreak is sufficiently worrying to put companies and the general population on a heightened state of alert.

The Singapore government has since suspended the entry and transit of visitors with recent travel history to or passports issued in Hubei. Meanwhile, contact-tracing has started to locate those who have had close contact with patients and those who have been exposed to the coronavirus quarantined. Business continuity plans are also being prepared while big-scale scheduled events in the republic have been cancelled.

And the mitigating measures are already having an effect on the Singapore economy. While official data on tourist arrivals here between December 2019 and January have yet to be released, businesses in the retail and tourism sectors are already feeling the pinch, based on anecdotal evidence.

The retail assistant of an apparel shop at Chinatown The Edge Singapore spoke to noted a 50% drop in sales since late-January when the bans kicked in. “Chinese tourists are the ones who normally come and buy a lot. Now that they are mostly gone, we are having difficulty selling our clothes,” says the woman.

To be sure, tourism was a bright spot for Singapore in 2019, whose growth contrasted starkly with the weakening manufacturing and export-oriented sectors. The latest data from the Singapore Tourism Board (STB) showed a total of 17.4 million arrivals in Singapore from January to November 2019. Of this, 24.3% or 4.2 million were from China, the highest after Southeast Asia.

Fewer arrivals also mean lower occupancy at hotels and fewer visitors to Singapore’s attractions like Gardens by the Bay and Resorts World Sentosa. A spokesman from the Association of Singapore Attractions says there was a noticeable drop in visits to Singapore’s key attractions and attributed this to the decline in Chinese tourists who made up most of the visitors at these places of interest.

He notes that Singaporeans and other tourists too have been staying away from these places. “Visitors are generally more sensitive towards visiting attractions due to perceived risks from crowded places,” he points out. For now, the sector is taking relief from the STB’s waiver of licence fees to tourism-related businesses.

Another group affected by the outbreak is the construction sector. The Building and Construction Authority says builders are now bracing themselves for possible missed deadlines given some of their workers are stuck in China or in self-quarantine. The sector employs 341,200 foreigners, who make up three quarters of the construction workforce. Like tourism, construction was a key growth sector in 2019, expanding for the first time in 1Q2019 after 10 consecutive months of contraction.

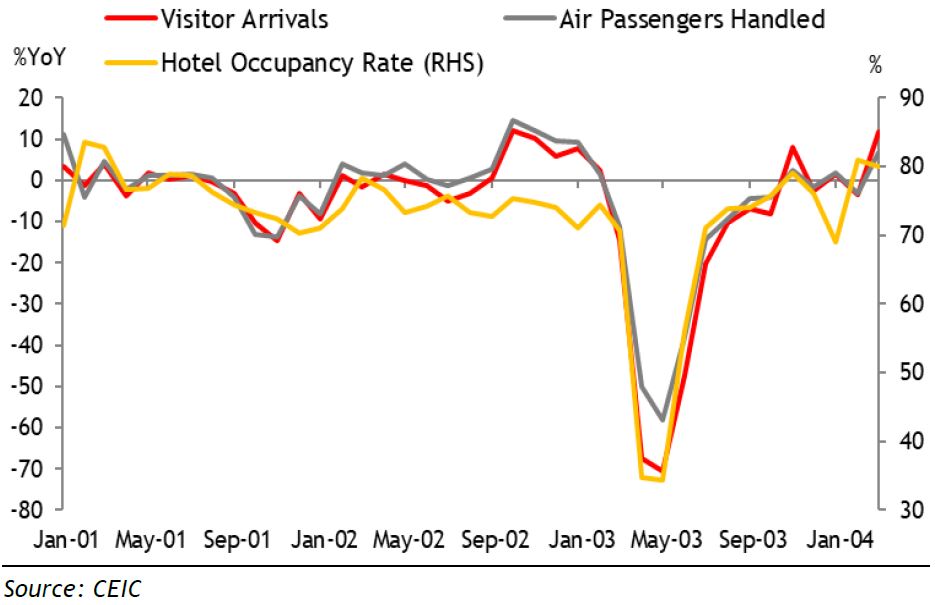

A recent report by Nomura comparing the economic implications of the coronavirus outbreak to the spread of SARS in 2003, shows that the worst is yet to come. “Based on our study of the coronavirus’ characteristics and the Chinese government’s responses thus far, we reckon the coronavirus could deal a more severe blow to China’s economy in the near term, relative to SARS,” says the financial institution.

