If Lam can have his way, the commercial aerospace market will be one to stay in. “We think of factors that run in the long term, such as government support and political stability. So we believe that it is with this approach that our business has continued to deliver good, positive returns.”

For the company’s 1HFY2023 ended June, the commercial aerospace segment contributed more than $1.8 billion in revenue, up 32% y-o-y. Its ebit, meanwhile, was up 60% y-o-y in the same period. The revenue contributed by commercial aerospace makes it a close second to ST Engineering’s original core business of defence and public security, which generated $2.1 billion in sales.

Artists' impression of the Changi Creek facility / Image: ST Engineering

See also: Vietnam’s richest man names wife chair of taxi firm GSM — report

The new 84,000 sq m (about 904,200 sq ft) facility at Changi Creek, at the northern end of Changi Airport’s runway, will have four hangar bays. The first hangar will be ready in mid-2025, with the remaining three primed for service by 2026. The facility can service widebody aircraft, and will also include a hybrid paint and maintenance bay.

Lam points out that the new facility looks to build upon, not replace, ST Engineering’s existing MRO infrastructure in Singapore.

“Rather, our intent is to attract more customers and workload here [to Singapore] to signal growth,” he says.

See also: Back in business: ASTI Holdings’ clean comeback from suspension to resumption

As the world’s largest third-party MRO service provider, ST Engineering is already running numerous hangar facilities worldwide. Besides Changi, there are facilities in Paya Lebar and Seletar. ST Engineering also operates this business in Dresden, Germany; Guangzhou and Shanghai in China; Mobile, Pensacola and San Antonio in the US.

ST Engineering can work on up to 44 widebody, 26 narrowbody and 24 general aviation aircraft across this global network at any time. Once fully operational, the Changi Creek facility will provide an extra 1.3 million man-hours annually, roughly equivalent to 10% of ST Engineering’s existing global airframe MRO capacity.

In pursuing sustainability, Changi Creek is integrating green technology by installing solar panels on its hangar roof. Equally significant is the implementation of advanced equipment and systems, including automated guided vehicles and digital tools, to facilitate paperless operations. “In terms of their ability to handle an aircraft’s shape and form, these facilities don’t change much.

So ultimately, it comes down to the software, where there are many tools to help manage workload and certain situations,” Lam explains.

“During the pandemic, we had segregation among different processes, which was all assisted by software. So certainly, we want a facility that’s good for the next generation, with more IT tools, more green fea-

tures. And of course, it means more ability to take customers in,” he adds.

Once operational, Changi Creek will generate over 550 jobs, spanning aircraft engineers, planning and production control experts, mechanics, and warehouse and logistics staff. Besides new hires, certain positions at the new facility would possibly be filled by transferring employees, especially those holding supervisory positions, from other MRO facilities due to their existing knowledge, says Lam.

To build a steady pipeline of potential hires, ST Engineering is already running various programmes with institutions in Singapore to source skilled local workers, but in the absence of this, contract work from workers overseas will also be looked at, says Lam.

To stay ahead of Singapore and the region’s corporate and economic trends, click here for Latest Section

MRO contract wins

The establishment of the Changi Creek facility comes about befittingly. According to an industry report by Oliver Wyman’s Global Fleet and MRO forecast for 2022 to 2023, fleet growth and MRO demand in the Asia Pacific region look projected to increase at CAGRs of 2.5% and 1.8% respectively over the next decade.

Given the significant upswing in global air passenger activity post-pandemic, channel checks indicate that the MRO market is becoming increasingly tight, says DBS in its 4Q outlook put out by its CIO office on Sept 27.

"While airlines still have a backlog of deferred maintenance to clear, we anticipate that MRO operators will experience increased demand over the next few years due to widespread technical issues with new generation engines, as well as prolonged OEM delivery delays that have prompted airlines to postpone the retirement of older aircraft," says DBS.

Meanwhile, to add further buzz, in the few days following the groundbreaking on Sept 23, ST Engineering quickly announced related MRO contract wins from two customers, Indonesia’s Lion Air Group and Japan Airlines.

With Lion Air Group, a five-year contract has been signed to provide MRO services for the group’s existing Boeing 737 MAX aircraft fleet under its carriers, including Lion Air, Batik Air, Batik Air Malaysia and Thai Lion.

