“It will not be at all easy to stage a comeback,” the 71-year-old industry veteran said in an interview this week. “If we miss this opportunity now, there may not be another one.”

Chips shortages that have crimped global production of everything from refrigerators to game consoles to cars this year have sent governments in China, South Korea, the US and Japan scrambling to beef up their domestic supply. Japan is vulnerable because, after decades of under-investment, its manufacturers have to import about two-thirds of their chips.

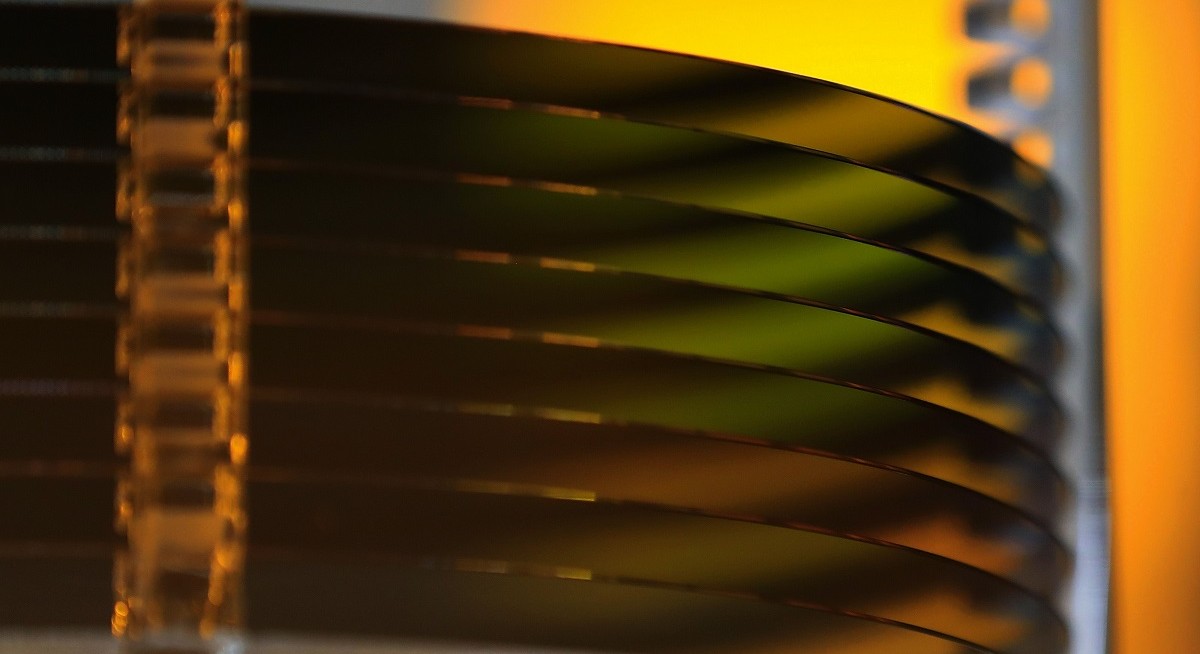

Governments from Beijing to Washington and Brussels are prepping unprecedented investments into local chip manufacturing, intent on securing the basic components for most modern-day devices and military systems. But the money will go fast in an era where a single advanced wafer fab runs more than US$10 billion.

President Joe Biden has laid out a US$52 billion plan to bolster domestic chip manufacturing, responding in part to China’s accelerating blueprint to place semiconductors at the heart of its development. South Korean companies like Samsung Electronics and SK Hynix are committing US$450 billion over a decade on chip research and expansion, while leader Taiwan Semiconductor Manufacturing alone has earmarked US$100 billion over the next three years.

In a report this month, Japan’s trade ministry said it would treat boosting growth in the industry as a national project, as important as securing food and energy. Part of the plan includes setting up domestic manufacturing bases that could include joint ventures with overseas chip foundries.

TSMC is among firms that Japan wants to recruit, Higashi said, echoing recent comments from ruling party lawmaker and former economy minister Akira Amari. The Taiwanese company has so far declined to comment on whether it’s planning to set up a fab in the country, although its board this year approved setting up a subsidiary near Tokyo to expand materials research with funding from the Japanese government.

Higashi becomes one of the most prominent industry voices so far to sound the alarm on Japan’s rapidly waning prowess in a critical technological field. The former head of Tokyo Electron, one of the world’s largest suppliers of chipmaking equipment, said Japan’s economy, national security, and its efforts to go carbon neutral by 2050 all depend on semiconductors.

To make deals happen, Japan needs to provide subsidies, give tax breaks and facilitate technology sharing, Higashi said.

Lawmakers are debating whether Japan’s economy needs more stimulus spending this fiscal year, but Higashi says any extra budget would need to include funding for chip investment.

In particular, more money should go toward the publicly-funded project in the works near Tokyo, where several Japanese firms plan to work with TSMC to develop 3-D chips that are faster and more energy-efficient.

But this year’s money would only be the start.

“It takes 10 years or more to build a world-class industry,” Higashi said. “If we don’t go forward with the understanding, and we just try to throw money at this in a one-time way, I can see us failing.”