For now, Nomura expects Singapore and other Asean economies to be the most vulnerable to the negative effects of the outbreak. “These open economies are also at a greater risk from any negative spillover effects due to a slowdown in China’s economy. During the SARS outbreak in 2003, the slowdown in services exports in these economies was mostly offset by a double-digit growth in goods export. In contrast, export growth currently remains tepid and this has had a negative spillover on domestic demand,” Nomura says.

For now, Nomura expects Singapore and other Asean economies to be the most vulnerable to the negative effects of the outbreak. “These open economies are also at a greater risk from any negative spillover effects due to a slowdown in China’s economy. During the SARS outbreak in 2003, the slowdown in services exports in these economies was mostly offset by a double-digit growth in goods export. In contrast, export growth currently remains tepid and this has had a negative spillover on domestic demand,” Nomura says.

Figure 1: GDP fell by -0.3% in 2Q03 as hospitality and travel plunge

Figure 2: GDP fell by -0.3% in 2Q03 as hospitality and travel plunge

The ‘E’ word

Economists too are moderating their growth forecasts for the year. Maybank Kim Eng economist Chua Hak Bin expects full-year GDP to clock in at 1.1%, down from 1.8% earlier, while DBS economist Irvin Seah is looking at 1.4%.

To this end, analysts expect an expansionary Budget 2020 to provide much needed relief to companies and workers in sectors including healthcare, employment, tourism and hospitality. DPM Heng said on Feb 1 that “we will have a strong budget in 2020” amid a broader slowdown.

Before the virus outbreak, Budget 2020 was widely expected to be an election Budget after the government failed to call for one in Budget 2019, to the surprise of many political pundits. At a briefing last year, a government official, when asked if Budget 2019 was focused on the “E” word, was quick to reply “the only ‘E’ we care about is ‘economy’”.

Given a general election has to be called latest by April 2021, there is renewed speculation that an election will be held later this year. Going by this logic, DPM Heng, slated to take over as Prime Minister in the next term of the government, is expected to dole out a bigger-than-usual package of “goodies” for both individuals, households and businesses alike so as to “sweeten” the ground and secure more votes.

In any case, the government, with its current term coming to an end, has accumulated plenty of surpluses over the past four fiscal years and can afford to be generous, observes Singapore Management University’s law don Eugene Tan.

And there has been a historical pattern of the ruling party doling out such pre-election goodies. In the Budgets leading to the 2006 and 2011 elections, GST rebates and cash dividends up to some $800 were given out, but not for 2015.

“No doubt Budget 2020 will be generous, and the focus will be to buttress the economy,” says DBS senior economist Irvin Seah in a Feb 4 note. He expects the government to incur an overall deficit of some $7.9 billion for FY2020, equivalent to 1.6% of Singapore’s nominal GDP, thereby making this year’s expenditure the largest since the GFC period of 2008–2009.

But Heng has been careful to manage expectations. On Jan 20, Heng said the coming budget is not “a goodie bag” but rather, a financial plan supporting a more strategic pathway for Singapore’s future.

“Many of the things we invest in our budget, whether it’s to restructure the economy, to provide better opportunities for our people – helps us to build capabilities not just in one or two years, but over the long term,” he said. Ultimately, the emphasis will be on “ways in which the resources of the country are put to the best use for the long-term future”, he adds.

With this in mind, SMU’s Tan anticipates Budget 2020 to have a “socio-economic” focus balancing the needs, concerns and aspirations of Singaporeans with the social and economic realities of the city-state.

“It will be a budget not so much defined by numbers but also by the social policies whether refinements or new, that will be rolled out for a society undergoing significant change and stresses,” says Tan.

Meanwhile, economists Selena Ling and Seah of OCBC and DBS respectively, are looking at something more specific: Targeted help for marginalised Singaporeans, be it low income workers or PMETs facing threats to their jobs.

With PMETs accounting for about 72% of total retrenchment in 3Q19 – higher than the 56% employed – Seah is championing tax deductions to incentivise companies to hire these individuals. He suggests a deduction equivalent to six months’ salary of the newly hired PMET. Maybank’s Chua says such measures should be complemented with top-ups to SkillsFuture credits of around $10 billion, so that individuals can pick up new IT skills that are required for one to stay relevant in the workplace of today.