Similarly, ST Engineering has secured a multi-year contract to provide Japan Airlines with component maintenance-by-the-hour and other related services.

On Sept 27, ST Engineering announced a collaboration with Quickstep Holdings, Australia’s largest independent aerospace engineering company. Under the terms of this partnership, the two companies will establish a regional nacelle pool in Australia, supporting both Boeing and Airbus aircraft.

Nacelles are the critical structures holding aircraft engines to the wings.

Quickstep will assume responsibility for the day-to-day operations via its facilities in Sydney and Melbourne. On the other hand, ST Engineering will leverage its MRO expertise in nacelles and aerostructures to provide engineering support.

Quickstep will assume responsibility for the day-to-day operations via its facilities in Sydney and Melbourne. On the other hand, ST Engineering will leverage its MRO expertise in nacelles and aerostructures to provide engineering support.

‘Room to grow’

Analysts generally hold a positive view of ST Engineering’s commercial aerospace business. Changi Creek will be a further boost. “This expansion should support earnings growth of its commercial aerospace segment, backed by the recovery of international aviation traffic,” writes RHB Bank Singapore analyst Sheikhar Jaiswal in his Sept 25 note, where he has kept his “buy” call and $4.50 target price on this stock.

The team at OCBC Investment Research, which has a “buy” call and a $4.45 target price, shares this view. “Having surpassed pre-pandemic revenue levels in 1HFY2023, commercial aerospace is well-positioned to capitalise on the last leg of recovery, with its strategic hangar capacity expansion supporting higher MRO demand from the resumption of China’s outbound tourism in full,” says OCBC in its Sept 15 report.

Peggy Mak of PhillipCapital notes that total contract wins by ST Engineering’s commercial aerospace unit in 1HFY2023 hit $3 billion, of which $2.3 billion were secured in 2QFY2023 alone, pointing to strong underlying demand.

Next, citing figures from the International Air Transport Association, Mak points out that global air passenger-km in the first half of this year was still 9.7% below the pre-Covid-19 level in 1H2019. Asia Pacific, the last region to re-open, lagged at 20.3% lower than 1H2019’s level. “There is, therefore, room for MRO demand to grow,” writes Mak in her report on Sept 26, as she initiated coverage on the stock with a “buy” call and

$4.50 target price.

Besides commercial aerospace, analysts have a broadly favourable perspective on the company’s two other big business segments: the urban solutions and SatCom (USS) sector, and its defence and public

security sector.

In this era of heightened geopolitical tension, defence spending is rising again worldwide, Singapore included. In FY2021 and FY2022, Singapore’s defence and security spending increased by 12% and 17%, respectively. “This is expected to rise further, providing revenue visibility for ST Engineering,” says Mak, noting that total defence and security contracts won by ST Engineering amounted to $5.2 billion in 1H2023, 20.9% higher than the whole of FY2022, and thereby contributing to the company’s record order book of more than $27 billion.

ST Engineering’s acquisition of US-based traffic systems provider TransCore should start to pay off too, along with more new contracts. “TransCore’s acquisition is on track to be earnings-accretive from 2HFY2023, we believe, leading to positive FY2023 earnings before interest and taxes (ebit) for the USS division,” says Mak.

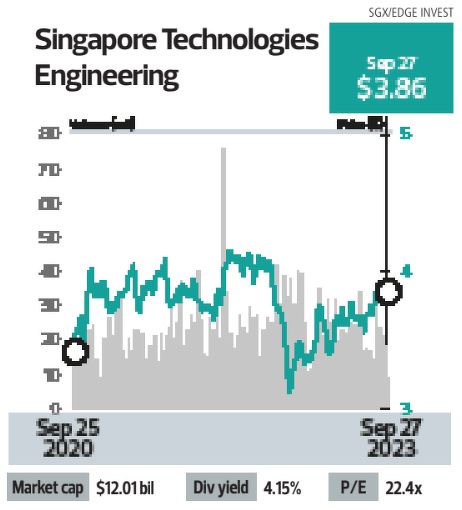

Shares in ST Engineering have outperformed the benchmark Straits Times Index with a 9.35% increase year-to-date to $3.86 as at Sept 27.