These benefits can also be extended to employers of older workers, in line with the move to increase Singapore’s retirement age to 65 by 2030; the re-employment age cap will consequently go up from 67 to 70. This is in line with the Singapore National Employers’ push to renew an existing wage offset package for senior workers under the special employment credit scheme. This provides employers with wage offsets of up to 8% of monthly pay for Singaporean workers aged 55 and above and earning up to $4,000. An additional offset of up to 3% is available for employers that hire older workers aged 67 and above.

Melissa Kwee, director of the National Volunteer Philanthropy Centre, believes incentivising employers to hire experienced mature workers is a good move. “Gone are the days when the illiterate elder suffering poor health at 50 is the norm. Our 50 year-old today is fitter and more educated and digitally savvy with an eye on decades longer of productive contribution,” says Kwee who is leading the Singapore Business Federation’s (SBF) task force on sustainable employment for mature workers.

Maybank’s Chua is proposing a “Coronavirus Relief Package” of at least $700 million – comparable (in terms of % GDP) to the $230 million allocated 17 years ago when SARS hit. Chua says this amount should trickle down to property tax rebates for commercial, retail and hotel spaces and reliefs for air and land transport operators.

Combating climate change

Despite short-term measures to mitigate the ill effects of the outbreak, the government will not lose sight of its longer-term policy goals and needs, like dealing with the effects of climate change.

In his National Day Rally speech last year, Prime Minister Lee Hsien Loong said Singapore can expect to spend some $100 billion or more over the next 50 to 100 years to protect itself particularly from rising sea levels resulting from climate change.

The city state has already been working on this, following the 2015 Paris Agreement where it pledged intentions to reduce the intensity of its emissions by the amount of greenhouse gases emitted per dollar of gross domestic product. This translates into 36% of 2005 levels and a complete stabilisation of emissions by 2030.

Market watchers are looking for further “green” incentives, such as those promoting the wider adoption of electric vehicles. From just 12 in 2016, there are 1,036 EVs registered as of end Sept 2019, but this number is still a tiny fraction of Singapore’s total vehicle population of 970,344. Clearly there is a lot more room for EVs to grow and policies should help nudge car owners towards this direction if Singapore is to have real credibility in going green.

Sanjay Kuttan, chairman at the Sustainable Infrastructure Committee at Singapore’s Sustainable Energy Association, says a more effective way could be through the issuance of green Certificates of Entitlement (COEs) for new cars. Since fully electric cars reduces the number of fuel cars on the road and also reduces expenses to consumers, consumers will find it easier to make the switch.

Another way is via green financial instruments which the Monetary Authority of Singapore (MAS) had previously announced in preparation for potential changes in asset values and policies caused by climate change. “The economy of the future has to be greener, which means the financial sector has to be greener than before and be in a position to support that kind of activity,” said Ravi Menon, managing director of MAS at the Singapore Fintech Festival last November.

Three years ago, MAS rolled out its green bond grant programme to help companies fund up to $100,000 in expenses related to the sale of green bonds. Under this, borrowers must sell bonds that are at least $200 million, or have a bond programme of that amount with an initial issuance of $20 million. Southeast Asian nations, some of which are most vulnerable to climate change, are estimated to need US$200 billion ($272 billion) in green investments each year till 2030 and Singapore hopes to gain a foothold in this domain.

Riding the next digital wave

Another recurring, multi-year theme for the Budget is that of helping homegrown companies ride the next big advancement in digital technology. New technologies – ranging from cybersecurity and AI to 5G networks and robotics – are capabilities that can give them that extra edge.

Tay Hong Beng, KPMG Singapore’s head of tax and real estate, suggests the government introduce packages encouraging companies to send their staff for training in new digital skills.

And with the rollout of 5G mobile networks, objects, equipment and vehicles can all linked up in a wireless network to achieve better efficiency and productivity so Budget 2020 can include grants or schemes to encourage businesses to find such new ways to tap 5G networks.With the expertise gained, they can then try and export to neighbouring countries, and help add another growth engine to Singapore's economy.